How Much Money Do ATM Machines Hold?

Whether considering installing a standalone ATM or a wall-mounted unit, knowing the typical cash capacity is an important aspect of running an ATM business. At Boston North Company, offering ATM placement with both sales and servicing across New England is part of guiding them toward informed decisions. From small retail shops to busy gas stations, the amount of cash inside varies, and understanding that variety helps determine traffic flow, security protocols, and revenue potential.

Key Takeaways

- Most ATMs can hold up to $10,000 and $20,000, depending on cassette count and denomination, while some high-capacity machines typically located at larger banks, and high-traffic locations may hold up to $100,00+ in cash.

- Withdrawal limits are usually set by the bank per card, not by the machine

- ATM cash capacity depends on the number and size of cash cassettes, denominations, and refill frequency

- Boston North Company offers tailored ATM placement and support solutions across New England

Average ATM Cash Capacity Explained

Most store-based ATMs are stocked with $20 bills, often loaded with a single cassette holding up to 1,000 notes. Retail operators typically limit cash loading for security and cash-flow reasons.

Higher-capacity units—such as bank-owned or high-volume site ATMs—may include multiple cassettes, each fitting up to 2,000 notes. With four cassettes loaded with mixed denominations ($20, $50), these machines can hold $50,000 to $100,000+ in cash. The actual maximum amount is rarely fully loaded in retail settings, both for risk and cost management.

Withdrawal limits per customer (commonly $300–$500 per transaction) are set by banks, not the machine’s cash supply. Knowing the machine’s cash capacity helps businesses plan for usage patterns and refill schedules. Businesses can also adjust the withdrawal limits to better manage cash flow and refill schedules.

What Determines ATM Cash Capacity

Several factors determine how much money ATM machines hold at any time:

- Number of Cassettes: Most ATMs use 1–4 cassettes, each holding 1,000–2,000 notes.

- Denomination Mix: Higher‑value notes (e.g. $50) increase total stored cash per cassette but you need to understand the needs of the customer you serve and how much money they would typically be withdrawing

- Location & Traffic: High-volume places like malls or busy stores load more cash to prevent shortages.

- Security Guidelines: Businesses often limit loads to $5K–$20K to reduce insurance exposure.

- Refill Frequency: Frequent refilling lets operators keep lower cash levels safely.

Cash Capacity by Location Type

Different installations call for different cash load levels. Here’s a breakdown for business owners:

- Retail or Convenience Store ATMs: Usually hold $5,000–$20,000 in $20 bills, loaded as often as needed, depending on usage.

- Gas Stations or High-Traffic Retailers: May load $10,000–$50,000 or more, in anticipation of frequent withdrawals.

- Bank-Owned or Urban Public ATMs: Can contain $50,000–$100,000+, equipped with multiple cassettes and diverse denominations.

- Wall ATM Units or Through-The-Wall ATMs: Often used in hospitality venues—loaded with moderate amounts ($5K–$20K), balancing service and security.

- Restaurants, Bars, and Salons: These types of cash paying businesses, especially those who offer Keno or lottery my load $5,000+ and refill as needed, depending on daily usage.

Boston North Company supports a variety of ATM solutions: freestanding, wall ATM models, and teller machine rotations, customizing each placement based on space, expected volume, and cash handling protocols.

Managing Replenishment & Withdrawal Limits

Here’s a quick look at cash management and machine limitations:

- Withdrawal limit per card is set by the bank (typically $300–$500 per transaction) but can be customized to manage cash flow and refill frequency

- Maximum amount held is often much more, but not accessible per user.

- Replenishment schedules—daily or weekly—depend on usage patterns; electronic monitoring tools help reduce downtime.

- Boston North Company provides support to set optimal refill levels based on customer traffic and security standards.

This ensures ATMs operate reliably without running dry while keeping cash exposure reasonable.

Why Understanding Capacity Matters for ATM Businesses

Knowing how much money ATM machines hold helps businesses optimize several areas:

- Revenue predictions: More cash capacity means fewer service interruptions and more surcharge opportunities.

- Space planning: Choosing between freestanding or wall ATM units depends on available floor space and refill access.

- Security considerations: Lower on-hand amounts reduce risk and ease insurance constraints.

- Operational efficiency: Proper sizing of cassette capacity leads to fewer refills and better uptime.

Boston North Company guides clients in selecting machine types and cash load strategies appropriate to their location and transaction volume while balancing convenience and safety.

Get ATM Solutions Today with Boston North Company

Boston North Company offers businesses across New England expert guidance on choosing the right machine, configuring cash capacity, and managing replenishment. Whether considering a freestanding unit or a compact wall ATM, understanding cash amounts and how they work is key to lasting success. Contact our team to explore ATM placement and service solutions.

Frequently Asked Questions (FAQs)

How much money can an ATM typically hold?

A standard retail ATM holds around $10,000–$20,000. Higher-capacity units in busy locations may hold as much as $50,000–$100,000+ by using multiple cassettes.

What is the withdrawal limit at an ATM?

Withdrawal limits (e.g. $300–$500 per transaction) are set by your bank, not determined by the ATM’s cash supply.

Why don’t ATMs fill to maximum capacity?

Businesses often limit load amounts for security, cash flow, and insurance reasons, even when machines are technically capable of higher amounts.

How can I set the right cash levels for my ATM?

Working with ATM providers like Boston North Company ensures placement, dispenser size, and refill schedules are tailored to your usage and risk profile.

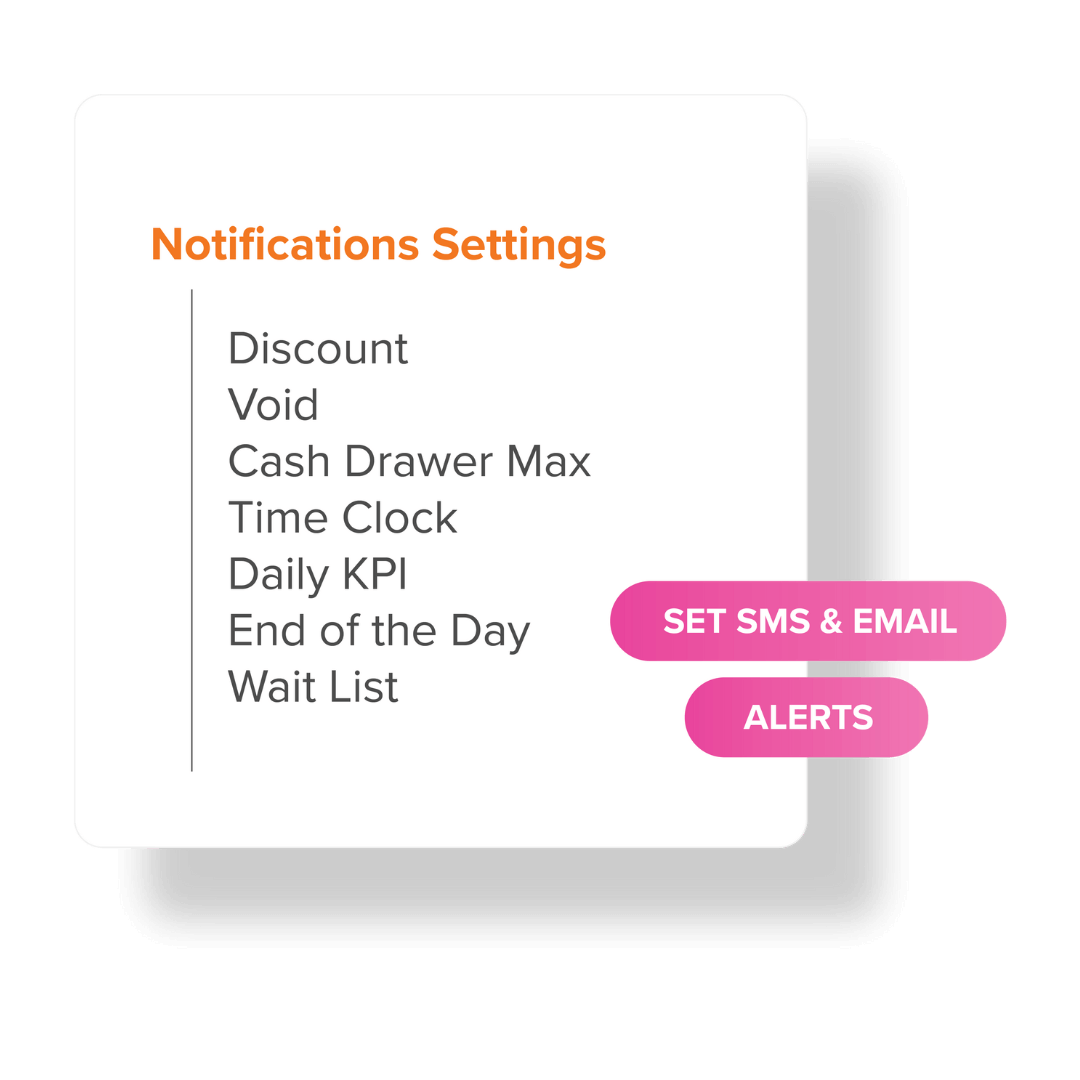

Tracking and managing inventory has never been easier with this fully integrated application. Set alerts for when inventory is low, reminding you to replenish items. LexgiaPOS Inventory also allows you to define minimum stock levels for any and all products, prompting the system to create automated shopping lists with every item that must be replenished. Check for the most popular items and plan restocking accordingly.

Tracking and managing inventory has never been easier with this fully integrated application. Set alerts for when inventory is low, reminding you to replenish items. LexgiaPOS Inventory also allows you to define minimum stock levels for any and all products, prompting the system to create automated shopping lists with every item that must be replenished. Check for the most popular items and plan restocking accordingly.

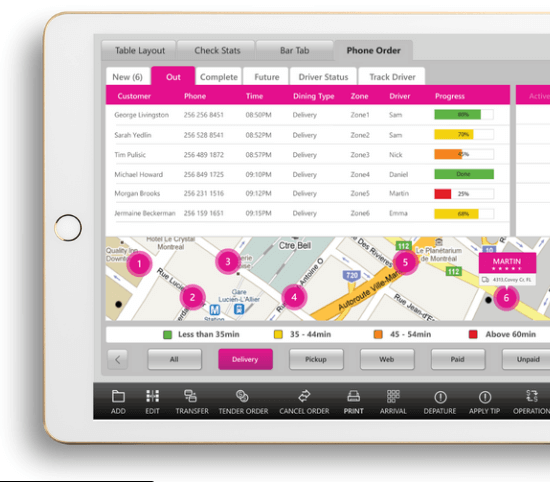

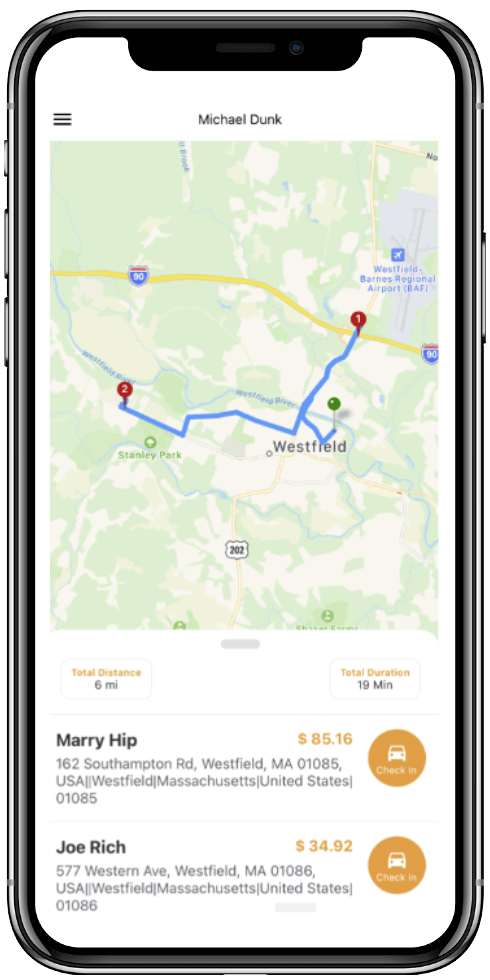

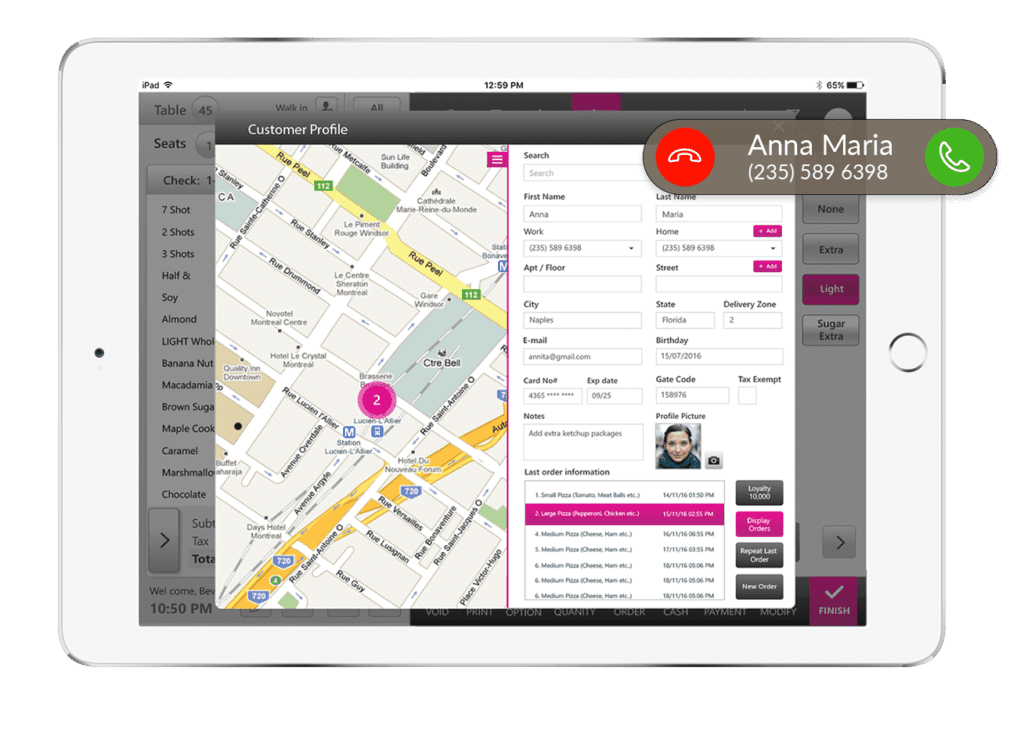

Delivery service is a valuable asset for any business, as it conveniences customers and creates another avenue for profit. LexgiaPOS Driver is a fully integrated application developed for restaurants as well as their drivers to foster a seamless delivery process.

Delivery service is a valuable asset for any business, as it conveniences customers and creates another avenue for profit. LexgiaPOS Driver is a fully integrated application developed for restaurants as well as their drivers to foster a seamless delivery process. Quickly and easily assign drivers to certain deliveries or delivery routes within the system, speeding up the process. They can be informed anywhere at any time with SMS alerts, allowing for route changes and quick turnaround time. The system provides real-time driver status and allows you to collect data to measure driver performance.

Quickly and easily assign drivers to certain deliveries or delivery routes within the system, speeding up the process. They can be informed anywhere at any time with SMS alerts, allowing for route changes and quick turnaround time. The system provides real-time driver status and allows you to collect data to measure driver performance.

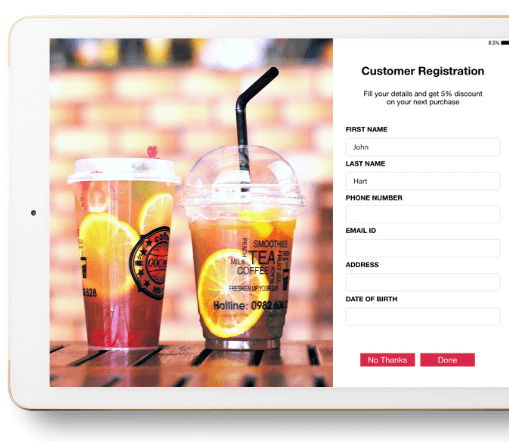

LexgiaPOS's S customer loyalty application allows businesses to create customized loyalty programs based on the best interests of both their consumers and the business itself. Loyalty rewards can be based on a variety of factors, including enrollment, customer visits, a fixed spent amount, specific menu items, and menu category.

LexgiaPOS's S customer loyalty application allows businesses to create customized loyalty programs based on the best interests of both their consumers and the business itself. Loyalty rewards can be based on a variety of factors, including enrollment, customer visits, a fixed spent amount, specific menu items, and menu category. LexgiaPOS CDS is a customer facing display that they are able to interact with during checkout. The easy and fast technology provides high levels of service and convenience for customers, allowing for less delay at checkout and increased consumer satisfaction. Equipped with a tip processing feature and required digital signature, the system provides quick service that is both enjoyable and more secure. The application can also prompt customers to opt-in to your loyalty program if you choose, driving more signups.

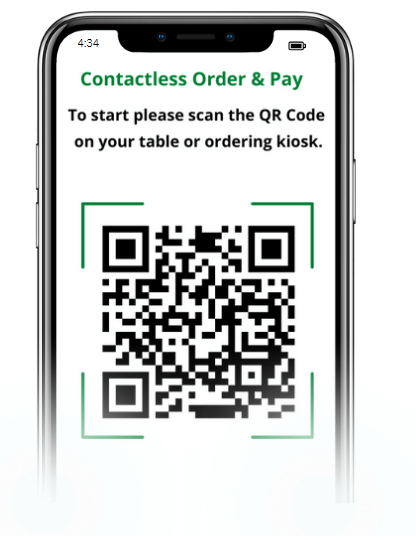

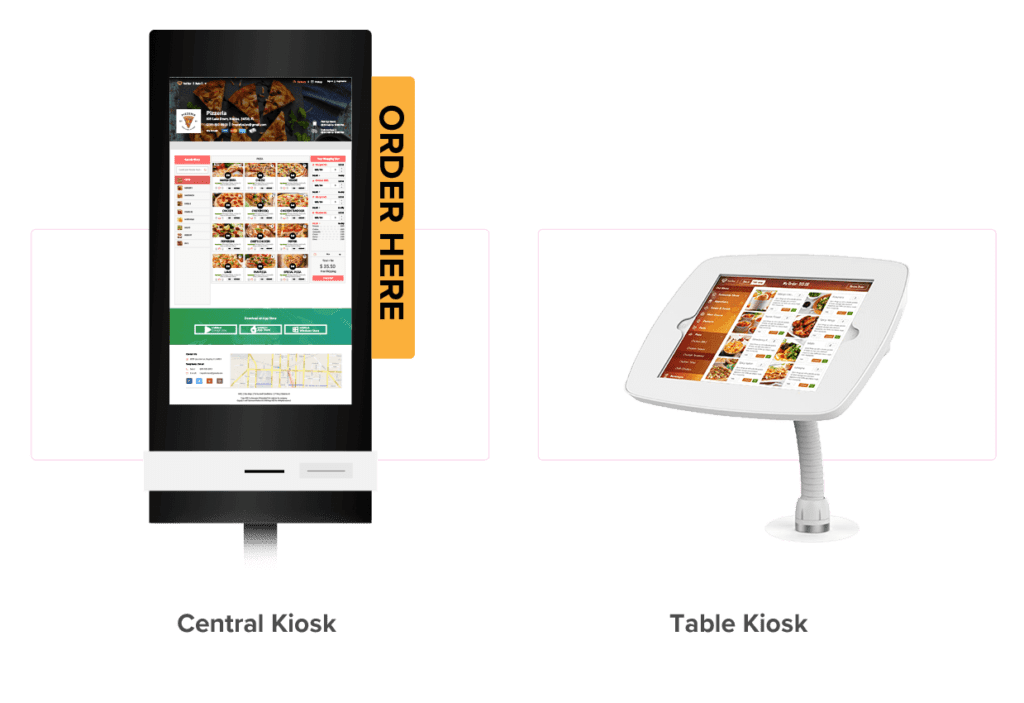

LexgiaPOS CDS is a customer facing display that they are able to interact with during checkout. The easy and fast technology provides high levels of service and convenience for customers, allowing for less delay at checkout and increased consumer satisfaction. Equipped with a tip processing feature and required digital signature, the system provides quick service that is both enjoyable and more secure. The application can also prompt customers to opt-in to your loyalty program if you choose, driving more signups. Self-order kiosk checkouts allow for customers to fully engage with the order and checkout processes independently, creating a more convenient customer experience while simultaneously lifting pressure from the front-of-house staff. LexgiaPOS Kiosk quickens the process of making and dispatching orders by communicating directly to a second display system located in the kitchen. The application eliminates extra steps by enabling direct communication from your consumers’ fingertips to the eyes of the kitchen staff.

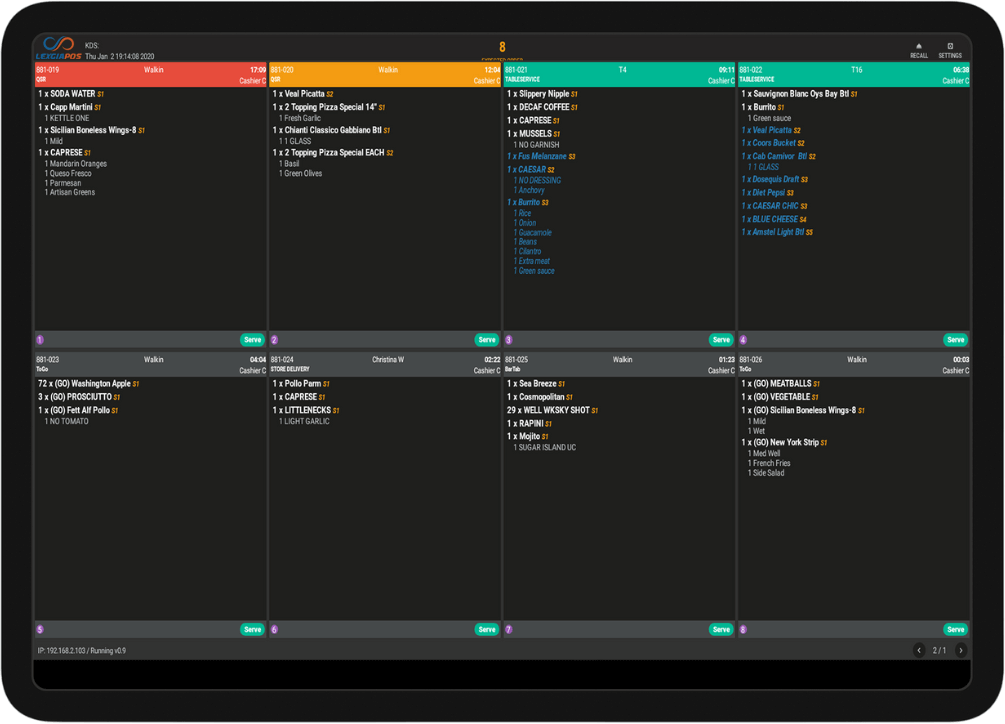

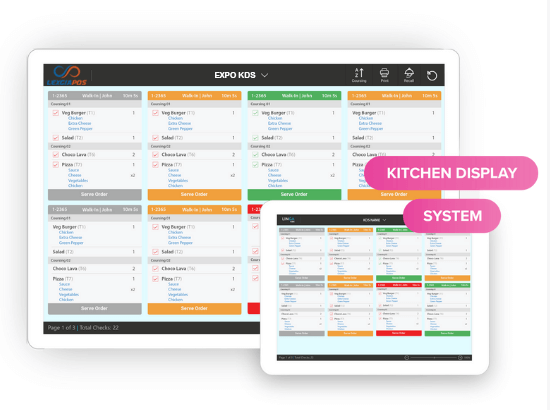

Self-order kiosk checkouts allow for customers to fully engage with the order and checkout processes independently, creating a more convenient customer experience while simultaneously lifting pressure from the front-of-house staff. LexgiaPOS Kiosk quickens the process of making and dispatching orders by communicating directly to a second display system located in the kitchen. The application eliminates extra steps by enabling direct communication from your consumers’ fingertips to the eyes of the kitchen staff. LexgiaPOS KDS is a system specifically designed for catering to needs inside the kitchen. Always in direct communication with the front-of-house display, both systems can stay connected even without internet, allowing for no interruptions to the flow of your workday.

LexgiaPOS KDS is a system specifically designed for catering to needs inside the kitchen. Always in direct communication with the front-of-house display, both systems can stay connected even without internet, allowing for no interruptions to the flow of your workday. If your restaurant serves pizza, LexgiaPOS KDS allows your customers to customize a pie down to the slice and make their topping choices as elaborate as desired. Customers can also receive SMS text alerts directly from the kitchen so that they are notified as soon as their order has been completed. The kitchen display system allows for optimal efficiency and a significant reduction of error and waiting time.

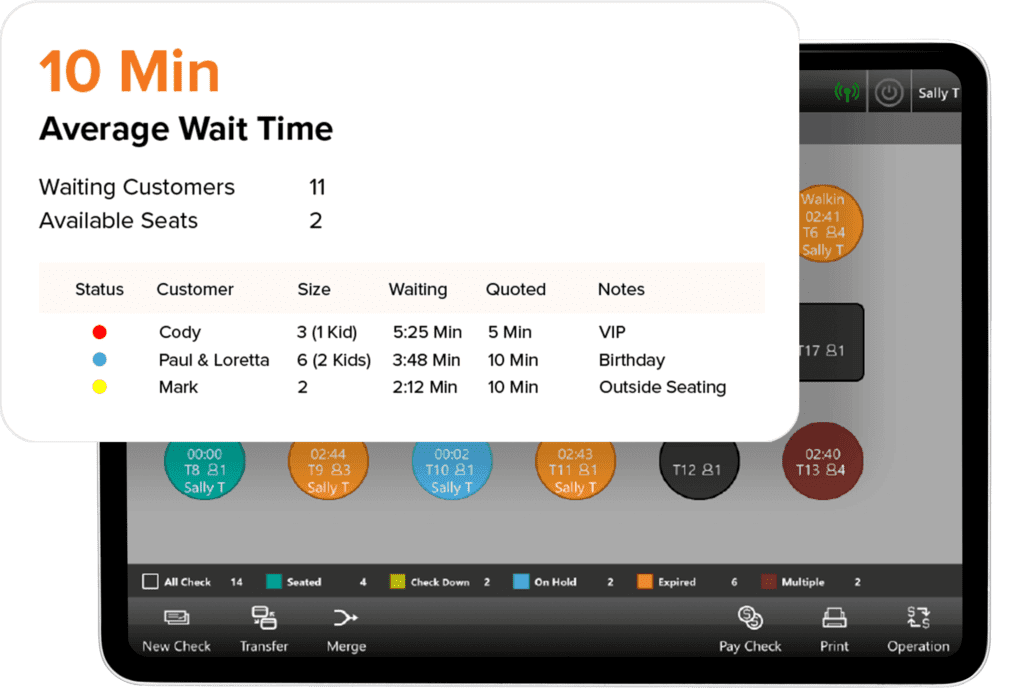

If your restaurant serves pizza, LexgiaPOS KDS allows your customers to customize a pie down to the slice and make their topping choices as elaborate as desired. Customers can also receive SMS text alerts directly from the kitchen so that they are notified as soon as their order has been completed. The kitchen display system allows for optimal efficiency and a significant reduction of error and waiting time. Excessive wait times can lead to customer dissatisfaction, lack of repeat business, and loss of sales. LexgiaPOS Waitlist is a fully integrated application within the operating system that tracks and manages your business’s bookings and guests to ensure minimal wait time and maximal communication with your customers. Equipped with a wait time calculator and synced with the statuses of your tables, the application remains constantly updated and can keep your customers in the loop as well by sending SMS text alerts regarding the status of their wait.

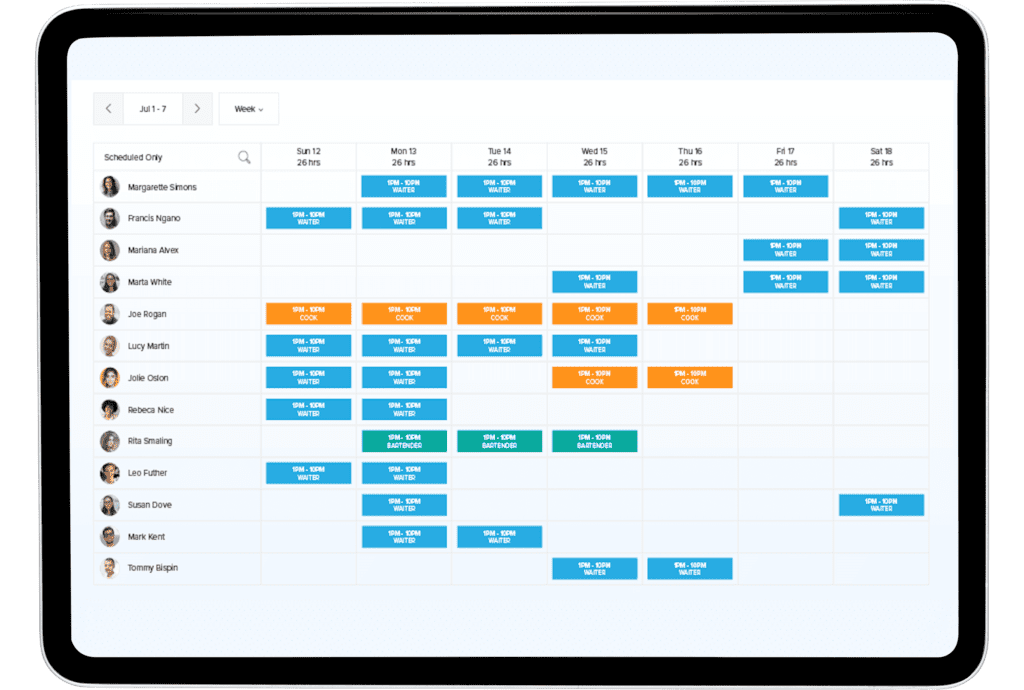

Excessive wait times can lead to customer dissatisfaction, lack of repeat business, and loss of sales. LexgiaPOS Waitlist is a fully integrated application within the operating system that tracks and manages your business’s bookings and guests to ensure minimal wait time and maximal communication with your customers. Equipped with a wait time calculator and synced with the statuses of your tables, the application remains constantly updated and can keep your customers in the loop as well by sending SMS text alerts regarding the status of their wait.