How Do ATM Machines Work—and Why Businesses Should Care

Most people use ATMs regularly, but few stop to consider how these machines actually work behind the scenes. Whether it’s a quick cash withdrawal or a balance inquiry, ATMs perform secure transactions in seconds. For businesses, understanding how ATM machines work opens the door to new revenue streams, improved customer convenience, and added foot traffic.

ATMs are more than banking tools—they’re business opportunities. At Boston North Company, we help businesses across New England take advantage of ATM services that benefit both the customer and the bottom line. Let’s learn more about how these machines work.

What Happens When You Use an ATM?

When someone walks up to an automated teller machine (ATM) to withdraw cash, a precise process kicks into motion. First, the customer inserts a debit card or credit card into the machine’s card reader. Then, they enter their personal identification number (PIN) to access their bank account securely.

Once the PIN is verified, the customer chooses a transaction—typically a cash withdrawal, balance inquiry, or transfer. The ATM connects to the bank’s system via a secure network ATM, checks the account balance, and confirms the request.

If approved, the cash dispenser inside the ATM calculates and releases the exact amount of cash requested. Within moments, the customer receives their money, a printed receipt, and updated account data—all without needing to interact with a bank teller. It’s this seamless, automated process that defines modern ATM convenience.

Key Components That Make ATMs Work

Every automated teller machine operates using several integrated components. Together, these pieces of hardware and software make ATM use simple and secure:

- Card Reader – Scans the magnetic stripe or chip on a debit card or credit card to begin the transaction.

- PIN Pad – Allows the user to enter their personal identification number (PIN) securely.

- Cash Dispenser – Dispenses the exact amount of cash requested during ATM transactions.

- Display Screen – Guides users step-by-step through their selected service.

- Receipt Printer – Issues a printed summary for record-keeping.

- Computer & Software System – Processes data and communicates with the banking network.

- Internal Vault – Secures large amounts of cash in a locked environment.

- Modem/Network Interface – Links the ATM to the financial institution’s servers through a network ATM connection.

Each of these components is essential to the reliable operation of automated banking machines, allowing users to interact with their bank account quickly and securely, 24/7.

Where ATMs Are Used—and Why That Matters to Businesses

ATMs aren’t just found at banks anymore—they’re commonly located in grocery stores, gas stations, convenience stores, salons, restaurants, bars, and other high-traffic areas. These automated teller machines allow customers to access funds anytime without needing a bank teller, creating a convenient experience.

For business owners, hosting an ATM is more than a courtesy—it’s a smart business move. Customers are more likely to make impulse purchases when they withdraw cash on-site, and many prefer having easy access to their account balance during shopping. Research shows that a significant portion of funds withdrawn from in-store ATMs—sometimes up to 30%—is spent at the same location.

Boston North Company offers a variety of ATM solutions that make implementation simple. With flexible placement options, revenue-sharing programs, and ongoing maintenance, adding an ATM to your business is easier than ever.

Explore our ATM Sales & Service offerings to learn how your business can benefit from increased customer convenience and additional income through surcharge revenue.

Why Understanding ATMs Helps Businesses Make Smarter Decisions

For business owners, knowing how ATM machines work can inform smart decisions about placement, usage, and profitability. Many business owners assume ATM ownership is complicated, but today’s systems are designed for low maintenance and high performance.

Boston North Company offers multiple program options. With full ownership, businesses can keep 100% of the surcharge revenue while controlling refills and maintenance. For those seeking a more hands-off approach, shared revenue or full-service models allow the business to provide ATM access without managing logistics.

Regardless of the model, the benefits remain clear. Automated teller machines attract foot traffic, improve the customer experience, and give cash-preferred shoppers a reason to stay and spend. Businesses also cut down on credit card processing fees and reduce the risk of card-only sales environments.

Learn How to Boost Your Business with ATMs from Boston North Company

From cash withdrawals to balance checks, automated teller machines have become a fixture of daily life. Adding an ATM helps businesses offer more than just products or services—it adds real, everyday value while boosting the bottom line. With expert guidance and flexible programs, Boston North Company makes implementation easy and profitable. Contact our team to learn how an ATM can add value to your business today.

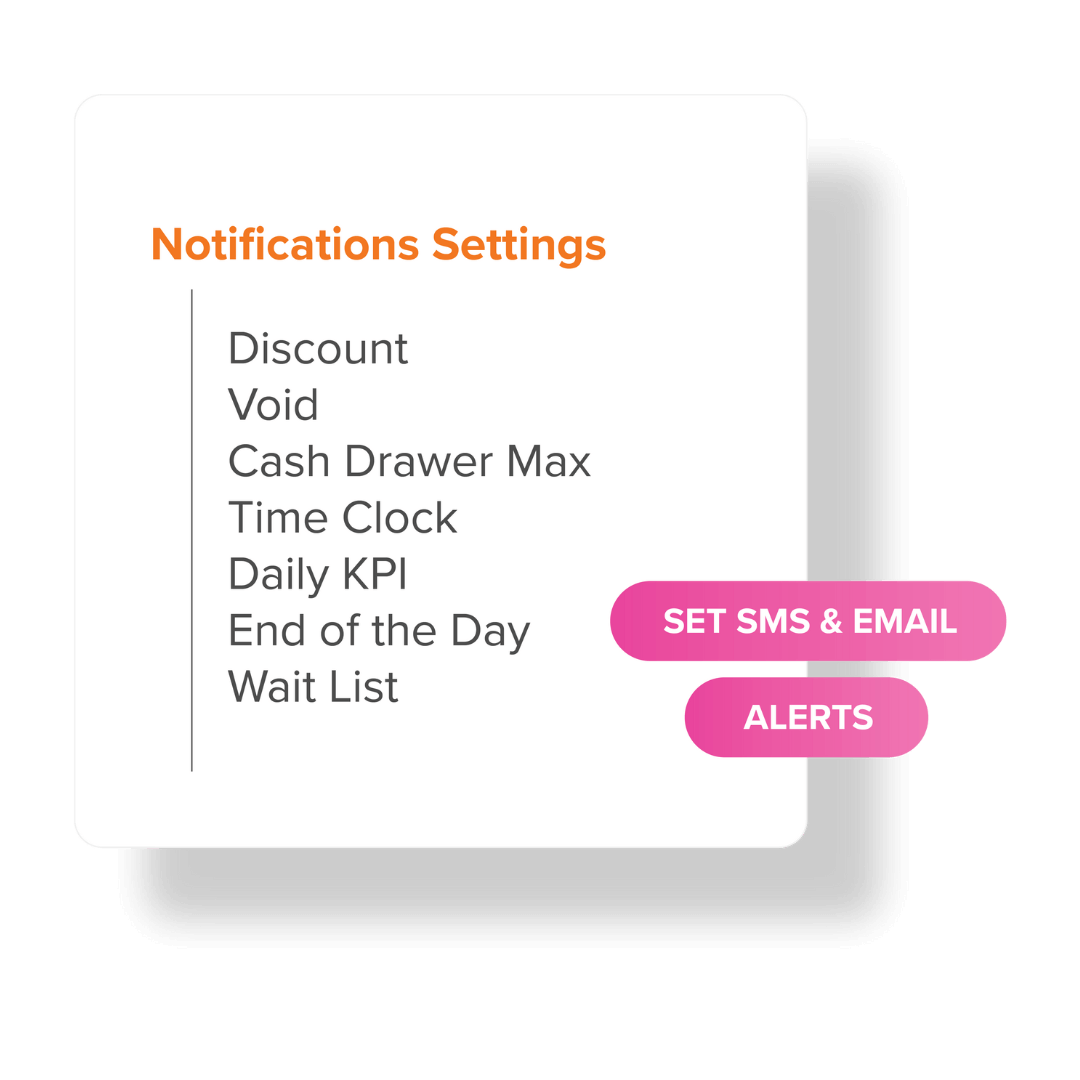

Tracking and managing inventory has never been easier with this fully integrated application. Set alerts for when inventory is low, reminding you to replenish items. LexgiaPOS Inventory also allows you to define minimum stock levels for any and all products, prompting the system to create automated shopping lists with every item that must be replenished. Check for the most popular items and plan restocking accordingly.

Tracking and managing inventory has never been easier with this fully integrated application. Set alerts for when inventory is low, reminding you to replenish items. LexgiaPOS Inventory also allows you to define minimum stock levels for any and all products, prompting the system to create automated shopping lists with every item that must be replenished. Check for the most popular items and plan restocking accordingly.

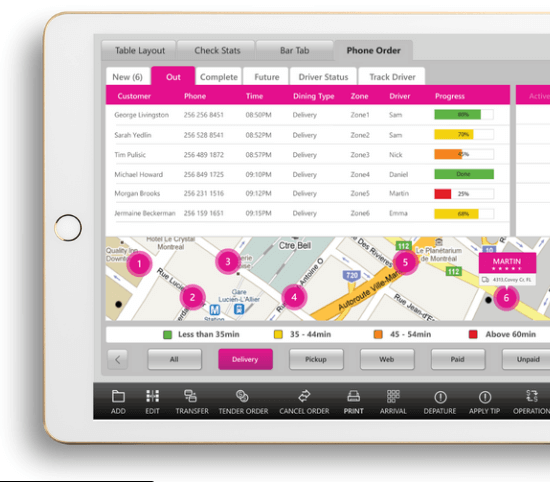

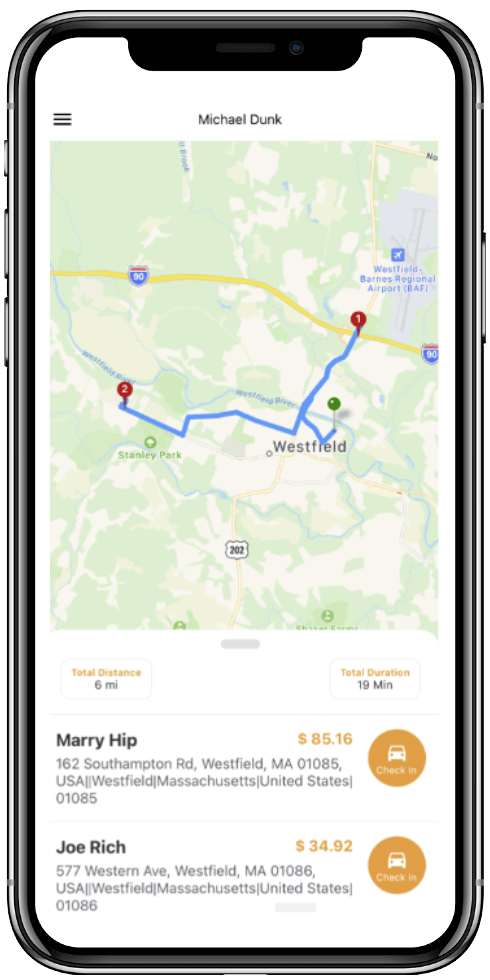

Delivery service is a valuable asset for any business, as it conveniences customers and creates another avenue for profit. LexgiaPOS Driver is a fully integrated application developed for restaurants as well as their drivers to foster a seamless delivery process.

Delivery service is a valuable asset for any business, as it conveniences customers and creates another avenue for profit. LexgiaPOS Driver is a fully integrated application developed for restaurants as well as their drivers to foster a seamless delivery process. Quickly and easily assign drivers to certain deliveries or delivery routes within the system, speeding up the process. They can be informed anywhere at any time with SMS alerts, allowing for route changes and quick turnaround time. The system provides real-time driver status and allows you to collect data to measure driver performance.

Quickly and easily assign drivers to certain deliveries or delivery routes within the system, speeding up the process. They can be informed anywhere at any time with SMS alerts, allowing for route changes and quick turnaround time. The system provides real-time driver status and allows you to collect data to measure driver performance.

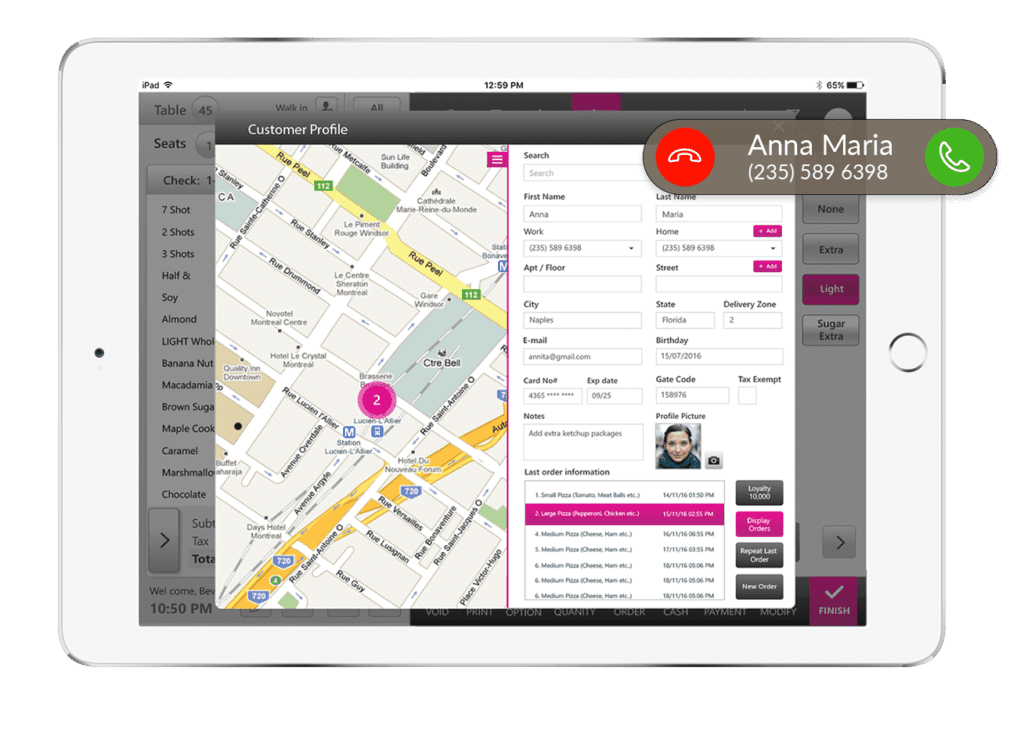

LexgiaPOS's S customer loyalty application allows businesses to create customized loyalty programs based on the best interests of both their consumers and the business itself. Loyalty rewards can be based on a variety of factors, including enrollment, customer visits, a fixed spent amount, specific menu items, and menu category.

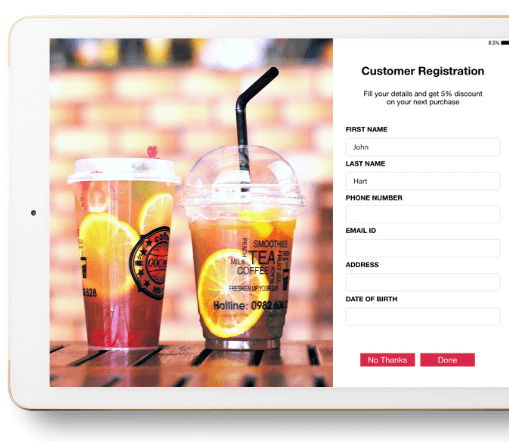

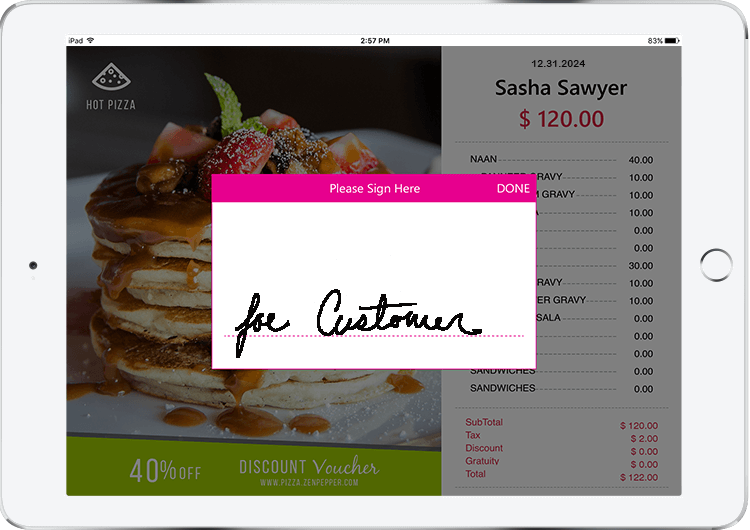

LexgiaPOS's S customer loyalty application allows businesses to create customized loyalty programs based on the best interests of both their consumers and the business itself. Loyalty rewards can be based on a variety of factors, including enrollment, customer visits, a fixed spent amount, specific menu items, and menu category. LexgiaPOS CDS is a customer facing display that they are able to interact with during checkout. The easy and fast technology provides high levels of service and convenience for customers, allowing for less delay at checkout and increased consumer satisfaction. Equipped with a tip processing feature and required digital signature, the system provides quick service that is both enjoyable and more secure. The application can also prompt customers to opt-in to your loyalty program if you choose, driving more signups.

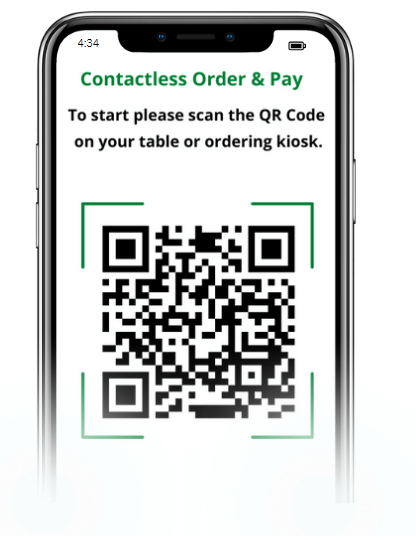

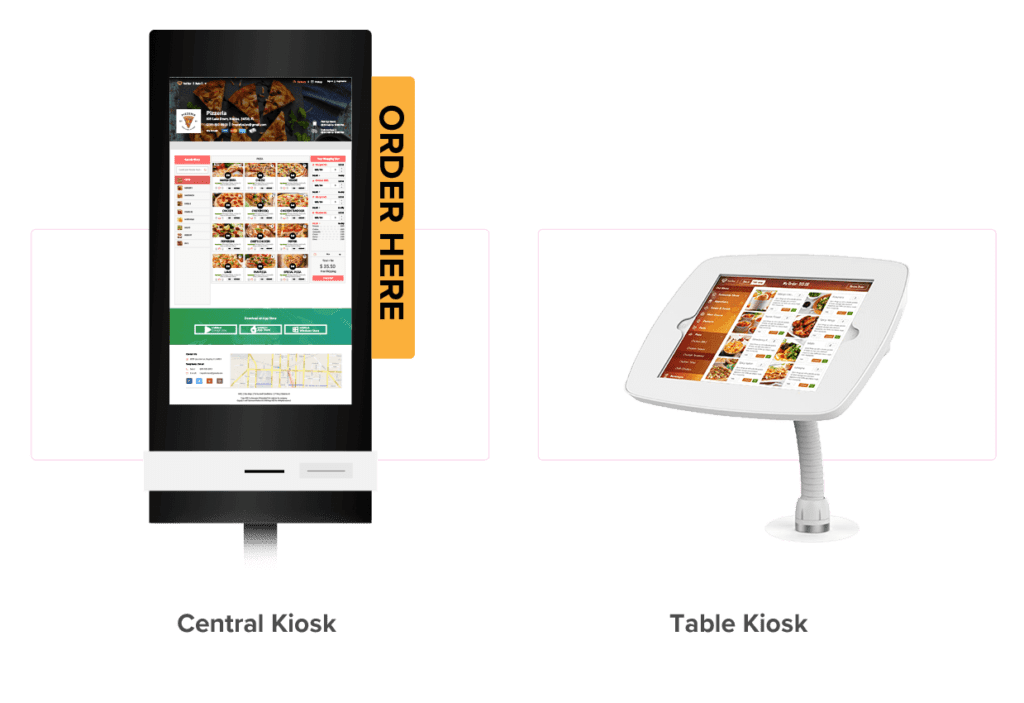

LexgiaPOS CDS is a customer facing display that they are able to interact with during checkout. The easy and fast technology provides high levels of service and convenience for customers, allowing for less delay at checkout and increased consumer satisfaction. Equipped with a tip processing feature and required digital signature, the system provides quick service that is both enjoyable and more secure. The application can also prompt customers to opt-in to your loyalty program if you choose, driving more signups. Self-order kiosk checkouts allow for customers to fully engage with the order and checkout processes independently, creating a more convenient customer experience while simultaneously lifting pressure from the front-of-house staff. LexgiaPOS Kiosk quickens the process of making and dispatching orders by communicating directly to a second display system located in the kitchen. The application eliminates extra steps by enabling direct communication from your consumers’ fingertips to the eyes of the kitchen staff.

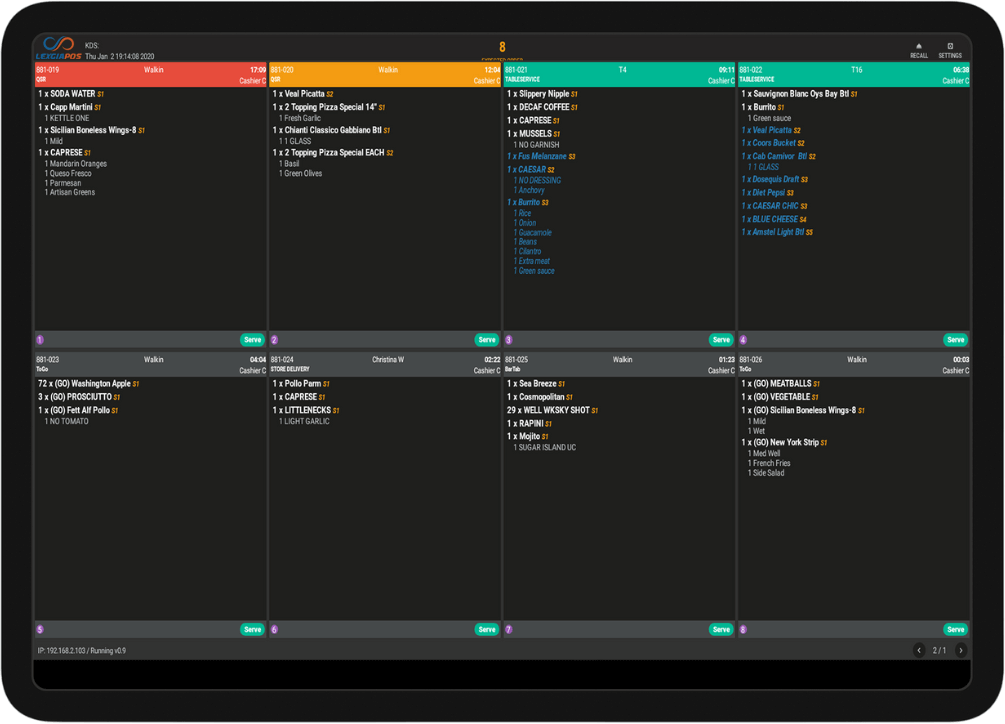

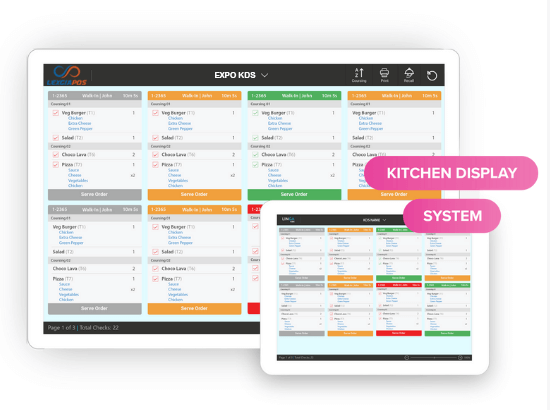

Self-order kiosk checkouts allow for customers to fully engage with the order and checkout processes independently, creating a more convenient customer experience while simultaneously lifting pressure from the front-of-house staff. LexgiaPOS Kiosk quickens the process of making and dispatching orders by communicating directly to a second display system located in the kitchen. The application eliminates extra steps by enabling direct communication from your consumers’ fingertips to the eyes of the kitchen staff. LexgiaPOS KDS is a system specifically designed for catering to needs inside the kitchen. Always in direct communication with the front-of-house display, both systems can stay connected even without internet, allowing for no interruptions to the flow of your workday.

LexgiaPOS KDS is a system specifically designed for catering to needs inside the kitchen. Always in direct communication with the front-of-house display, both systems can stay connected even without internet, allowing for no interruptions to the flow of your workday. If your restaurant serves pizza, LexgiaPOS KDS allows your customers to customize a pie down to the slice and make their topping choices as elaborate as desired. Customers can also receive SMS text alerts directly from the kitchen so that they are notified as soon as their order has been completed. The kitchen display system allows for optimal efficiency and a significant reduction of error and waiting time.

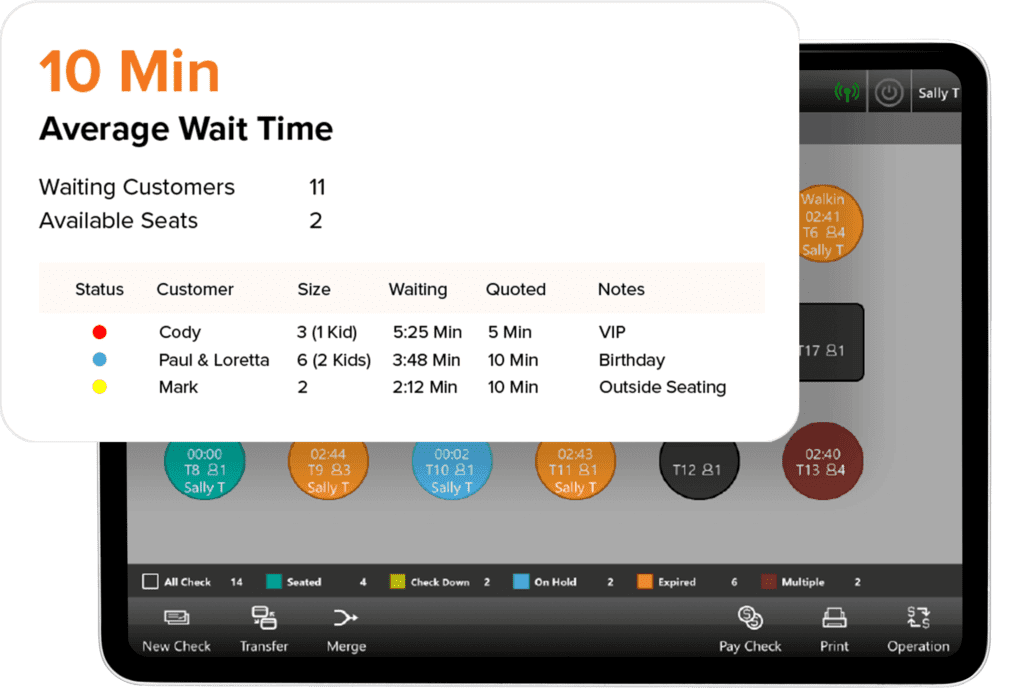

If your restaurant serves pizza, LexgiaPOS KDS allows your customers to customize a pie down to the slice and make their topping choices as elaborate as desired. Customers can also receive SMS text alerts directly from the kitchen so that they are notified as soon as their order has been completed. The kitchen display system allows for optimal efficiency and a significant reduction of error and waiting time. Excessive wait times can lead to customer dissatisfaction, lack of repeat business, and loss of sales. LexgiaPOS Waitlist is a fully integrated application within the operating system that tracks and manages your business’s bookings and guests to ensure minimal wait time and maximal communication with your customers. Equipped with a wait time calculator and synced with the statuses of your tables, the application remains constantly updated and can keep your customers in the loop as well by sending SMS text alerts regarding the status of their wait.

Excessive wait times can lead to customer dissatisfaction, lack of repeat business, and loss of sales. LexgiaPOS Waitlist is a fully integrated application within the operating system that tracks and manages your business’s bookings and guests to ensure minimal wait time and maximal communication with your customers. Equipped with a wait time calculator and synced with the statuses of your tables, the application remains constantly updated and can keep your customers in the loop as well by sending SMS text alerts regarding the status of their wait.