Why You Should Have an ATM Machine on Your Business Premises

ATM machines provide unmatched convenience to consumers that wish to have easy access to cash. According to the 2019 Federal Reserve payments study, there were over 5.1 billion ATM transactions across the US in 2018 worth $800 billion. A National Cash Systems survey showed that ATM cardholders use them at least 8-10 times a month.

ATMs are quick and easy to use, typically without any long queues. Such convenience and efficiency make the purchase of an ATM machine for sale a smart decision. Here are seven benefits of installing an ATM Machine at your business.

1. Build Traffic

A survey by Transaction Network Services indicated that 78% of respondents felt it’s important to have access to cash. Purchasing an ATM machine for sale allows you to serve potential customers better by providing quick access to cash. You can increase foot traffic to your stores as more people walk in to withdraw money. An ATM within your location may allow your customers to combine banking and shopping in one trip.

2. Increased Sales

Up to 30% of the money withdrawn on an ATM is spent within the business premises that houses the machine. With the average ATM transaction being $60, you can leverage the ATM installation to net more revenue for your business through increased sales. Besides, on-screen advertising and coupon options may help you register more income receipts for your business.

3. Additional Income Stream

Buying an ATM machine for sale may also boost your business bottom line. You can earn extra income from the surcharges on customers taking money out of their accounts. In a pristine location, the fees collected may be enough for the ATM to pay for itself and provide you with a recurring income stream.

4. Reduce Credit Card Processing Fees and Chargebacks

A significant number of credit card users prefer to pay in cash if given the opportunity. Buying ATMs for your business decreases the processing fees that you may have to pay. The switchover to cash can save you an average of $0.80 per transaction, providing more savings to your business. Additionally, customers who pay in cash reduce the risk of check disputes and chargebacks, preserving your profits.

5. Convenience

An ATM can help increase your competitive edge by building customer loyalty. Your target customers will not have to walk out of your establishment to the ATM down the street and potentially not return. Customers can find a one-stop solution to accommodate their cash needs, increasing customer retention.

6. Increase Customer Loyalty

A recent survey highlighted that a significant percentage of ATM users never leave the location where they withdraw money. Having an ATM at your business premises can provide a convenient service to your customers and further improve their loyalty. This is through offering them easy access to cash as well as using those ATMs with on-screen advertising for marketing promotions, coupons, or other offers.

7. Flexible ATM Plans

You can enjoy flexible ownership programs that make it feasible to buy the ATM machine for sale. You can opt for a direct sale, lease, or rent-to-own program. A direct purchase allows you to own and operate the ATM, keeping 100% of the surcharge revenue. You can tailor the lease and rent-to-own programs to fit your budgetary needs, driving in more customers and revenue for your business.

An ATM provides convenience over the traditional banking methods currently used by individuals and businesses, especially when it comes to accessing cash. An ATM for sale increases convenience levels while offering other benefits like transactions fees savings and increased traffic, among many others. It can also help you earn extra profits within your establishment. BOSTON NORTH COMPANY offers wall-mount and through-wall mount ATMs and POS systems that can match your budgetary allocation. Call us to kickstart your journey today.

Tracking and managing inventory has never been easier with this fully integrated application. Set alerts for when inventory is low, reminding you to replenish items. LexgiaPOS Inventory also allows you to define minimum stock levels for any and all products, prompting the system to create automated shopping lists with every item that must be replenished. Check for the most popular items and plan restocking accordingly.

Tracking and managing inventory has never been easier with this fully integrated application. Set alerts for when inventory is low, reminding you to replenish items. LexgiaPOS Inventory also allows you to define minimum stock levels for any and all products, prompting the system to create automated shopping lists with every item that must be replenished. Check for the most popular items and plan restocking accordingly.

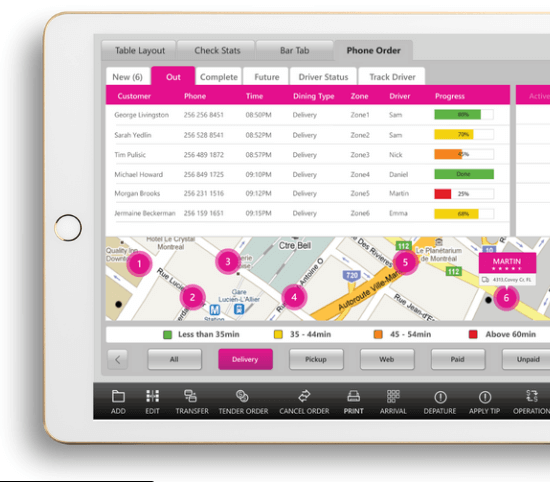

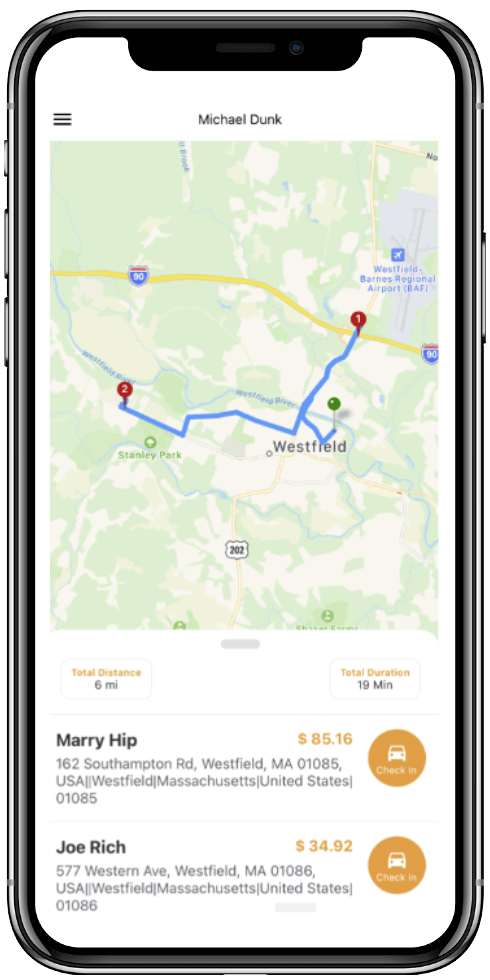

Delivery service is a valuable asset for any business, as it conveniences customers and creates another avenue for profit. LexgiaPOS Driver is a fully integrated application developed for restaurants as well as their drivers to foster a seamless delivery process.

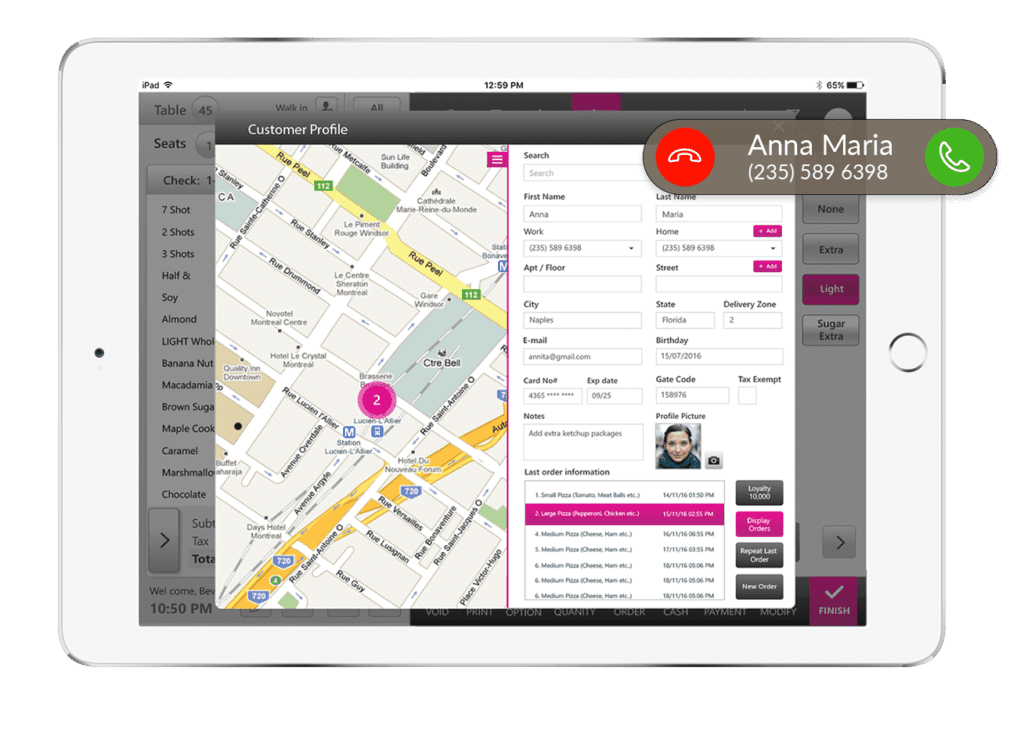

Delivery service is a valuable asset for any business, as it conveniences customers and creates another avenue for profit. LexgiaPOS Driver is a fully integrated application developed for restaurants as well as their drivers to foster a seamless delivery process. Quickly and easily assign drivers to certain deliveries or delivery routes within the system, speeding up the process. They can be informed anywhere at any time with SMS alerts, allowing for route changes and quick turnaround time. The system provides real-time driver status and allows you to collect data to measure driver performance.

Quickly and easily assign drivers to certain deliveries or delivery routes within the system, speeding up the process. They can be informed anywhere at any time with SMS alerts, allowing for route changes and quick turnaround time. The system provides real-time driver status and allows you to collect data to measure driver performance.

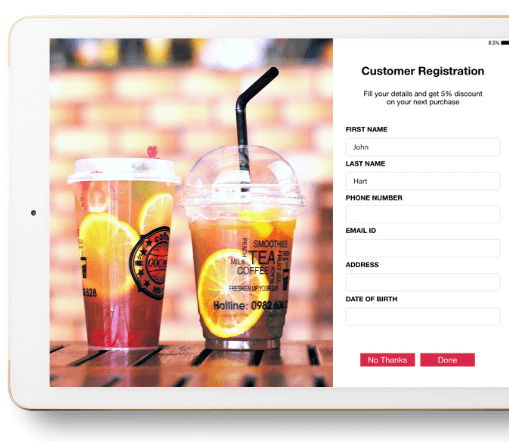

LexgiaPOS's S customer loyalty application allows businesses to create customized loyalty programs based on the best interests of both their consumers and the business itself. Loyalty rewards can be based on a variety of factors, including enrollment, customer visits, a fixed spent amount, specific menu items, and menu category.

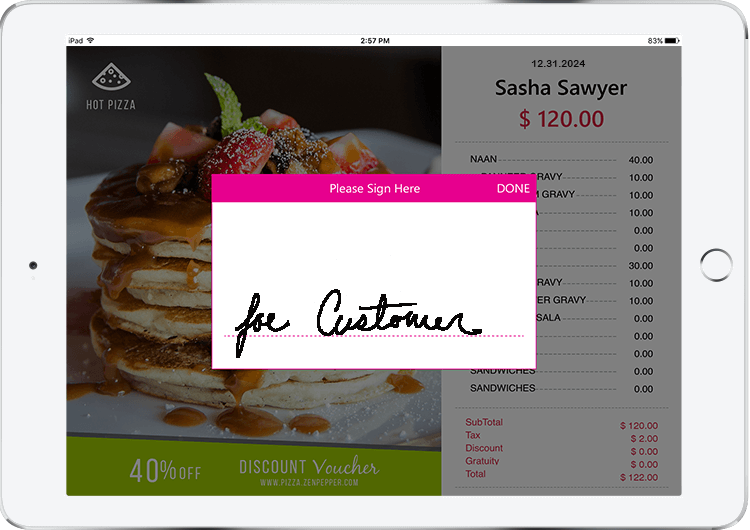

LexgiaPOS's S customer loyalty application allows businesses to create customized loyalty programs based on the best interests of both their consumers and the business itself. Loyalty rewards can be based on a variety of factors, including enrollment, customer visits, a fixed spent amount, specific menu items, and menu category. LexgiaPOS CDS is a customer facing display that they are able to interact with during checkout. The easy and fast technology provides high levels of service and convenience for customers, allowing for less delay at checkout and increased consumer satisfaction. Equipped with a tip processing feature and required digital signature, the system provides quick service that is both enjoyable and more secure. The application can also prompt customers to opt-in to your loyalty program if you choose, driving more signups.

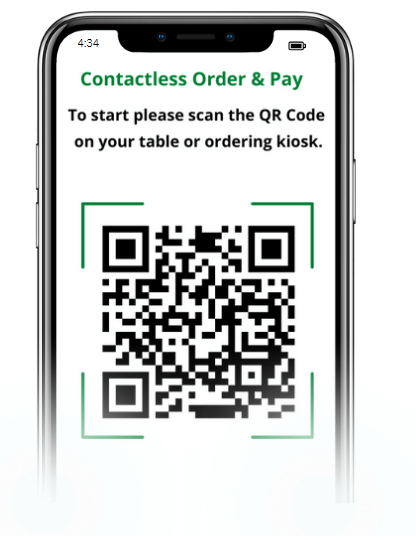

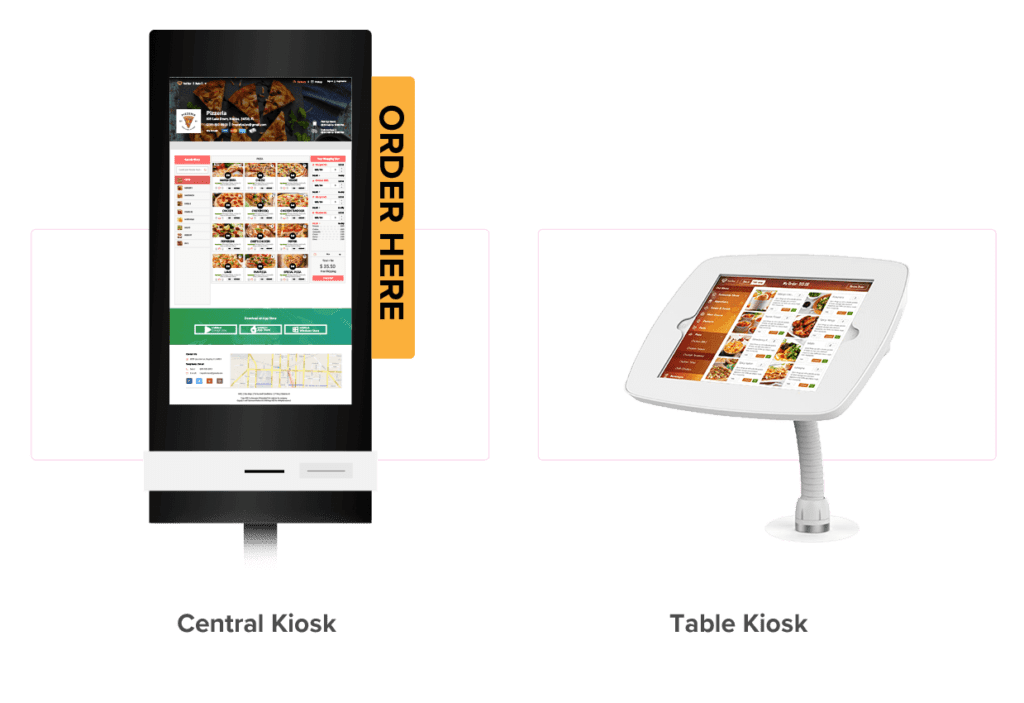

LexgiaPOS CDS is a customer facing display that they are able to interact with during checkout. The easy and fast technology provides high levels of service and convenience for customers, allowing for less delay at checkout and increased consumer satisfaction. Equipped with a tip processing feature and required digital signature, the system provides quick service that is both enjoyable and more secure. The application can also prompt customers to opt-in to your loyalty program if you choose, driving more signups. Self-order kiosk checkouts allow for customers to fully engage with the order and checkout processes independently, creating a more convenient customer experience while simultaneously lifting pressure from the front-of-house staff. LexgiaPOS Kiosk quickens the process of making and dispatching orders by communicating directly to a second display system located in the kitchen. The application eliminates extra steps by enabling direct communication from your consumers’ fingertips to the eyes of the kitchen staff.

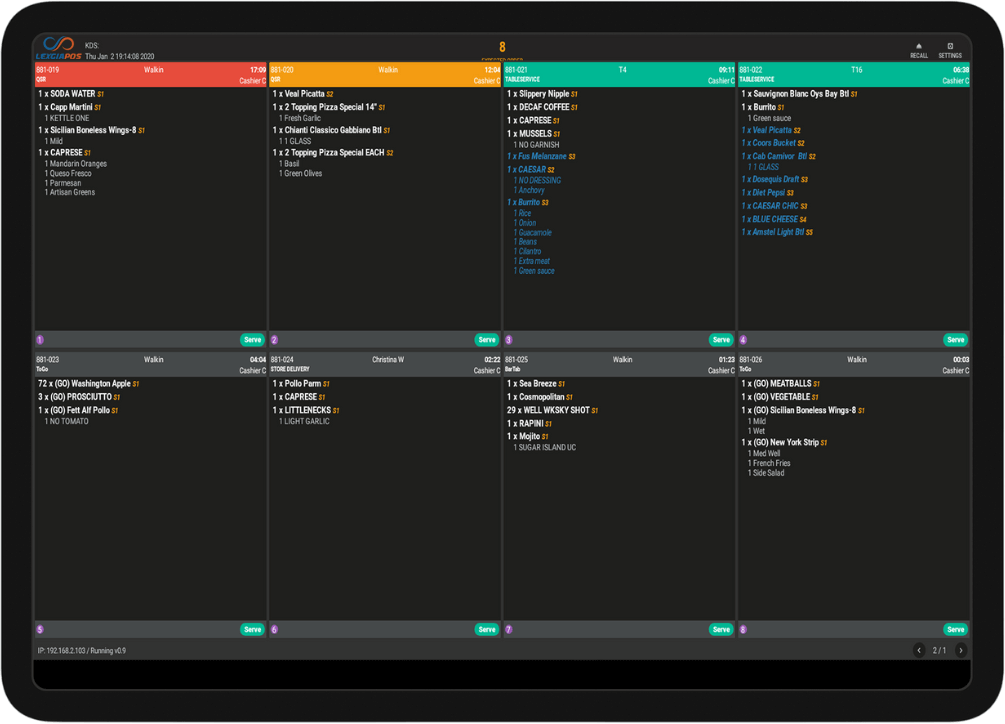

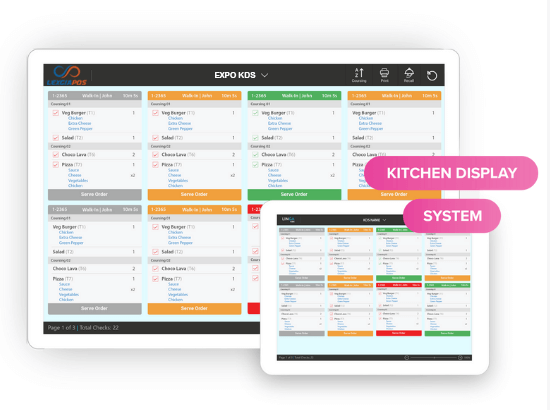

Self-order kiosk checkouts allow for customers to fully engage with the order and checkout processes independently, creating a more convenient customer experience while simultaneously lifting pressure from the front-of-house staff. LexgiaPOS Kiosk quickens the process of making and dispatching orders by communicating directly to a second display system located in the kitchen. The application eliminates extra steps by enabling direct communication from your consumers’ fingertips to the eyes of the kitchen staff. LexgiaPOS KDS is a system specifically designed for catering to needs inside the kitchen. Always in direct communication with the front-of-house display, both systems can stay connected even without internet, allowing for no interruptions to the flow of your workday.

LexgiaPOS KDS is a system specifically designed for catering to needs inside the kitchen. Always in direct communication with the front-of-house display, both systems can stay connected even without internet, allowing for no interruptions to the flow of your workday. If your restaurant serves pizza, LexgiaPOS KDS allows your customers to customize a pie down to the slice and make their topping choices as elaborate as desired. Customers can also receive SMS text alerts directly from the kitchen so that they are notified as soon as their order has been completed. The kitchen display system allows for optimal efficiency and a significant reduction of error and waiting time.

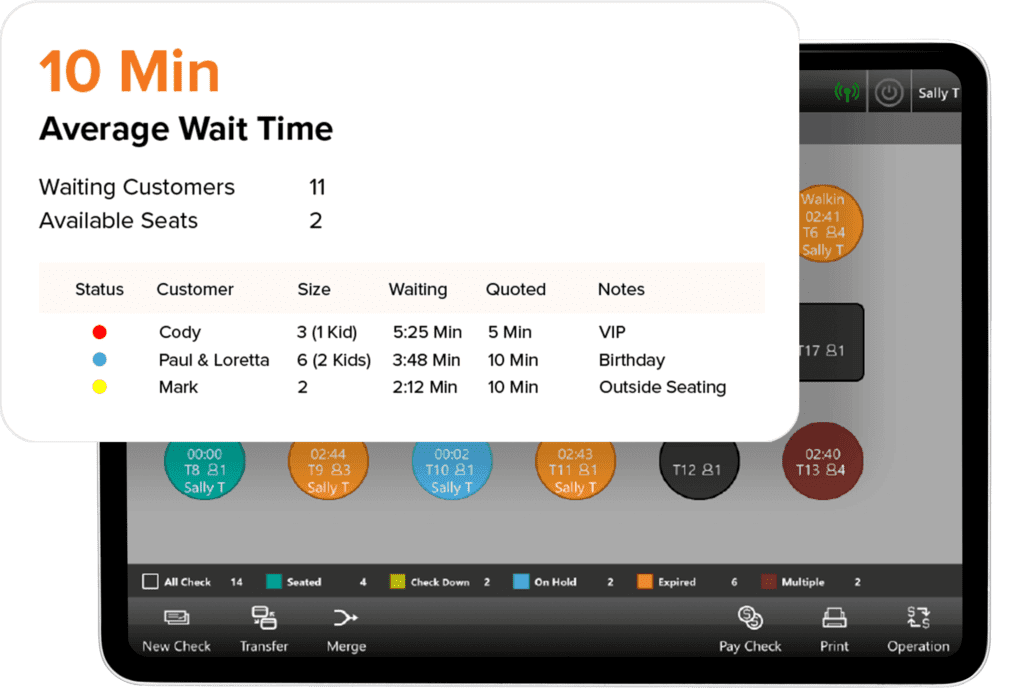

If your restaurant serves pizza, LexgiaPOS KDS allows your customers to customize a pie down to the slice and make their topping choices as elaborate as desired. Customers can also receive SMS text alerts directly from the kitchen so that they are notified as soon as their order has been completed. The kitchen display system allows for optimal efficiency and a significant reduction of error and waiting time. Excessive wait times can lead to customer dissatisfaction, lack of repeat business, and loss of sales. LexgiaPOS Waitlist is a fully integrated application within the operating system that tracks and manages your business’s bookings and guests to ensure minimal wait time and maximal communication with your customers. Equipped with a wait time calculator and synced with the statuses of your tables, the application remains constantly updated and can keep your customers in the loop as well by sending SMS text alerts regarding the status of their wait.

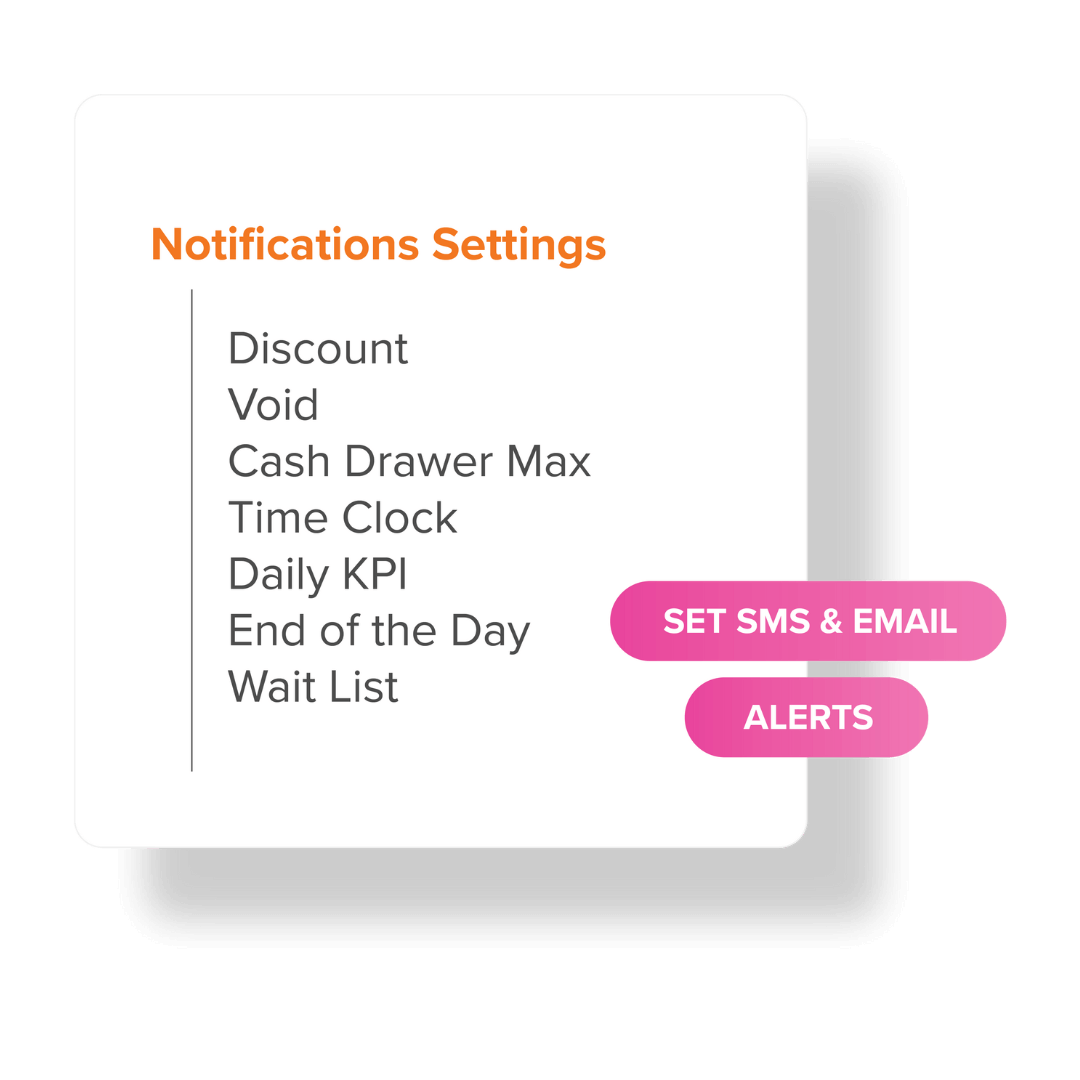

Excessive wait times can lead to customer dissatisfaction, lack of repeat business, and loss of sales. LexgiaPOS Waitlist is a fully integrated application within the operating system that tracks and manages your business’s bookings and guests to ensure minimal wait time and maximal communication with your customers. Equipped with a wait time calculator and synced with the statuses of your tables, the application remains constantly updated and can keep your customers in the loop as well by sending SMS text alerts regarding the status of their wait.