What is PCI Compliance?

Mastering PCI Compliance: Safeguarding Your Business and Customers in the Digital Era

PCI compliance refers to the adherence of businesses to a set of security standards established by major credit card companies. These standards, known as the Payment Card Industry Data Security Standard (PCI DSS), are designed to protect the confidentiality and integrity of credit card information during transactions. Compliance involves implementing secure practices such as encryption, access controls, and regular system testing to safeguard against data breaches and ensure a secure payment environment.

In simple terms, PCI compliance is like a security guard for your credit card information when you make purchases online or in stores. Imagine your credit card details are like precious treasures, and PCI compliance sets rules and standards to keep those treasures safe from thieves and bad guys. It's a set of guidelines created by big credit card companies to make sure businesses handle your card information carefully. So, when you see a website or a store saying they are "PCI compliant," it's like them proudly declaring they have a top-notch security system to protect your credit card data, making it much harder for anyone with ill intentions to get their hands on your sensitive information. It's all about giving you peace of mind when you swipe, tap, or click to buy something.

For comprehensive instructions on the requirements for PCI compliance, businesses are advised to visit the following link: https://www.pcisecuritystandards.org/

To maintain PCI compliance, businesses can follow a few key steps. Firstly, it's crucial to secure and regularly update systems that handle credit card information. Use strong passwords, encryption, and access controls to keep data safe. Conduct quarterly vulnerability scans to identify and address potential security risks. Additionally, businesses should complete an annual self-assessment questionnaire, which helps ensure that all aspects of PCI DSS requirements are met. By staying vigilant with security measures and regularly assessing compliance, businesses can help safeguard customer credit card data and maintain a secure payment environment.

It's important to clarify that the responsibility for PCI compliance lies solely with the businesses and not with BOSTON NORTH COMPANY. While we are dedicated to supporting a secure environment for our services, achieving and maintaining compliance with the Payment Card Industry Data Security Standard (PCI DSS) is an integral part of your business operations. Please ensure that your systems and practices align with the required standards to safeguard customer credit card information effectively.

We understand that PCI compliance can be a source of frustration for businesses, and we want to provide clarity on the matter. It's crucial to recognize that the fees associated with non-compliance are not imposed by BOSTON NORTH COMPANY but stem directly from credit card processors. Unfortunately, some businesses may not fully grasp the intricacies of PCI compliance and, in turn, express dissatisfaction with associated charges. Hopping from one Point of Sale (POS) company to another won't alleviate this issue, as the fees are inherent to credit card processing and persist regardless of the service provider. Whether you choose our services or those of another POS company, adherence to PCI compliance regulations is essential to avoid non-compliance fees from credit card processors.

At BOSTON NORTH COMPANY, we acknowledge the impact that fees related to PCI non-compliance can have on a business. We understand the financial strain it may pose, and we are committed to supporting our clients in navigating this landscape. It is crucial for businesses to recognize the significance of staying proactive and vigilant in maintaining PCI compliance. By doing so, you not only protect your customers' sensitive data but also eliminate the unnecessary financial burden associated with non-compliance fees. We are here to assist you every step of the way, providing guidance and resources to ensure a secure and compliant payment environment for your business. Feel free to reach out to us for any clarifications or assistance you may require in this regard.

Who Should You Contact About Your PCI Compliance?

If your processor is Global Payments (EVO/Sterling) or if your MID begins with 777 or 5611

PCI Compliance Team Phone: (888) 826-7895

If your processor is Global Payments (TSYS Broomfield) or if your MID begins with 5436

Global Payments PCI TEAM Phone: (800) 745-1425 or (888) 670-0768

PCI Website: PPEZ.GPNDI.COM

PCI Email: SUPPORT@GPNDI.COM

If your processor is Global Payments (Cayan/Capital Bankcard-TSYS) or if your MID begins with 9305

Phone: (877) 277-1178 or (800) 909-5134

If your processor is WorldPay-FIS Global or if your MID begins with 444

PCI Compliance Team Phone: (866) 493-8756

Email Help Desk: www.saferpayments.yoursecurejourney.com

If your processor is WorldPay-FIS Global-Novera or your MID begins with 5429

PCI Compliance Team Phone: (866) 493-8756

Email Help Desk: www.saferpayments.yoursecurejourney.com

If your processor is AFS (Agile Financial Systems) or your MID begins with 5668

PCI Team Phone: (888) 708-8019

PCI Website: https://go-afs.pcicompliance.ws/

If your processor is CardConnect or if your MID begins with 4963 or 5180

PCI Compliance Team: (877) 257-0239

If your processor is PayArc or your MID begins with 5670

PCI Compliance Team: (801) 995-6400

PCI Link: https://www.securitymetrics.com/

If your processor is SpotOn or your MID begins with 5455

PCI Compliance Team: (800) 363-1621 Option 1

PCI Website: https://managepci.com

PCI Email: support@securetrust.com

If your processor is Aldelo Pay or your MID begins with 5436

PCI Compliance Team: (800) 654-9256

PCI Website: https://pcicez.gpndi.com/safemaker/login/portal

If you need additional assistance, please contact our Credit Card Service and Support Department at 877-931-1404, extension 2.

Tracking and managing inventory has never been easier with this fully integrated application. Set alerts for when inventory is low, reminding you to replenish items. LexgiaPOS Inventory also allows you to define minimum stock levels for any and all products, prompting the system to create automated shopping lists with every item that must be replenished. Check for the most popular items and plan restocking accordingly.

Tracking and managing inventory has never been easier with this fully integrated application. Set alerts for when inventory is low, reminding you to replenish items. LexgiaPOS Inventory also allows you to define minimum stock levels for any and all products, prompting the system to create automated shopping lists with every item that must be replenished. Check for the most popular items and plan restocking accordingly.

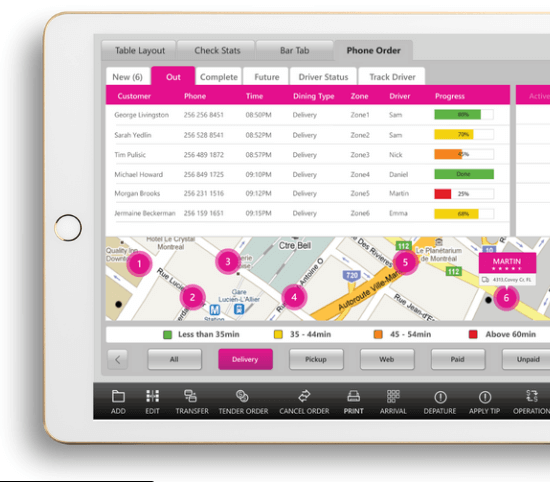

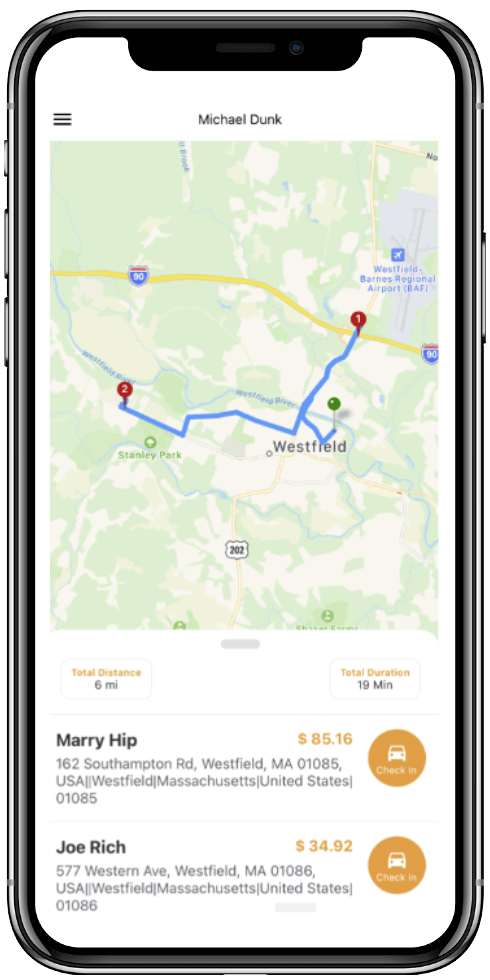

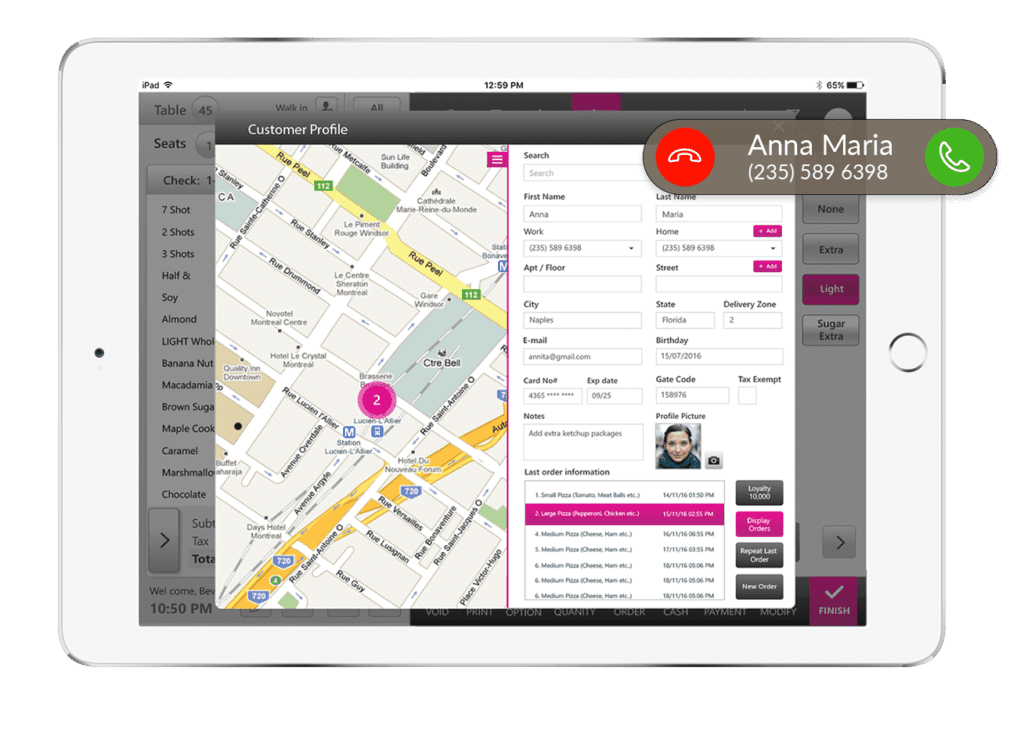

Delivery service is a valuable asset for any business, as it conveniences customers and creates another avenue for profit. LexgiaPOS Driver is a fully integrated application developed for restaurants as well as their drivers to foster a seamless delivery process.

Delivery service is a valuable asset for any business, as it conveniences customers and creates another avenue for profit. LexgiaPOS Driver is a fully integrated application developed for restaurants as well as their drivers to foster a seamless delivery process. Quickly and easily assign drivers to certain deliveries or delivery routes within the system, speeding up the process. They can be informed anywhere at any time with SMS alerts, allowing for route changes and quick turnaround time. The system provides real-time driver status and allows you to collect data to measure driver performance.

Quickly and easily assign drivers to certain deliveries or delivery routes within the system, speeding up the process. They can be informed anywhere at any time with SMS alerts, allowing for route changes and quick turnaround time. The system provides real-time driver status and allows you to collect data to measure driver performance.

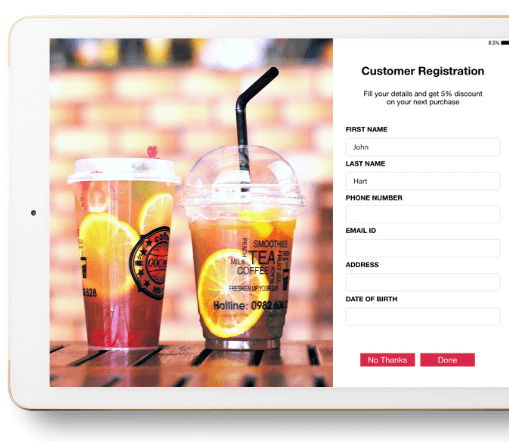

LexgiaPOS's S customer loyalty application allows businesses to create customized loyalty programs based on the best interests of both their consumers and the business itself. Loyalty rewards can be based on a variety of factors, including enrollment, customer visits, a fixed spent amount, specific menu items, and menu category.

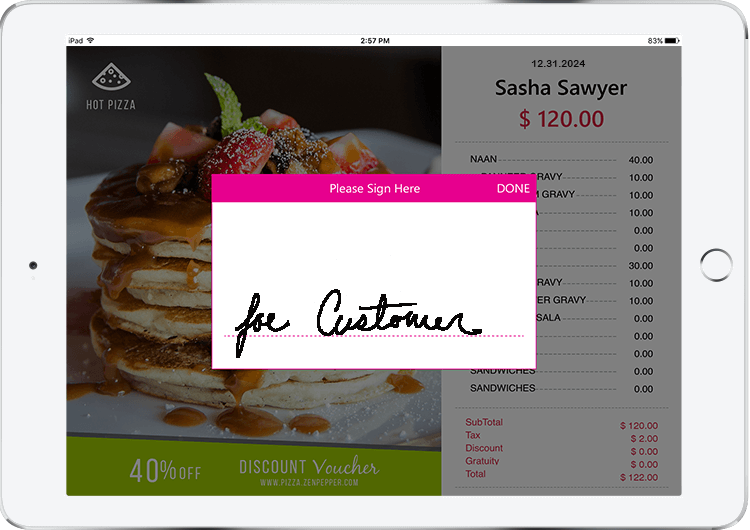

LexgiaPOS's S customer loyalty application allows businesses to create customized loyalty programs based on the best interests of both their consumers and the business itself. Loyalty rewards can be based on a variety of factors, including enrollment, customer visits, a fixed spent amount, specific menu items, and menu category. LexgiaPOS CDS is a customer facing display that they are able to interact with during checkout. The easy and fast technology provides high levels of service and convenience for customers, allowing for less delay at checkout and increased consumer satisfaction. Equipped with a tip processing feature and required digital signature, the system provides quick service that is both enjoyable and more secure. The application can also prompt customers to opt-in to your loyalty program if you choose, driving more signups.

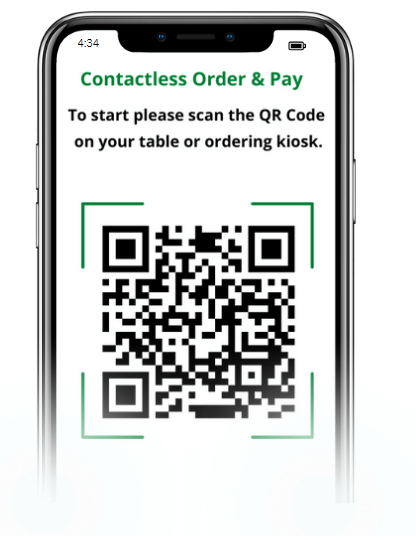

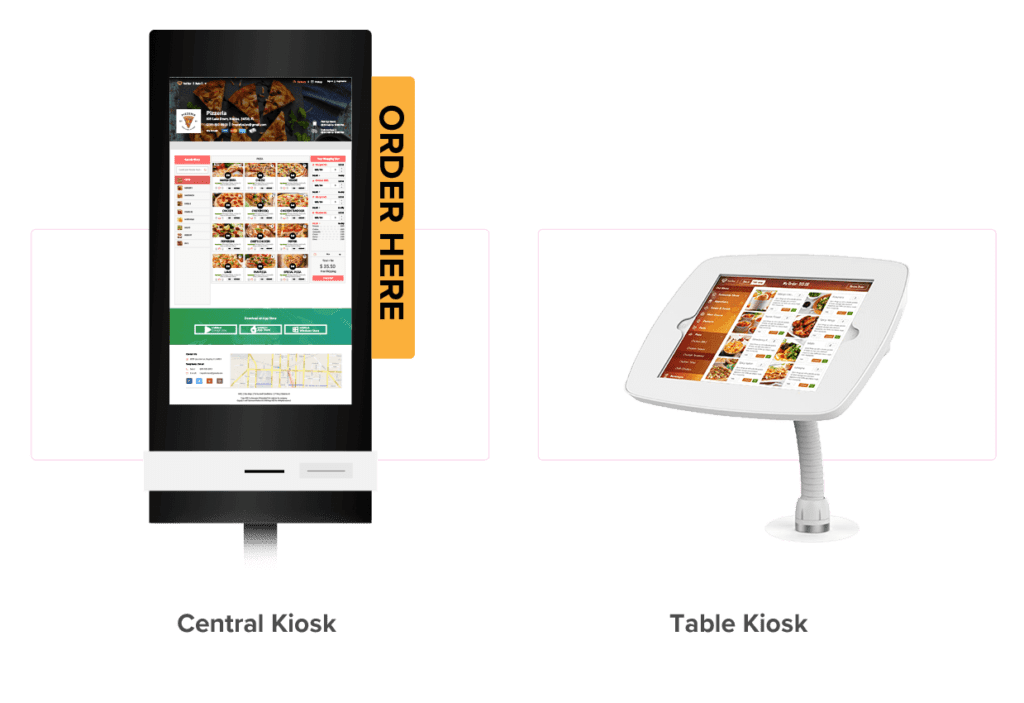

LexgiaPOS CDS is a customer facing display that they are able to interact with during checkout. The easy and fast technology provides high levels of service and convenience for customers, allowing for less delay at checkout and increased consumer satisfaction. Equipped with a tip processing feature and required digital signature, the system provides quick service that is both enjoyable and more secure. The application can also prompt customers to opt-in to your loyalty program if you choose, driving more signups. Self-order kiosk checkouts allow for customers to fully engage with the order and checkout processes independently, creating a more convenient customer experience while simultaneously lifting pressure from the front-of-house staff. LexgiaPOS Kiosk quickens the process of making and dispatching orders by communicating directly to a second display system located in the kitchen. The application eliminates extra steps by enabling direct communication from your consumers’ fingertips to the eyes of the kitchen staff.

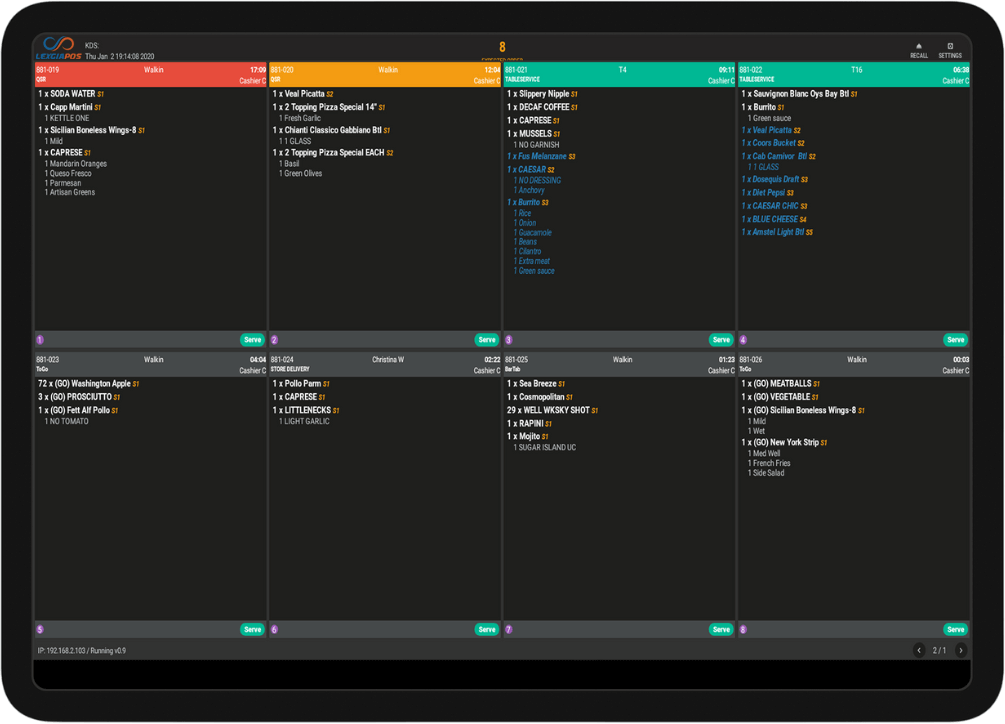

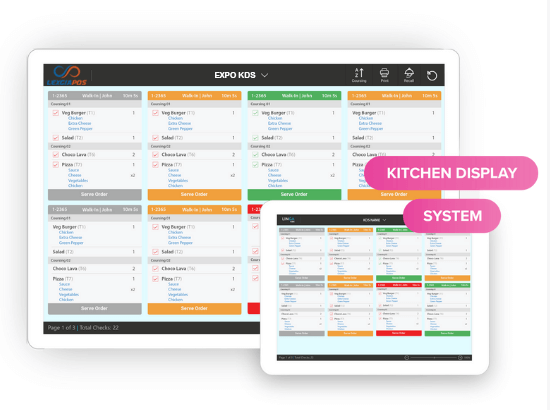

Self-order kiosk checkouts allow for customers to fully engage with the order and checkout processes independently, creating a more convenient customer experience while simultaneously lifting pressure from the front-of-house staff. LexgiaPOS Kiosk quickens the process of making and dispatching orders by communicating directly to a second display system located in the kitchen. The application eliminates extra steps by enabling direct communication from your consumers’ fingertips to the eyes of the kitchen staff. LexgiaPOS KDS is a system specifically designed for catering to needs inside the kitchen. Always in direct communication with the front-of-house display, both systems can stay connected even without internet, allowing for no interruptions to the flow of your workday.

LexgiaPOS KDS is a system specifically designed for catering to needs inside the kitchen. Always in direct communication with the front-of-house display, both systems can stay connected even without internet, allowing for no interruptions to the flow of your workday. If your restaurant serves pizza, LexgiaPOS KDS allows your customers to customize a pie down to the slice and make their topping choices as elaborate as desired. Customers can also receive SMS text alerts directly from the kitchen so that they are notified as soon as their order has been completed. The kitchen display system allows for optimal efficiency and a significant reduction of error and waiting time.

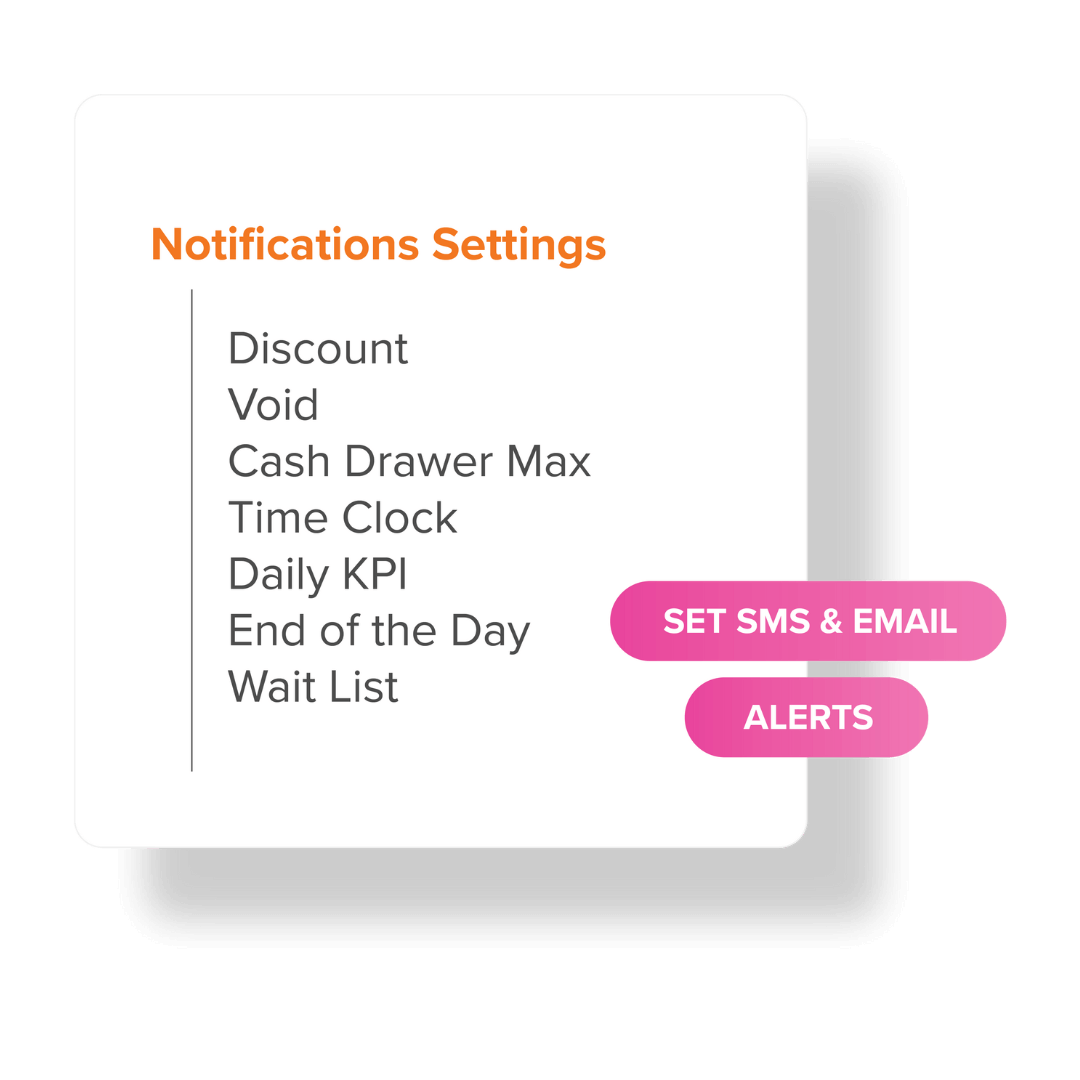

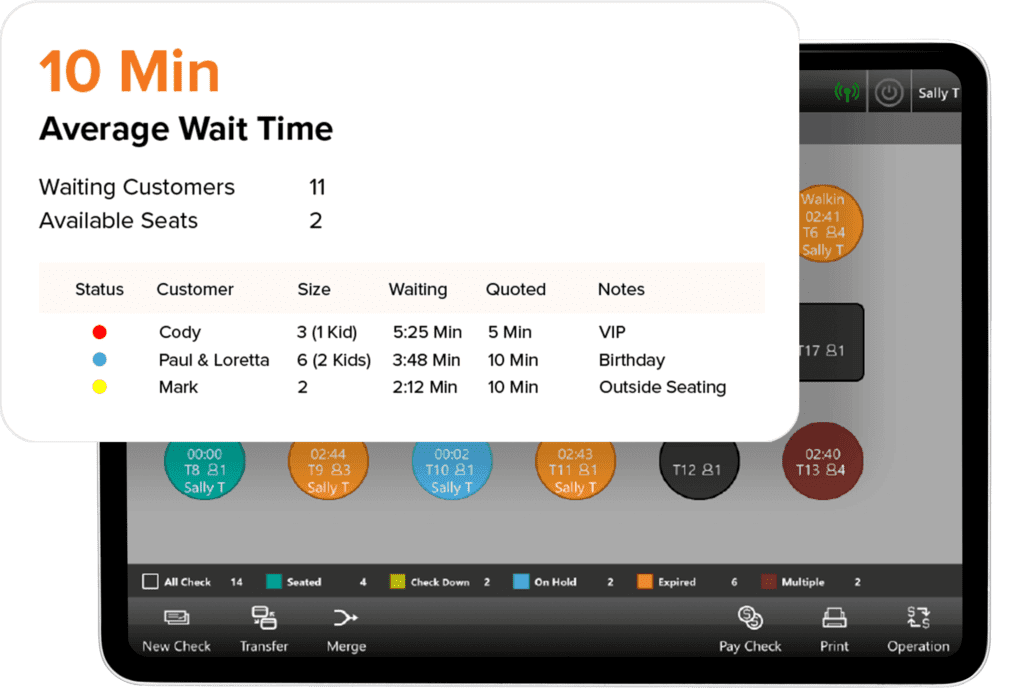

If your restaurant serves pizza, LexgiaPOS KDS allows your customers to customize a pie down to the slice and make their topping choices as elaborate as desired. Customers can also receive SMS text alerts directly from the kitchen so that they are notified as soon as their order has been completed. The kitchen display system allows for optimal efficiency and a significant reduction of error and waiting time. Excessive wait times can lead to customer dissatisfaction, lack of repeat business, and loss of sales. LexgiaPOS Waitlist is a fully integrated application within the operating system that tracks and manages your business’s bookings and guests to ensure minimal wait time and maximal communication with your customers. Equipped with a wait time calculator and synced with the statuses of your tables, the application remains constantly updated and can keep your customers in the loop as well by sending SMS text alerts regarding the status of their wait.

Excessive wait times can lead to customer dissatisfaction, lack of repeat business, and loss of sales. LexgiaPOS Waitlist is a fully integrated application within the operating system that tracks and manages your business’s bookings and guests to ensure minimal wait time and maximal communication with your customers. Equipped with a wait time calculator and synced with the statuses of your tables, the application remains constantly updated and can keep your customers in the loop as well by sending SMS text alerts regarding the status of their wait.