The Hidden Cost of “Too-Good-to-Be-True” POS Deals: What Leaving a Low-Cost System Can Really Cost Your Business

When Leaving a POS System Comes at a Steep Price For many restaurant and retail owners, switching point of sale systems feels like a routine business decision. Technology evolves, needs change, and operators look for better tools to support growth. What many do not realize is that exiting a POS agreement can sometimes come with unexpected and overwhelming financial consequences. At the center of the issue are contract structures that include early termination provisions often referred to as liquidated damages. While these clauses are legal and disclosed somewhere in the agreement, they are frequently misunderstood or underestimated at the time…

Protecting Your Business From Contracts That Sell Your Data to the Highest Bidder

Why Boston North Company’s POS System Protects Your Business and Your Community When it comes to point-of-sale (POS) systems, not all solutions are created equal. Some platforms lure restaurants in with low upfront costs, making it seem like a great deal. But once you dig deeper, the reality can be far less appealing for your business and the community you serve. Contracts Can Cost You Big Beware of “We’ll Pay You to Switch” dealsMany POS providers lock restaurants into contracts with a clause called liquidated damages. In plain terms, this means that if you cancel your contract early, you are…

The Best Bakery POS System: The Complete Guide

Running a bakery involves more than delicious bread and pastries—it requires efficiency at the counter, streamlined inventory, and meaningful customer connections. A modern bakery POS system helps accomplish all of these tasks while improving the overall experience for both staff and customers. At Boston North Company, bakeries across New England are supported with solutions that combine reliable technology and personalized service. The right system makes it easy to process transactions quickly, manage recipes and ingredients, and even engage customers with loyalty programs. Understanding what to look for ensures bakeries choose the best POS for their needs. Key Takeaways Why Bakeries…

How Much Money Do ATM Machines Hold?

Whether considering installing a standalone ATM or a wall-mounted unit, knowing the typical cash capacity is an important aspect of running an ATM business. At Boston North Company, offering ATM placement with both sales and servicing across New England is part of guiding them toward informed decisions. From small retail shops to busy gas stations, the amount of cash inside varies, and understanding that variety helps determine traffic flow, security protocols, and revenue potential. Key Takeaways Average ATM Cash Capacity Explained Most store-based ATMs are stocked with $20 bills, often loaded with a single cassette holding up to 1,000 notes.…

ATM Machine Business: Everything You Need to Know

The idea of starting an ATM machine business appeals to many business owners seeking extra revenue streams and improved customer convenience. ATMs not only provide access to cash but also drive additional spending within the business. With steady surcharge revenue and increased foot traffic, an ATM can be one of the most practical investments a local business can make. At Boston North Company, the focus is on providing New England businesses with tailored ATM solutions that combine reliable equipment, expert support, and industry knowledge. Understanding the ins and outs of the ATM industry is the first step toward making a…

How Much Does an ATM Machine Cost?

For retailers, restaurants, gas stations, and all types of businesses across New England, ATM ownership increases foot traffic, boosts spending, and generates passive income. But how much does an ATM machine cost to purchase? The answer depends on a few key factors—machine type, features, location, and support services. At Boston North Company, businesses get guidance on choosing, buying, and installing the right ATM for their space and budget. Here’s a full breakdown of what to expect when it comes to cost, setup, and ROI. Key Takeaways Understanding the Costs of ATM Ownership So, how much does an ATM machine cost?…

How to Buy an ATM Machine with Boston North Company

Adding an ATM to your business is more than a convenience—it’s a revenue opportunity. From retail shops and gas stations to cafés and clubs, having an in-house ATM makes it easier for customers to access cash, often resulting in increased spending. For business owners across New England, Boston North Company provides expert guidance on how to buy an ATM machine that fits your space, customer base, and budget. Whether you’re buying your first machine or expanding to multiple locations, Boston North Company can help streamline the process from selection to installation. Why Buying an ATM Is a Smart Business Move…

Why Invest in ATM Machines for Your Business?

In a competitive retail and service environment, finding new ways to boost revenue and improve the customer experience is key. One option more business owners are considering is to invest in ATM machines. These machines do more than dispense cash—they bring added value to your location and contribute directly to your bottom line. At Boston North Company, we help businesses throughout New England select and install ATM solutions that generate passive income, increase foot traffic, and elevate customer service. Let’s explore why adding an ATM to your location could be a smart investment for your business. How an ATM Adds…

The Best POS System for Small Businesses

Choosing the right POS system for small businesses is one of the most impactful decisions any owner can make. A smart, reliable point of sale system does more than ring up sales—it helps manage inventory, streamline operations, and create better customer experiences. Whether you run a café, deli, bar, or service business, a POS system built for small operations can be a game-changer. At Boston North Company, we guide businesses across New England to find the best POS systems and solutions to help their businesses grow. Why Small Businesses Need a Specialized POS A small business can’t afford to run…

How Do ATM Machines Work—and Why Businesses Should Care

Most people use ATMs regularly, but few stop to consider how these machines actually work behind the scenes. Whether it’s a quick cash withdrawal or a balance inquiry, ATMs perform secure transactions in seconds. For businesses, understanding how ATM machines work opens the door to new revenue streams, improved customer convenience, and added foot traffic. ATMs are more than banking tools—they’re business opportunities. At Boston North Company, we help businesses across New England take advantage of ATM services that benefit both the customer and the bottom line. Let’s learn more about how these machines work. What Happens When You Use…

Tracking and managing inventory has never been easier with this fully integrated application. Set alerts for when inventory is low, reminding you to replenish items. LexgiaPOS Inventory also allows you to define minimum stock levels for any and all products, prompting the system to create automated shopping lists with every item that must be replenished. Check for the most popular items and plan restocking accordingly.

Tracking and managing inventory has never been easier with this fully integrated application. Set alerts for when inventory is low, reminding you to replenish items. LexgiaPOS Inventory also allows you to define minimum stock levels for any and all products, prompting the system to create automated shopping lists with every item that must be replenished. Check for the most popular items and plan restocking accordingly.

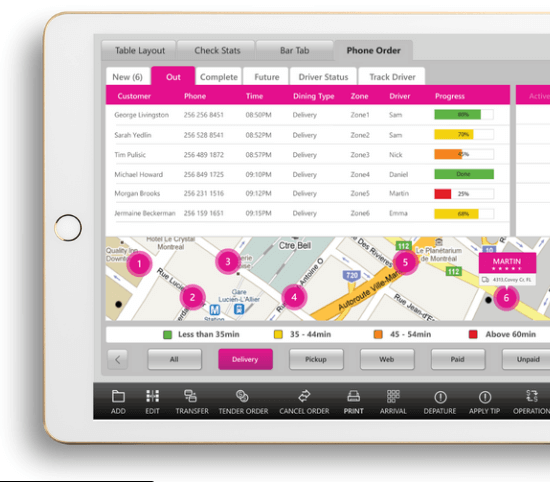

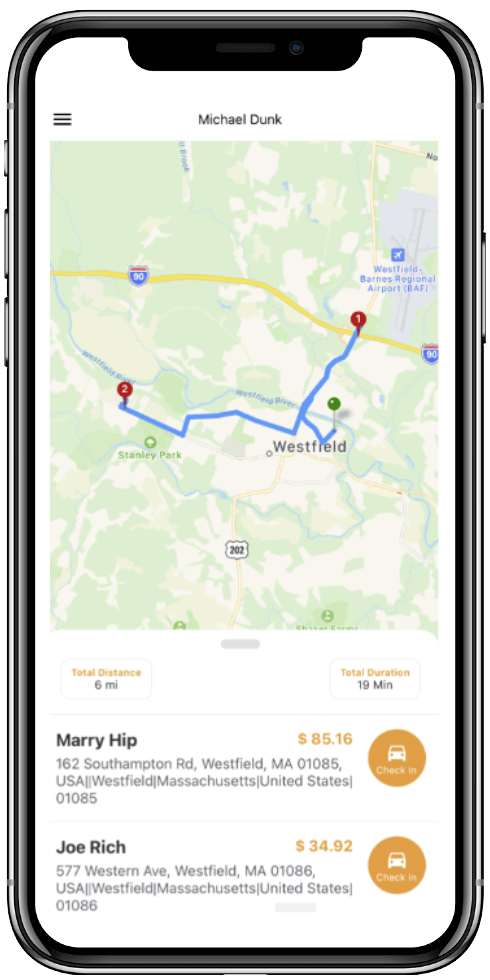

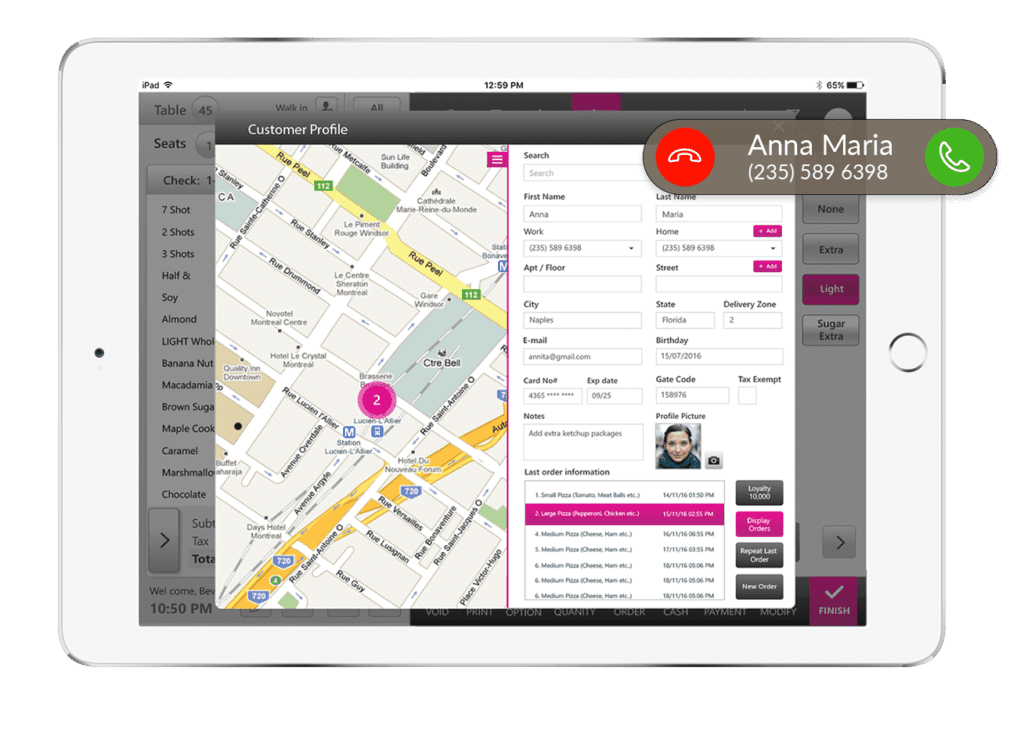

Delivery service is a valuable asset for any business, as it conveniences customers and creates another avenue for profit. LexgiaPOS Driver is a fully integrated application developed for restaurants as well as their drivers to foster a seamless delivery process.

Delivery service is a valuable asset for any business, as it conveniences customers and creates another avenue for profit. LexgiaPOS Driver is a fully integrated application developed for restaurants as well as their drivers to foster a seamless delivery process. Quickly and easily assign drivers to certain deliveries or delivery routes within the system, speeding up the process. They can be informed anywhere at any time with SMS alerts, allowing for route changes and quick turnaround time. The system provides real-time driver status and allows you to collect data to measure driver performance.

Quickly and easily assign drivers to certain deliveries or delivery routes within the system, speeding up the process. They can be informed anywhere at any time with SMS alerts, allowing for route changes and quick turnaround time. The system provides real-time driver status and allows you to collect data to measure driver performance.

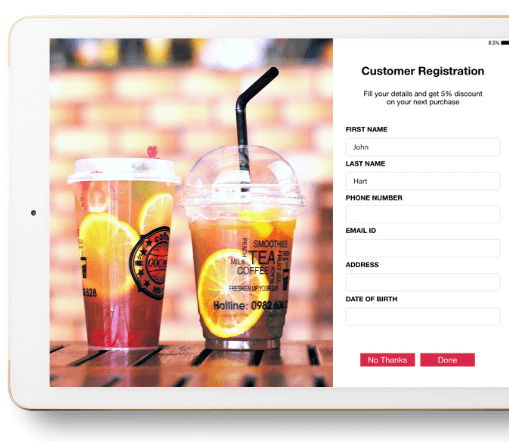

LexgiaPOS's S customer loyalty application allows businesses to create customized loyalty programs based on the best interests of both their consumers and the business itself. Loyalty rewards can be based on a variety of factors, including enrollment, customer visits, a fixed spent amount, specific menu items, and menu category.

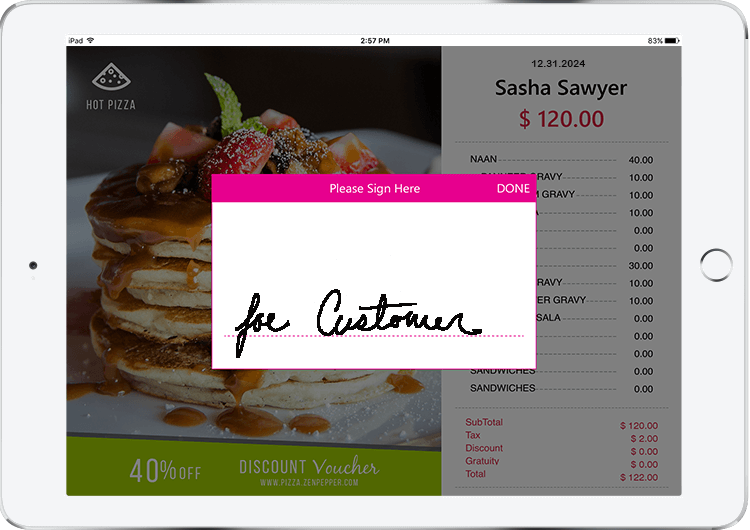

LexgiaPOS's S customer loyalty application allows businesses to create customized loyalty programs based on the best interests of both their consumers and the business itself. Loyalty rewards can be based on a variety of factors, including enrollment, customer visits, a fixed spent amount, specific menu items, and menu category. LexgiaPOS CDS is a customer facing display that they are able to interact with during checkout. The easy and fast technology provides high levels of service and convenience for customers, allowing for less delay at checkout and increased consumer satisfaction. Equipped with a tip processing feature and required digital signature, the system provides quick service that is both enjoyable and more secure. The application can also prompt customers to opt-in to your loyalty program if you choose, driving more signups.

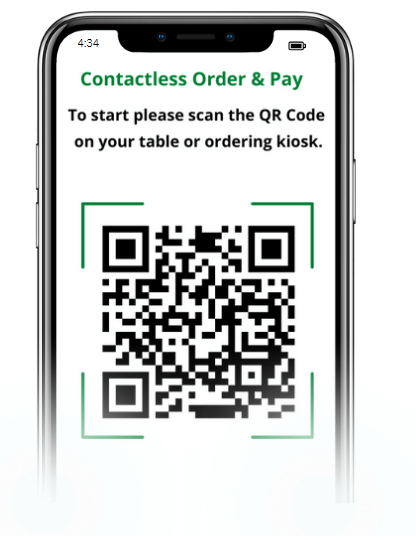

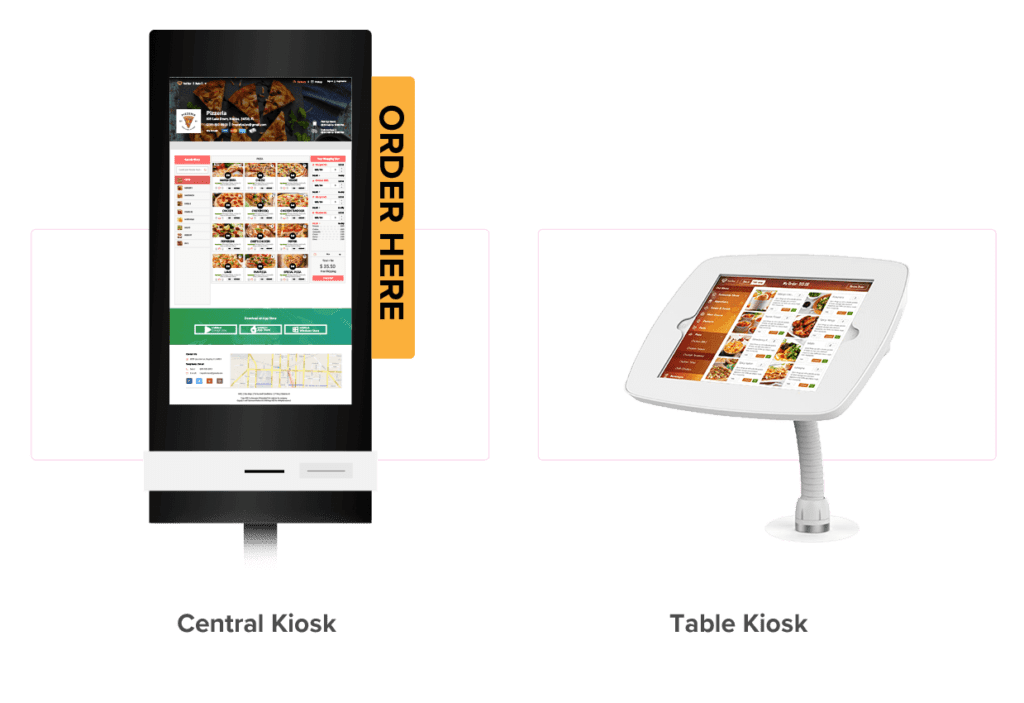

LexgiaPOS CDS is a customer facing display that they are able to interact with during checkout. The easy and fast technology provides high levels of service and convenience for customers, allowing for less delay at checkout and increased consumer satisfaction. Equipped with a tip processing feature and required digital signature, the system provides quick service that is both enjoyable and more secure. The application can also prompt customers to opt-in to your loyalty program if you choose, driving more signups. Self-order kiosk checkouts allow for customers to fully engage with the order and checkout processes independently, creating a more convenient customer experience while simultaneously lifting pressure from the front-of-house staff. LexgiaPOS Kiosk quickens the process of making and dispatching orders by communicating directly to a second display system located in the kitchen. The application eliminates extra steps by enabling direct communication from your consumers’ fingertips to the eyes of the kitchen staff.

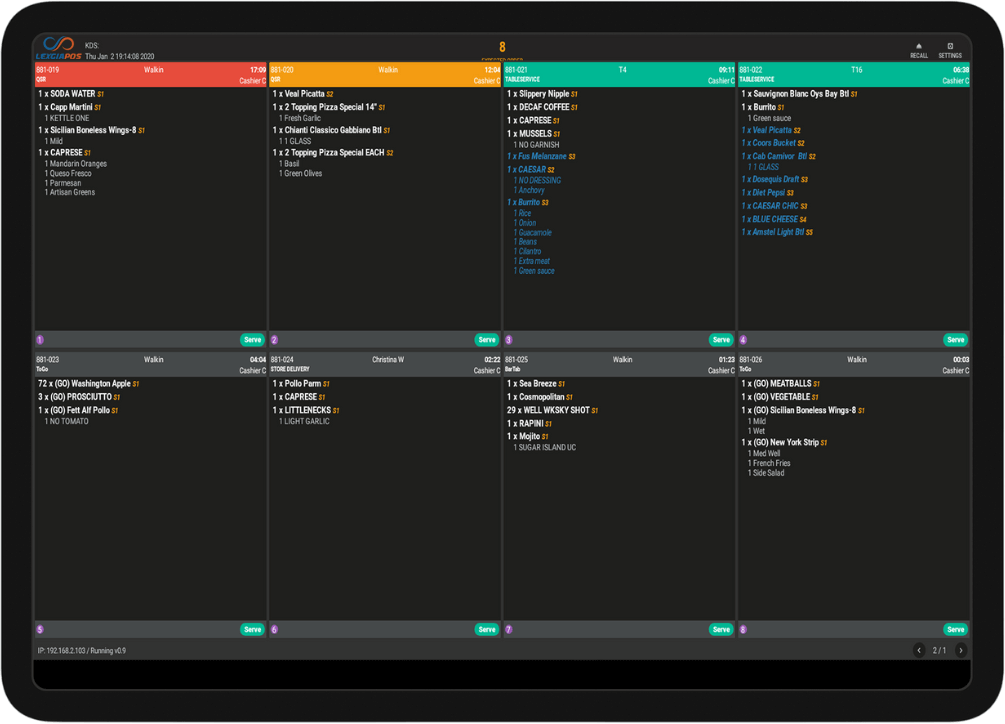

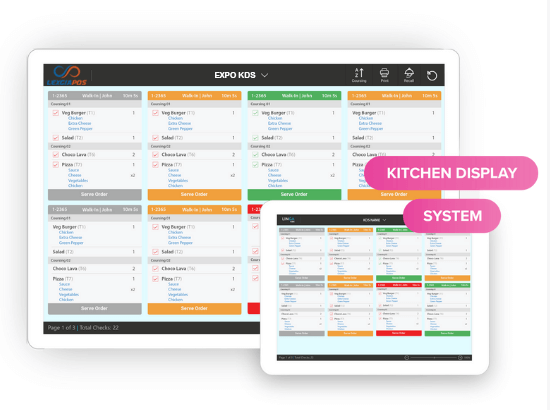

Self-order kiosk checkouts allow for customers to fully engage with the order and checkout processes independently, creating a more convenient customer experience while simultaneously lifting pressure from the front-of-house staff. LexgiaPOS Kiosk quickens the process of making and dispatching orders by communicating directly to a second display system located in the kitchen. The application eliminates extra steps by enabling direct communication from your consumers’ fingertips to the eyes of the kitchen staff. LexgiaPOS KDS is a system specifically designed for catering to needs inside the kitchen. Always in direct communication with the front-of-house display, both systems can stay connected even without internet, allowing for no interruptions to the flow of your workday.

LexgiaPOS KDS is a system specifically designed for catering to needs inside the kitchen. Always in direct communication with the front-of-house display, both systems can stay connected even without internet, allowing for no interruptions to the flow of your workday. If your restaurant serves pizza, LexgiaPOS KDS allows your customers to customize a pie down to the slice and make their topping choices as elaborate as desired. Customers can also receive SMS text alerts directly from the kitchen so that they are notified as soon as their order has been completed. The kitchen display system allows for optimal efficiency and a significant reduction of error and waiting time.

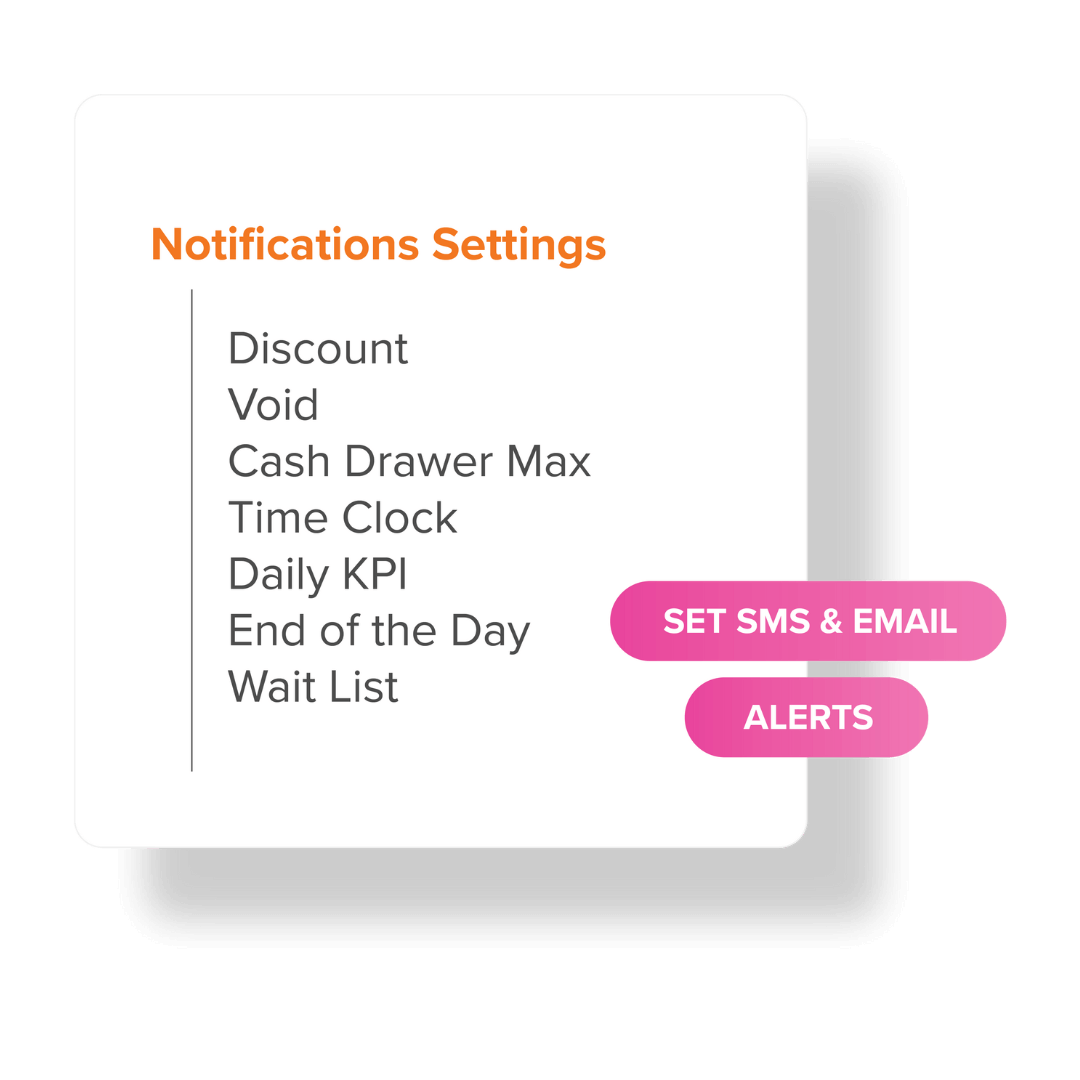

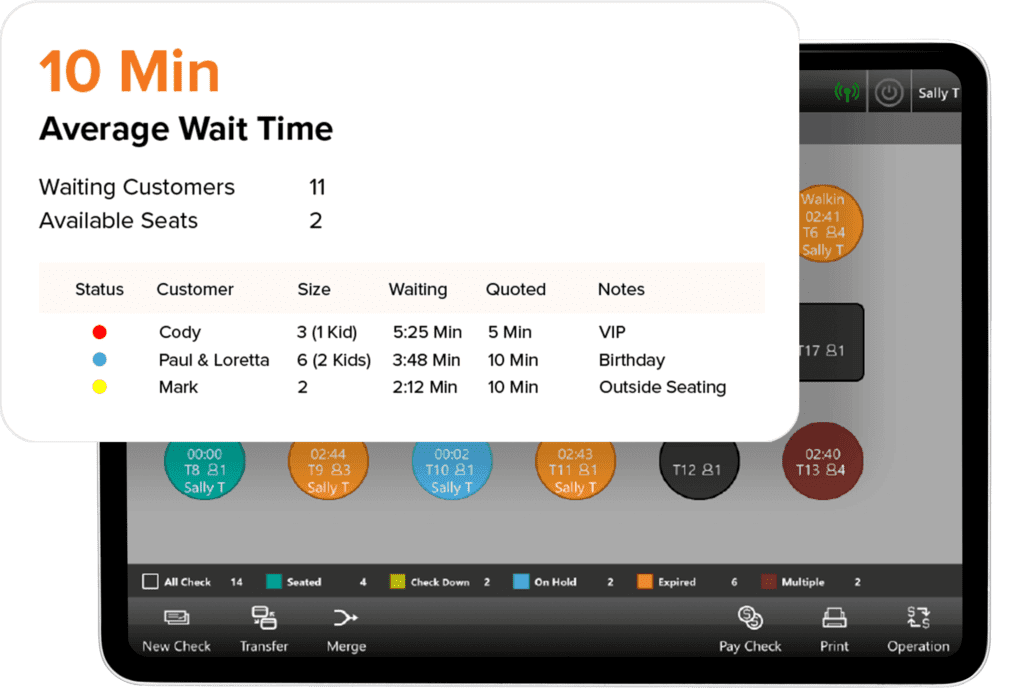

If your restaurant serves pizza, LexgiaPOS KDS allows your customers to customize a pie down to the slice and make their topping choices as elaborate as desired. Customers can also receive SMS text alerts directly from the kitchen so that they are notified as soon as their order has been completed. The kitchen display system allows for optimal efficiency and a significant reduction of error and waiting time. Excessive wait times can lead to customer dissatisfaction, lack of repeat business, and loss of sales. LexgiaPOS Waitlist is a fully integrated application within the operating system that tracks and manages your business’s bookings and guests to ensure minimal wait time and maximal communication with your customers. Equipped with a wait time calculator and synced with the statuses of your tables, the application remains constantly updated and can keep your customers in the loop as well by sending SMS text alerts regarding the status of their wait.

Excessive wait times can lead to customer dissatisfaction, lack of repeat business, and loss of sales. LexgiaPOS Waitlist is a fully integrated application within the operating system that tracks and manages your business’s bookings and guests to ensure minimal wait time and maximal communication with your customers. Equipped with a wait time calculator and synced with the statuses of your tables, the application remains constantly updated and can keep your customers in the loop as well by sending SMS text alerts regarding the status of their wait.