Surcharging

Navigating the Pitfalls: Why Smart Businesses Steer Clear of Surcharges, Dual Pricing, & Cash Discounts

In the ever-evolving landscape of business transactions, the allure of surcharge, dual pricing, & cash discount programs has taken center stage, promising a solution to the difficulty of credit card processing fees. However, as we navigate the complexities of these pricing strategies, it becomes imperative to scrutinize not only their mechanics but also the potential pitfalls they harbor. In this blog, we search into the dangers associated with adopting such pricing strategies, unraveling the risks and implications for both businesses and consumers. At BOSTON NORTH COMPANY, we firmly believe in transparency, fairness, and the preservation of trust in every transaction. Join us, as we explore the reasons why we stand against these programs, shedding light on the pitfalls that underscore our commitment to providing businesses with honest, reliable, and client-based solutions.

Decoding Payment Pricing: Understanding the Dynamics of Surcharging, Dual Pricing, & Cash Discounting

Navigating the terrain of payment processing can be a labyrinth of terms and options, with methods such as, surcharging, dual pricing, & cash discount programs, frequently finding their way into the conversation. At their core, these strategies aim to address the costs associated with credit card transactions, but their approaches differ significantly.

Surcharging is a pricing strategy that involves adding an extra fee to a transaction, typically when clients choose to pay with a credit card. Unlike cash discounting, where clients are incentivized with discounts for paying with cash, surcharging places an additional cost on electronic transactions. This approach is often employed by businesses as a means to offset the interchange fees imposed by credit card companies and banks. While surcharging can provide a way for businesses to recover some of the costs associated with card transactions, it is essential to navigate this strategy carefully, as regulations and consumer sentiments regarding surcharging vary.

Cash Discount Programs offer a discount to clients who opt for cash or alternative payment methods, incentivizing cost-effective choices. The key differentiator lies in how these approaches are presented: surcharges increase the price for credit card transactions, while cash discounts reduce the cost for non-card payments. Debit cards are subject to regulatory guidelines and restrictions that prohibit the practice of cash discounting. Unlike credit cards, which often carry interchange fees that can be modified based on merchant agreements, debit cards operate under different rules.

Dual pricing, the practice of setting different prices for the same product or service depending on the payment method (such as cash or card), can introduce potential negative impacts for both businesses and clients. Firstly, it may lead to client confusion and dissatisfaction, as individuals might perceive the dual pricing strategy as unfair or discriminatory. The transparency of pricing becomes crucial in maintaining trust, and dual pricing can erode that trust by creating a perception of hidden costs or preferential treatment. Operationally, implementing and managing dual pricing systems can be complex, requiring additional resources for communication and administrative efforts. This complexity can lead to errors, client disputes, and a generally less streamlined payment process. Overall, the potential for client discontent and operational challenges makes dual pricing a strategy that businesses should approach with caution, weighing its benefits against the risk of negative impacts on client relations and overall satisfaction.

As businesses weigh the pros and cons of each method, understanding these variations becomes pivotal in crafting a transparent and fair approach to pricing. In Maine, Massachusetts and Connecticut, the legal landscape around surcharging is clear – it’s strictly prohibited. However, cash discounting, a legal practice across all 50 states, offers businesses a legitimate means to incentivize non-card payments. Yet, the challenge arises when some businesses attempt to blur the lines between these practices, falsely passing off surcharges as cash discounts.

This misrepresentation not only undermines transparency but also carries severe legal consequences. Businesses need to tread carefully, ensuring compliance with state regulations, as mislabeling surcharges as cash discounts can lead to legal repercussions, potentially tarnishing reputations and incurring hefty penalties. In the intricate realm of payment practices, understanding and adhering to the laws governing surcharging, dual pricing, and cash discounting are paramount for fostering trust and steering clear of legal pitfalls.

The Minefield: Unraveling the Risks

Navigating the legal confusion of pricing regulations can be similar to crossing a minefield for businesses, where a single misstep, whether intentional or not, can spell the difference between survival and demise. For smaller businesses, fines stemming from non-compliance with these regulations can be catastrophic, potentially leading to closures and financial ruin. The disparity in the impact of fines is obvious; what may be a substantial penalty for a small business can be a mere slap on the hand for billion-dollar credit card companies. In the realm of cash discounting, surcharging, and dual pricing, it becomes evident that the primary beneficiaries are often the credit card processing companies, as these practices introduce additional fees and complexities, ultimately contributing to increased revenue for the middleman in the payment processing chain. Simple mishaps in understanding or implementing these regulations have the power to force businesses to close their doors, highlighting the critical importance of meticulous adherence to legal frameworks in the realm of pricing strategies. The stakes are high, emphasizing the need for businesses, regardless of size, to approach these practices with precision, caution, and a thorough understanding of the legal landscape.

In the age of digital connectivity, social media platforms play an integral role in shaping a business’s reputation and client relations, particularly for those participating in pricing strategies. These platforms act as a powerful conduit for client feedback and opinions, making businesses more susceptible to public scrutiny. Missteps or perceived unfairness in these strategies can quickly become magnified on social media, resulting in negative reviews, comments, and potentially, viral backlash. The widespread dissemination of negative sentiments can tarnish a business’s image, erode client trust, and, in extreme cases, lead to significant revenue loss. Businesses engaged in these pricing strategies must be acutely aware of the potential social media impact, emphasizing the need for transparency, clear communication, and a client-centric approach to mitigate the risks associated with participating in surcharge, dual pricing, and cash discount programs.

The Pillars of Trust: Business Success Through the Clarity and Consistency of Traditional Pricing

In the ever-evolving landscape of pricing strategies, the resilience and reliability of traditional pricing emerge as the unsung heroes. While others may be enticed by the allure of cash discounting, surcharging, or dual pricing, those who steadfastly adhere to traditional pricing are poised for long-term success. The simplicity and transparency inherent in traditional pricing not only foster trust with clients but also mitigate legal risks associated with more complex models. Businesses navigating the maze of payment options find solace in the stability offered by traditional pricing, avoiding the potential client dissatisfaction and operational intricacies tied to alternative strategies. In the end, those who choose the tried-and-true path of traditional pricing are likely to emerge as industry leaders, showcasing the enduring power of a straightforward and client-centric approach in a marketplace that constantly seeks stability and consistency.

Integrity in Transactions: BOSTON NORTH COMPANY‘s Stance

At BOSTON NORTH COMPANY, we firmly stand against the complexities and potential pitfalls associated with alternative pricing strategies like cash discounting, surcharging, and dual pricing. Instead, we wholeheartedly embrace the steadfast reliability of traditional pricing. Total transparency is not just a value we hold; it’s a commitment we live by. In an era where trust is paramount, BOSTON NORTH COMPANY proudly offers our clients more than just cutting-edge POS systems and exemplary client service – we provide the trust of a friend. Our unwavering commitment to honesty and the utmost respect for each business we serve is the cornerstone of our approach. With BOSTON NORTH COMPANY, businesses can rely on the stability, consistency, and transparency of traditional pricing, knowing that we are not just a service provider but a trusted partner invested in their success.

In the realm of POS solutions, BOSTON NORTH COMPANY takes pride in offering the best rates in the industry. We believe that providing exceptional value is not just about competitive pricing; it’s about delivering a comprehensive package that includes reliability, efficiency, and a personalized touch that echoes the warmth of a hometown establishment.

Our decision to stand against these pricing strategies is rooted in the understanding that these practices can have potentially catastrophic repercussions for businesses, especially the smaller ones that form the backbone of our local communities. We recognize that transparent and fair pricing is integral to fostering trust with our clients. We see the negative social media posts that clients make against restaurants who surcharge their clients and we recognize how it can negatively impact a business.

BOSTON NORTH COMPANY is not merely a provider of POS systems; we are guardians of your business’s financial health. By rejecting surcharging, dual pricing, and cash discounting, we shield our clients from the pitfalls that can arise from these practices – safeguarding their reputation, client loyalty, and, ultimately, their bottom line.

In a world where businesses navigate complex financial landscapes, we offer a beacon of reliability and a steadfast commitment to the prosperity of our clients. At BOSTON NORTH COMPANY, it’s not just about transactions; it’s about building enduring partnerships, contributing to the success of local businesses, and preserving the spirit of the hometown experience. At the core of our mission is a simple yet powerful goal: to consistently pursue what is undeniably in the best interest of our clients. We firmly believe that by prioritizing their success, we not only enhance their business but also contribute positively to the satisfaction and well-being of their valued clients. Choose BOSTON NORTH COMPANY for not just a POS solution but a promise – a promise to protect, empower, and elevate your business to new heights.

Tracking and managing inventory has never been easier with this fully integrated application. Set alerts for when inventory is low, reminding you to replenish items. LexgiaPOS Inventory also allows you to define minimum stock levels for any and all products, prompting the system to create automated shopping lists with every item that must be replenished. Check for the most popular items and plan restocking accordingly.

Tracking and managing inventory has never been easier with this fully integrated application. Set alerts for when inventory is low, reminding you to replenish items. LexgiaPOS Inventory also allows you to define minimum stock levels for any and all products, prompting the system to create automated shopping lists with every item that must be replenished. Check for the most popular items and plan restocking accordingly.

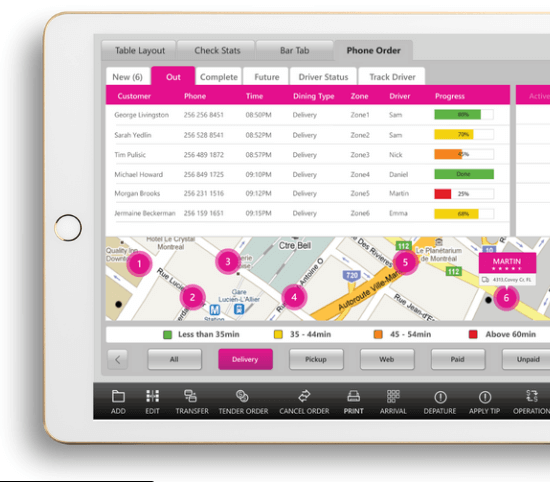

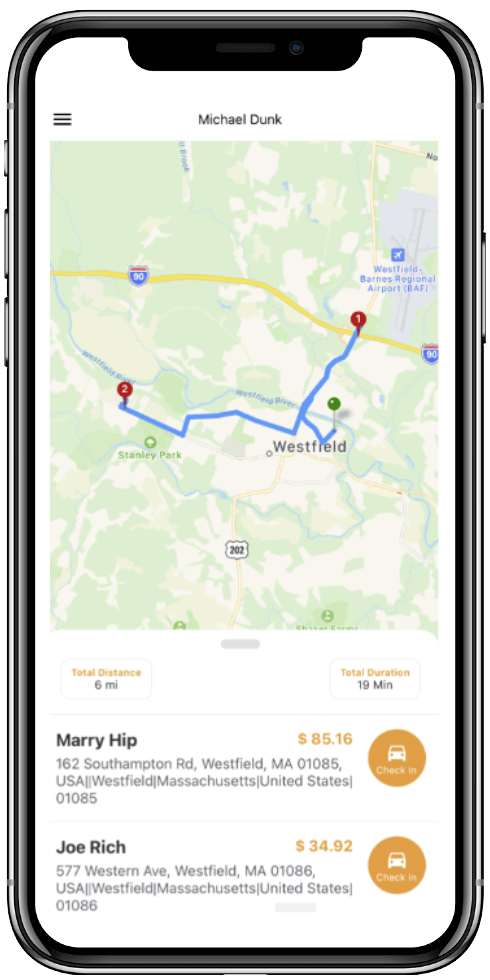

Delivery service is a valuable asset for any business, as it conveniences customers and creates another avenue for profit. LexgiaPOS Driver is a fully integrated application developed for restaurants as well as their drivers to foster a seamless delivery process.

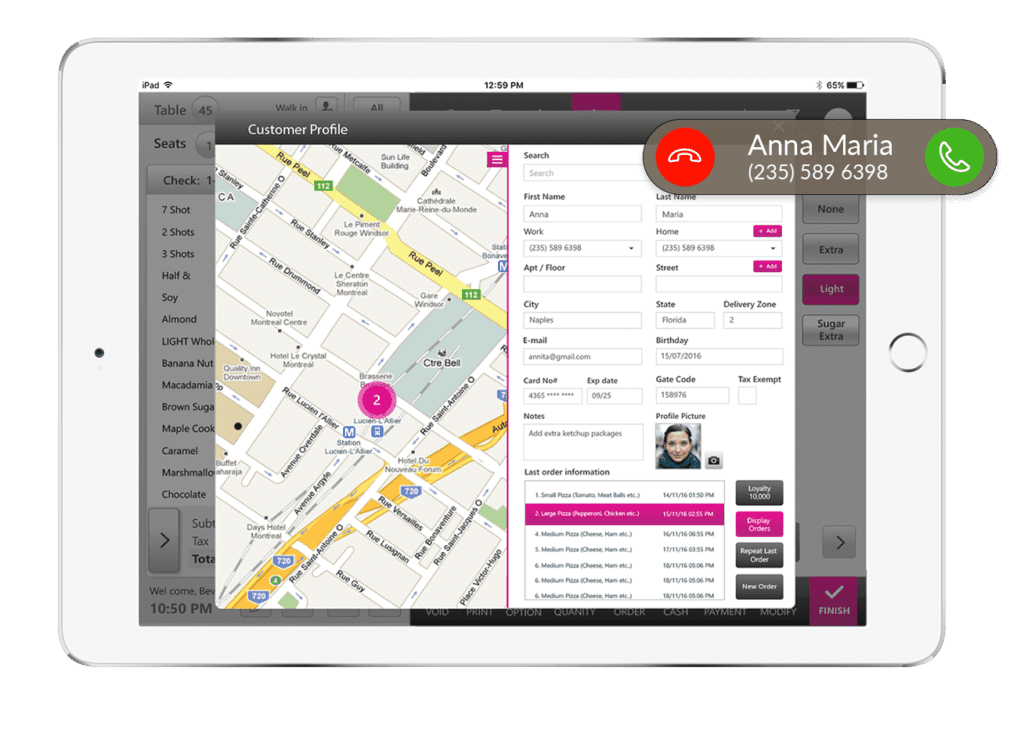

Delivery service is a valuable asset for any business, as it conveniences customers and creates another avenue for profit. LexgiaPOS Driver is a fully integrated application developed for restaurants as well as their drivers to foster a seamless delivery process. Quickly and easily assign drivers to certain deliveries or delivery routes within the system, speeding up the process. They can be informed anywhere at any time with SMS alerts, allowing for route changes and quick turnaround time. The system provides real-time driver status and allows you to collect data to measure driver performance.

Quickly and easily assign drivers to certain deliveries or delivery routes within the system, speeding up the process. They can be informed anywhere at any time with SMS alerts, allowing for route changes and quick turnaround time. The system provides real-time driver status and allows you to collect data to measure driver performance.

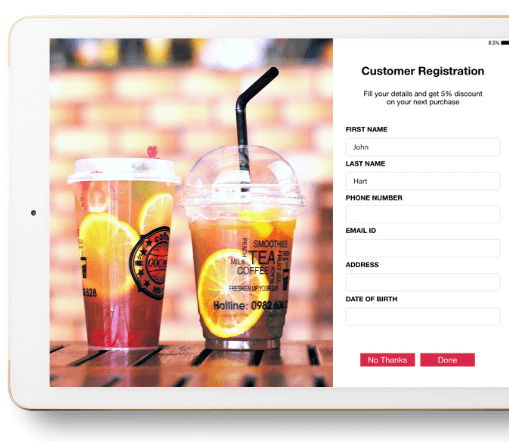

LexgiaPOS's S customer loyalty application allows businesses to create customized loyalty programs based on the best interests of both their consumers and the business itself. Loyalty rewards can be based on a variety of factors, including enrollment, customer visits, a fixed spent amount, specific menu items, and menu category.

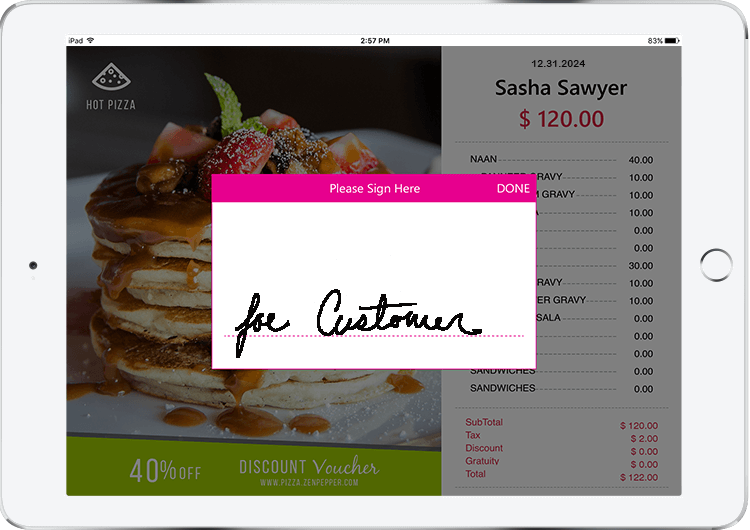

LexgiaPOS's S customer loyalty application allows businesses to create customized loyalty programs based on the best interests of both their consumers and the business itself. Loyalty rewards can be based on a variety of factors, including enrollment, customer visits, a fixed spent amount, specific menu items, and menu category. LexgiaPOS CDS is a customer facing display that they are able to interact with during checkout. The easy and fast technology provides high levels of service and convenience for customers, allowing for less delay at checkout and increased consumer satisfaction. Equipped with a tip processing feature and required digital signature, the system provides quick service that is both enjoyable and more secure. The application can also prompt customers to opt-in to your loyalty program if you choose, driving more signups.

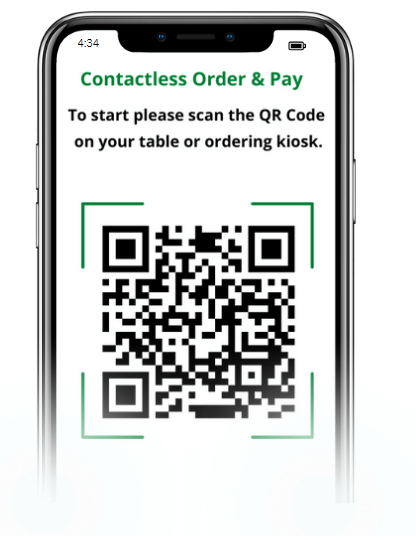

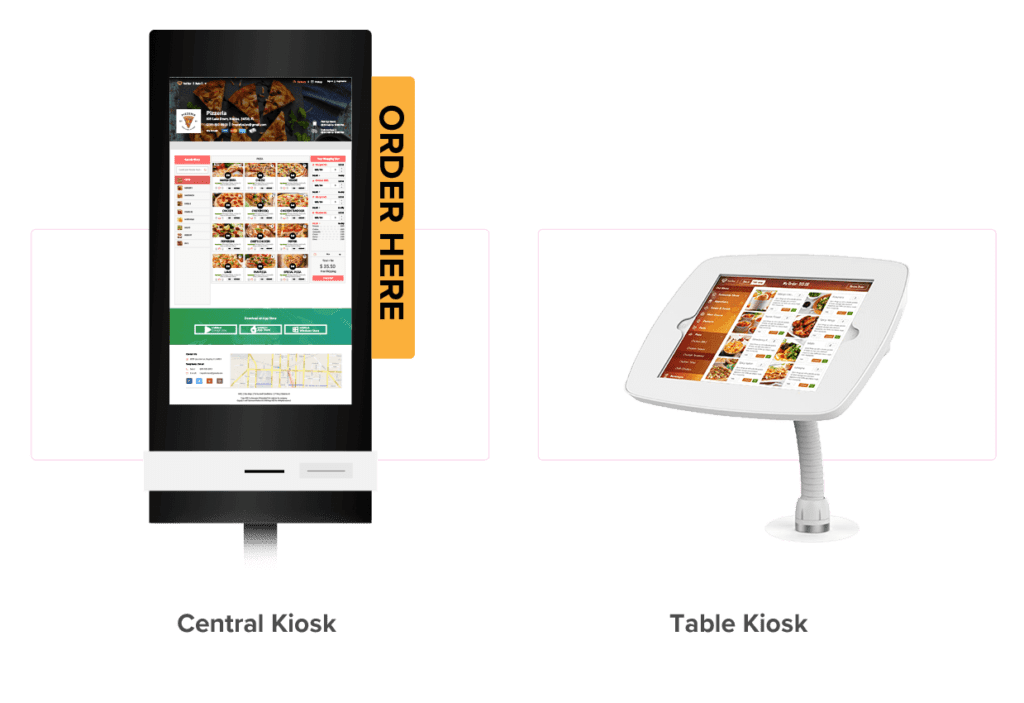

LexgiaPOS CDS is a customer facing display that they are able to interact with during checkout. The easy and fast technology provides high levels of service and convenience for customers, allowing for less delay at checkout and increased consumer satisfaction. Equipped with a tip processing feature and required digital signature, the system provides quick service that is both enjoyable and more secure. The application can also prompt customers to opt-in to your loyalty program if you choose, driving more signups. Self-order kiosk checkouts allow for customers to fully engage with the order and checkout processes independently, creating a more convenient customer experience while simultaneously lifting pressure from the front-of-house staff. LexgiaPOS Kiosk quickens the process of making and dispatching orders by communicating directly to a second display system located in the kitchen. The application eliminates extra steps by enabling direct communication from your consumers’ fingertips to the eyes of the kitchen staff.

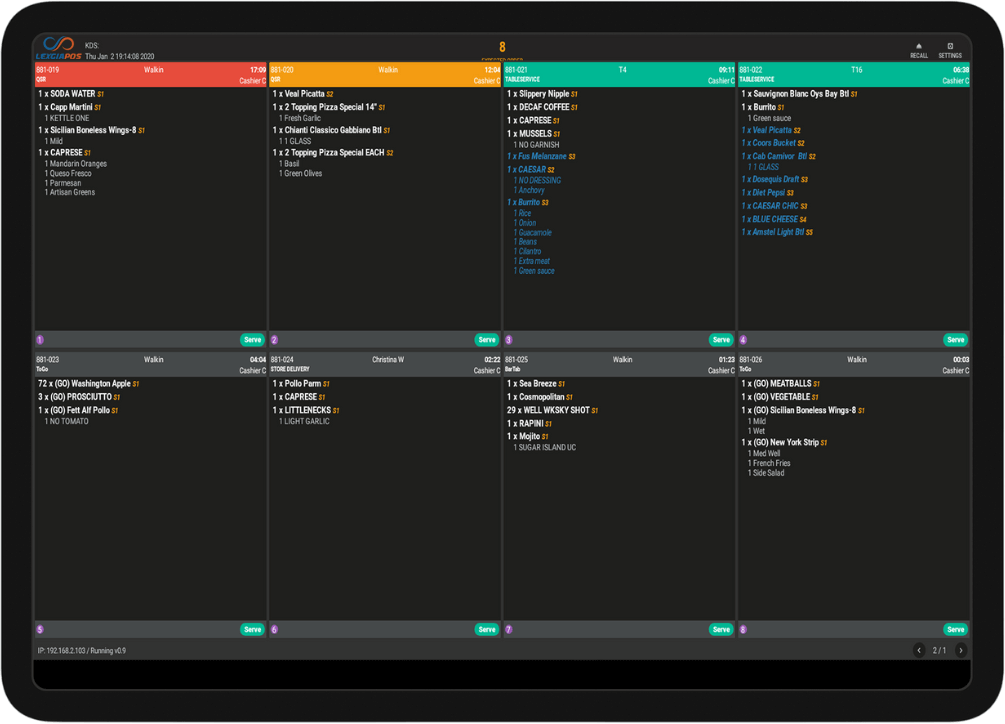

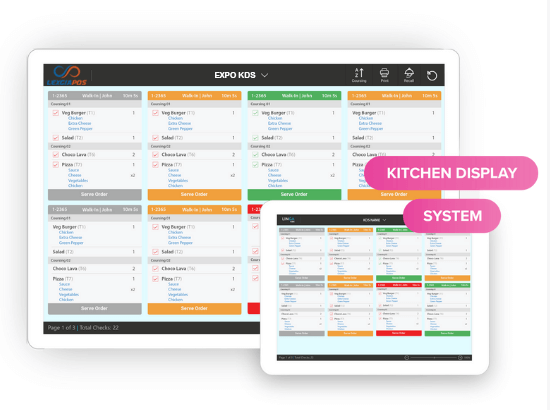

Self-order kiosk checkouts allow for customers to fully engage with the order and checkout processes independently, creating a more convenient customer experience while simultaneously lifting pressure from the front-of-house staff. LexgiaPOS Kiosk quickens the process of making and dispatching orders by communicating directly to a second display system located in the kitchen. The application eliminates extra steps by enabling direct communication from your consumers’ fingertips to the eyes of the kitchen staff. LexgiaPOS KDS is a system specifically designed for catering to needs inside the kitchen. Always in direct communication with the front-of-house display, both systems can stay connected even without internet, allowing for no interruptions to the flow of your workday.

LexgiaPOS KDS is a system specifically designed for catering to needs inside the kitchen. Always in direct communication with the front-of-house display, both systems can stay connected even without internet, allowing for no interruptions to the flow of your workday. If your restaurant serves pizza, LexgiaPOS KDS allows your customers to customize a pie down to the slice and make their topping choices as elaborate as desired. Customers can also receive SMS text alerts directly from the kitchen so that they are notified as soon as their order has been completed. The kitchen display system allows for optimal efficiency and a significant reduction of error and waiting time.

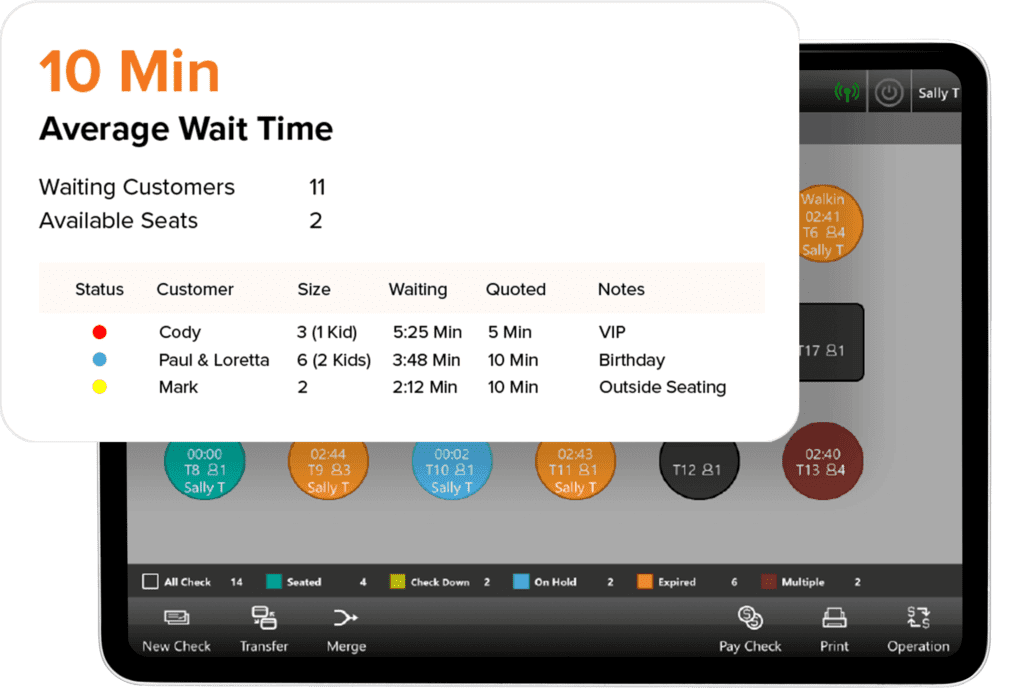

If your restaurant serves pizza, LexgiaPOS KDS allows your customers to customize a pie down to the slice and make their topping choices as elaborate as desired. Customers can also receive SMS text alerts directly from the kitchen so that they are notified as soon as their order has been completed. The kitchen display system allows for optimal efficiency and a significant reduction of error and waiting time. Excessive wait times can lead to customer dissatisfaction, lack of repeat business, and loss of sales. LexgiaPOS Waitlist is a fully integrated application within the operating system that tracks and manages your business’s bookings and guests to ensure minimal wait time and maximal communication with your customers. Equipped with a wait time calculator and synced with the statuses of your tables, the application remains constantly updated and can keep your customers in the loop as well by sending SMS text alerts regarding the status of their wait.

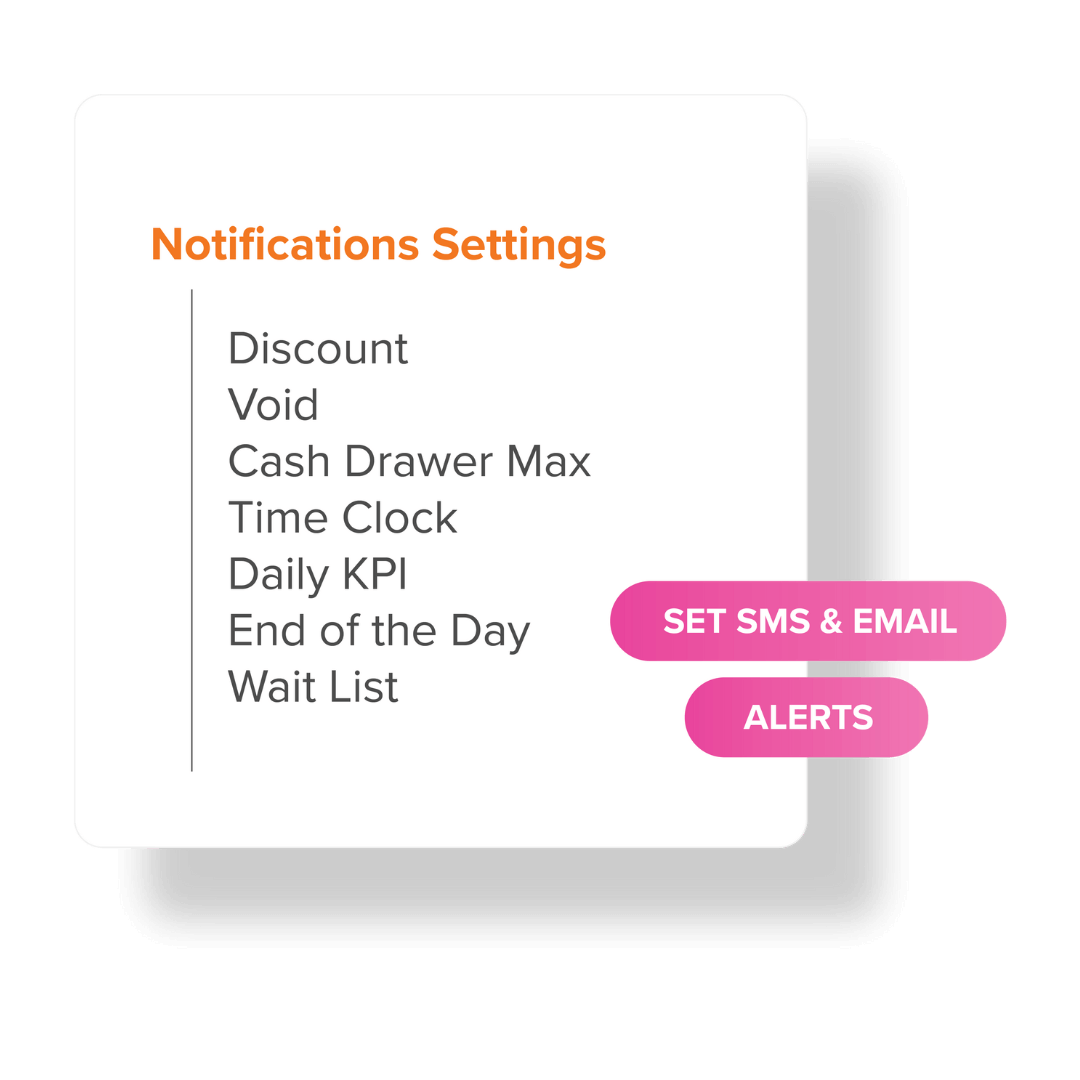

Excessive wait times can lead to customer dissatisfaction, lack of repeat business, and loss of sales. LexgiaPOS Waitlist is a fully integrated application within the operating system that tracks and manages your business’s bookings and guests to ensure minimal wait time and maximal communication with your customers. Equipped with a wait time calculator and synced with the statuses of your tables, the application remains constantly updated and can keep your customers in the loop as well by sending SMS text alerts regarding the status of their wait.