How Much Does an ATM Machine Cost?

For retailers, restaurants, gas stations, and all types of businesses across New England, ATM ownership increases foot traffic, boosts spending, and generates passive income. But how much does an ATM machine cost to purchase?

The answer depends on a few key factors—machine type, features, location, and support services. At Boston North Company, businesses get guidance on choosing, buying, and installing the right ATM for their space and budget. Here’s a full breakdown of what to expect when it comes to cost, setup, and ROI.

Key Takeaways

- ATM machines typically cost between $2,200 to $8,000, depending on the make, model and features, or even less if purchasing a used machine

- Business owners can earn back their investment through surcharge fees, often within a few months.

- Choosing the right ATM means evaluating location, traffic, and tech needs.

- Boston North Company offers full-service support throughout New England, including installation and 24/7 assistance.

- Wall ATM units are ideal for space-saving installations without sacrificing performance.

Understanding the Costs of ATM Ownership

So, how much does an ATM machine cost? Most ATMs fall in the range of $2,200+. Here’s a quick breakdown:

- Entry-level retail models like the Hantle 1700 Series start around $2,200+.

- Freestanding models with added features (e.g., Genmega G2500 or Hyosung HALO II) start around $2,500+.

- Wall ATM machines or through-the-wall options like the Genmega GT5000 and Nautilus Hyosung 2800T run higher—$5,000+, depending on customizations.

Additional costs may include:

- Installation fees

- Upgrades (touchscreens, electronic locks, multi-currency support)

- Networking & compliance tools (EMV and PCI certifications)

While up-front costs may seem high, most locations recover their investment in 6–12 months through surcharge revenue. Explore full-service options at Boston North Company ATM Sales & Service.

What Impacts ATM Pricing?

ATM machine pricing is influenced by multiple factors. Understanding these will help businesses make smarter investments:

- Traffic Volume: High-traffic venues like convenience stores or nightclubs need machines with higher capacity and better durability.

- Machine Type: A wall ATM saves space but usually costs more due to installation and weatherproofing requirements.

- Features: EMV chip readers, digital wallet compatibility, and remote monitoring raise the price but improve long-term functionality and compliance.

- Security Options: Reinforced vaults, encrypted keypads, and enhanced locking systems add cost but reduce liability.

- Customization: Custom branding, lighting, or multi-language support may influence pricing for hospitality-focused locations.

Boston North Company helps businesses evaluate each factor to find the best match. From boutique shops to bustling gas stations, there’s a model—and a price point—that makes sense.

ATM Ownership vs. Assist Programs

Boston North Company offers flexible ownership structures:

- Full Ownership: Buy an ATM outright, handle cash loading, and keep 100% of the surcharge revenue.

- Client Assist Program: Buy an ATM outright, let Boston North Company handle stocking and service, and share the surcharge earnings.

This flexibility lets business owners tailor ATM investment to their capacity and goals. Full ownership offers faster ROI, while the assist program reduces operational burden—ideal for first-time ATM buyers or small teams. Either way, Boston North Company handles programming, setup, and support so you can focus on running your business.

How Profitable Is an ATM: Revenue Potential & ROI

ATMs are one of the few business investments with near-instant revenue potential. Each transaction generates a surcharge (typically $2.50–$3.00), and high-volume locations can see dozens of transactions per day.

Consider the following example:

- A business averaging 300 transactions per month at a $2.75 surcharge earns $825 monthly.

- That’s $9,900 annually—a strong return on a $3,000–$5,000 investment.

According to the National ATM Council, up to 30% of cash withdrawn is spent in-store—boosting both direct and indirect revenue. With ATM use still prevalent, especially in cash-focused sectors, the ROI remains consistent.

Earn More Profits with Boston North Company’s ATM Solutions

Boston North Company doesn’t just sell ATMs—it delivers complete solutions. From selecting the right machine to managing installs, training, and 24/7 support, our team serves businesses across New England with unmatched expertise.

Brands like Genmega, Hyosung, and Hantle are featured in our lineup, each offering different benefits depending on your space, budget, and customer needs. We offer wall-mounted, freestanding, and through-the-wall options—backed by remote monitoring and on-call service.

Whether you run a local boutique or a multi-location chain, Boston North Company makes ATM ownership stress-free with trusted brands, flexible programs, and expert support across New England. If you’re ready to buy an ATM or want to learn more about our options, contact us today to get started.

Frequently Asked Questions (FAQs)

How much does an ATM machine cost for a small business?

Most small businesses might invest $2,200+ for a reliable retail ATM. Compact models like the Hantle 1700 are ideal for small spaces.

What is the average cost to install an ATM?

Wall ATM installation can range from $500+, depending on the location, wiring needs, and whether it’s through-the-wall or surface-mounted. We always recommend that you consult a contractor or construction expert. However, installation is included on stand-alone and wall-mounted ATM Units.

Can I make money if I buy an ATM?

Yes. Owning an ATM allows you to earn surcharge revenue on every transaction. Business owners can keep up to 100% of fees if they stock the machine themselves.

Where can I buy an ATM machine near me?

Businesses across New England can turn to Boston North Company for local, full-service ATM sales and support.

Tracking and managing inventory has never been easier with this fully integrated application. Set alerts for when inventory is low, reminding you to replenish items. LexgiaPOS Inventory also allows you to define minimum stock levels for any and all products, prompting the system to create automated shopping lists with every item that must be replenished. Check for the most popular items and plan restocking accordingly.

Tracking and managing inventory has never been easier with this fully integrated application. Set alerts for when inventory is low, reminding you to replenish items. LexgiaPOS Inventory also allows you to define minimum stock levels for any and all products, prompting the system to create automated shopping lists with every item that must be replenished. Check for the most popular items and plan restocking accordingly.

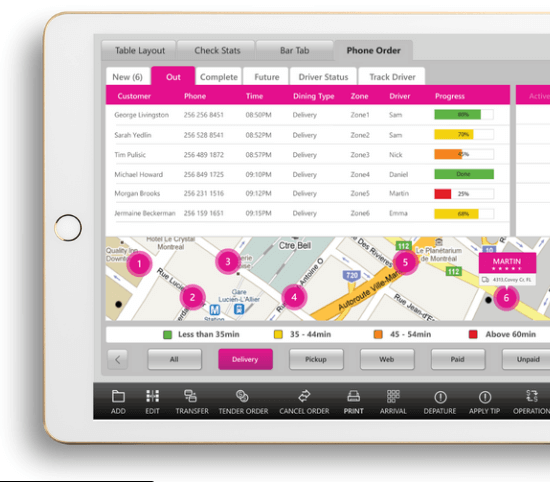

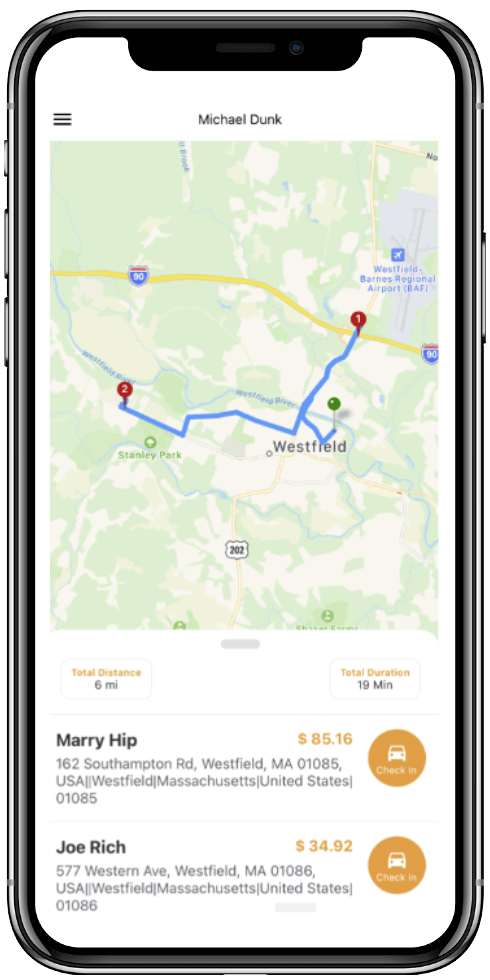

Delivery service is a valuable asset for any business, as it conveniences customers and creates another avenue for profit. LexgiaPOS Driver is a fully integrated application developed for restaurants as well as their drivers to foster a seamless delivery process.

Delivery service is a valuable asset for any business, as it conveniences customers and creates another avenue for profit. LexgiaPOS Driver is a fully integrated application developed for restaurants as well as their drivers to foster a seamless delivery process. Quickly and easily assign drivers to certain deliveries or delivery routes within the system, speeding up the process. They can be informed anywhere at any time with SMS alerts, allowing for route changes and quick turnaround time. The system provides real-time driver status and allows you to collect data to measure driver performance.

Quickly and easily assign drivers to certain deliveries or delivery routes within the system, speeding up the process. They can be informed anywhere at any time with SMS alerts, allowing for route changes and quick turnaround time. The system provides real-time driver status and allows you to collect data to measure driver performance.

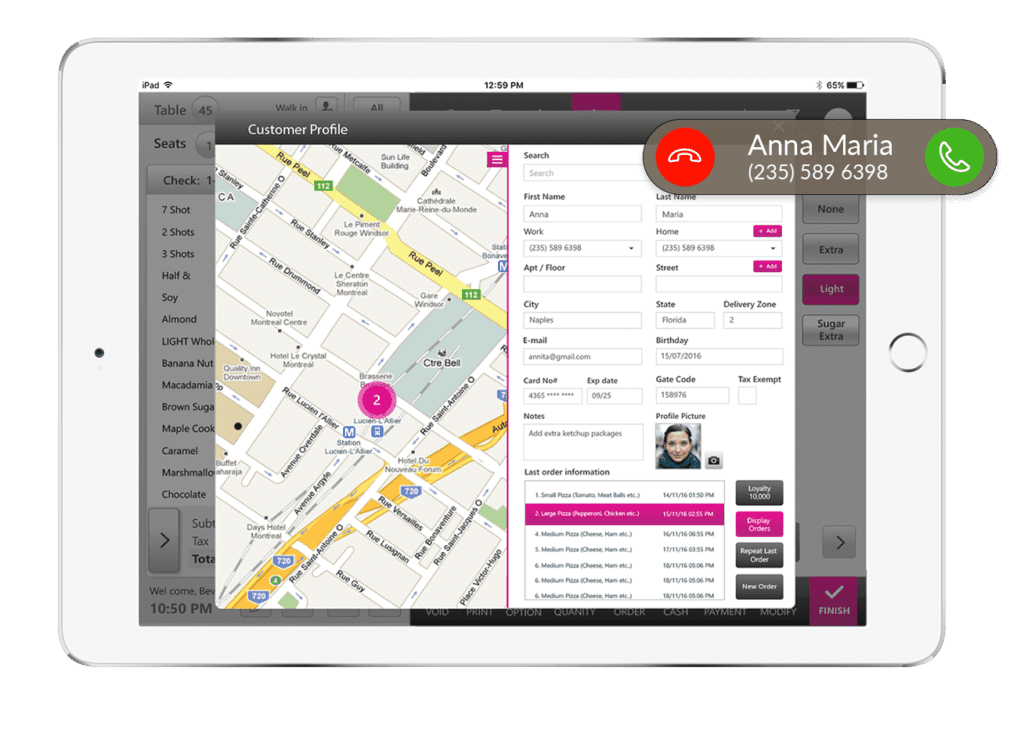

LexgiaPOS's S customer loyalty application allows businesses to create customized loyalty programs based on the best interests of both their consumers and the business itself. Loyalty rewards can be based on a variety of factors, including enrollment, customer visits, a fixed spent amount, specific menu items, and menu category.

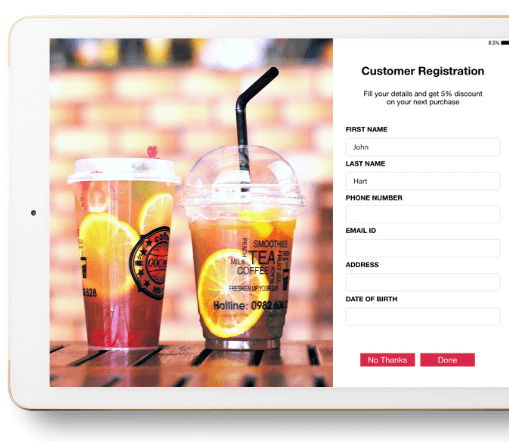

LexgiaPOS's S customer loyalty application allows businesses to create customized loyalty programs based on the best interests of both their consumers and the business itself. Loyalty rewards can be based on a variety of factors, including enrollment, customer visits, a fixed spent amount, specific menu items, and menu category. LexgiaPOS CDS is a customer facing display that they are able to interact with during checkout. The easy and fast technology provides high levels of service and convenience for customers, allowing for less delay at checkout and increased consumer satisfaction. Equipped with a tip processing feature and required digital signature, the system provides quick service that is both enjoyable and more secure. The application can also prompt customers to opt-in to your loyalty program if you choose, driving more signups.

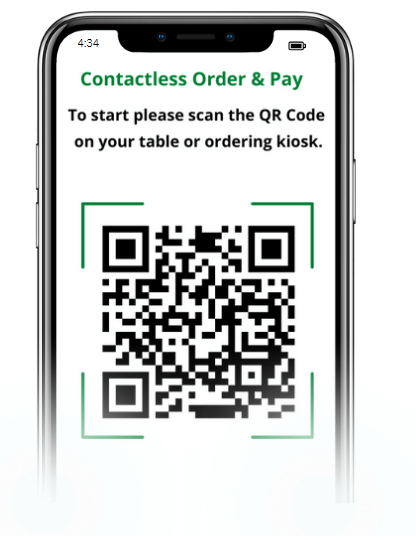

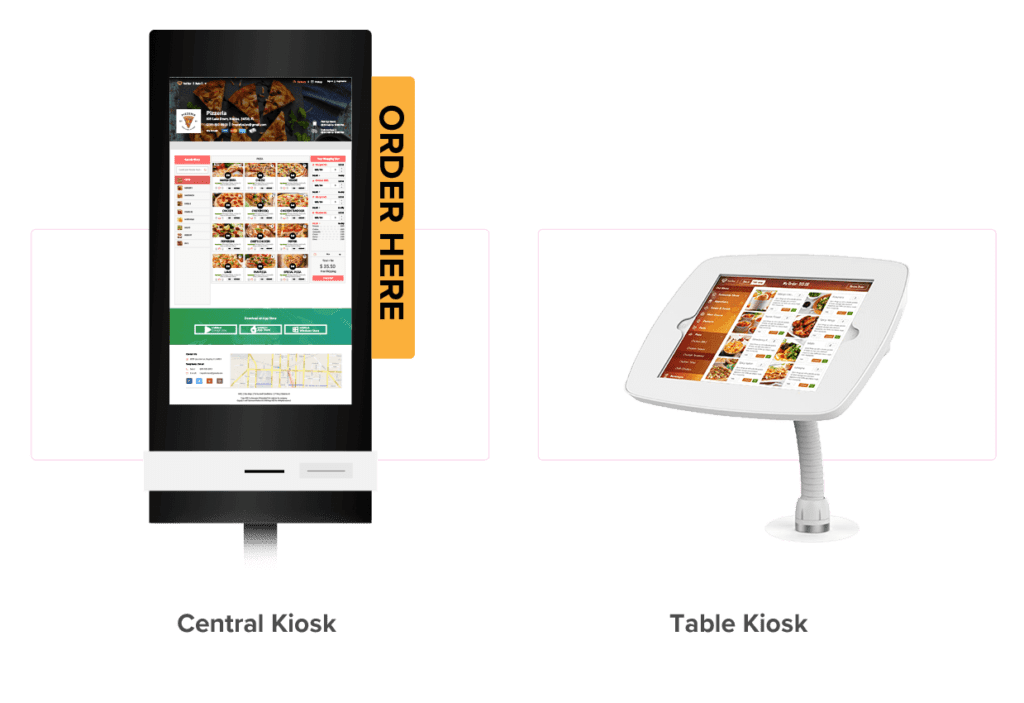

LexgiaPOS CDS is a customer facing display that they are able to interact with during checkout. The easy and fast technology provides high levels of service and convenience for customers, allowing for less delay at checkout and increased consumer satisfaction. Equipped with a tip processing feature and required digital signature, the system provides quick service that is both enjoyable and more secure. The application can also prompt customers to opt-in to your loyalty program if you choose, driving more signups. Self-order kiosk checkouts allow for customers to fully engage with the order and checkout processes independently, creating a more convenient customer experience while simultaneously lifting pressure from the front-of-house staff. LexgiaPOS Kiosk quickens the process of making and dispatching orders by communicating directly to a second display system located in the kitchen. The application eliminates extra steps by enabling direct communication from your consumers’ fingertips to the eyes of the kitchen staff.

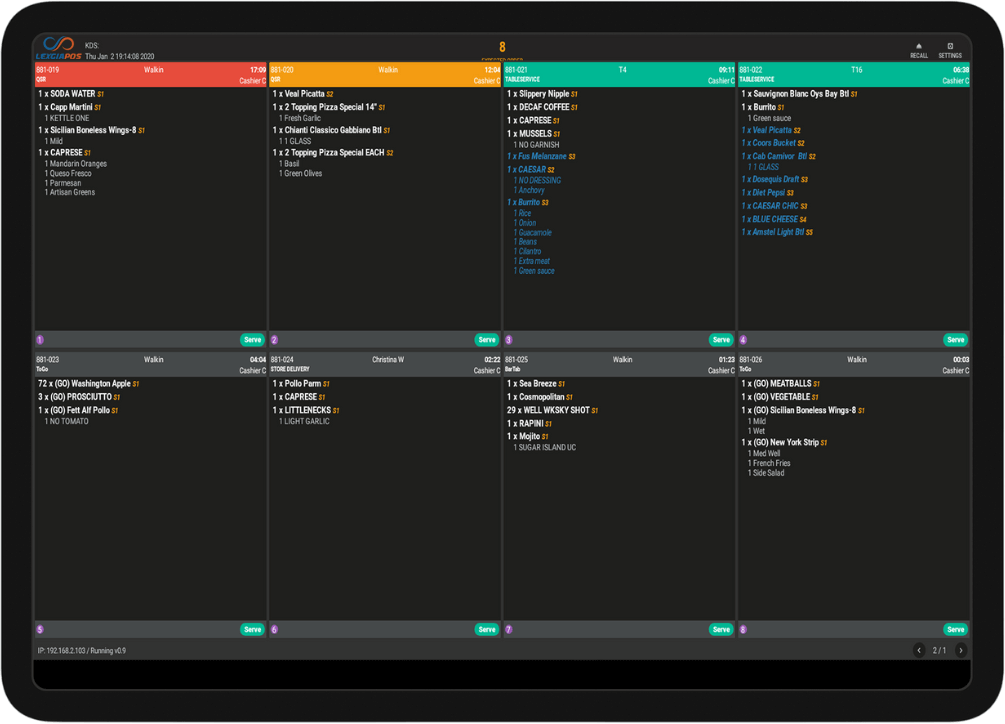

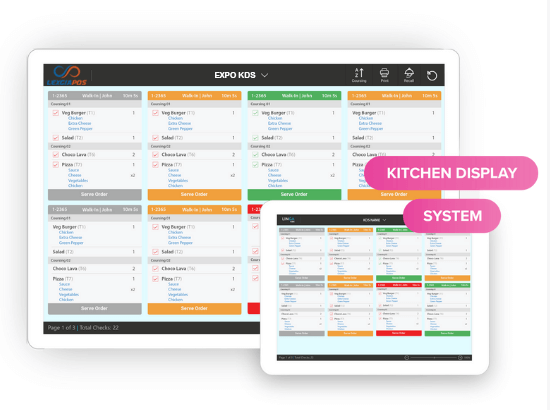

Self-order kiosk checkouts allow for customers to fully engage with the order and checkout processes independently, creating a more convenient customer experience while simultaneously lifting pressure from the front-of-house staff. LexgiaPOS Kiosk quickens the process of making and dispatching orders by communicating directly to a second display system located in the kitchen. The application eliminates extra steps by enabling direct communication from your consumers’ fingertips to the eyes of the kitchen staff. LexgiaPOS KDS is a system specifically designed for catering to needs inside the kitchen. Always in direct communication with the front-of-house display, both systems can stay connected even without internet, allowing for no interruptions to the flow of your workday.

LexgiaPOS KDS is a system specifically designed for catering to needs inside the kitchen. Always in direct communication with the front-of-house display, both systems can stay connected even without internet, allowing for no interruptions to the flow of your workday. If your restaurant serves pizza, LexgiaPOS KDS allows your customers to customize a pie down to the slice and make their topping choices as elaborate as desired. Customers can also receive SMS text alerts directly from the kitchen so that they are notified as soon as their order has been completed. The kitchen display system allows for optimal efficiency and a significant reduction of error and waiting time.

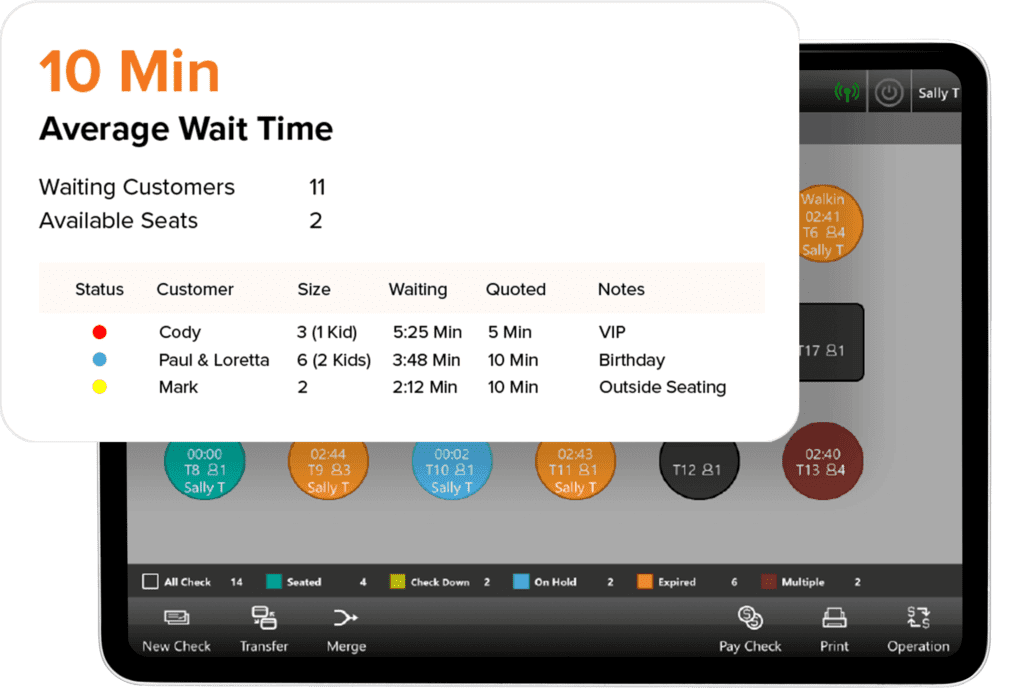

If your restaurant serves pizza, LexgiaPOS KDS allows your customers to customize a pie down to the slice and make their topping choices as elaborate as desired. Customers can also receive SMS text alerts directly from the kitchen so that they are notified as soon as their order has been completed. The kitchen display system allows for optimal efficiency and a significant reduction of error and waiting time. Excessive wait times can lead to customer dissatisfaction, lack of repeat business, and loss of sales. LexgiaPOS Waitlist is a fully integrated application within the operating system that tracks and manages your business’s bookings and guests to ensure minimal wait time and maximal communication with your customers. Equipped with a wait time calculator and synced with the statuses of your tables, the application remains constantly updated and can keep your customers in the loop as well by sending SMS text alerts regarding the status of their wait.

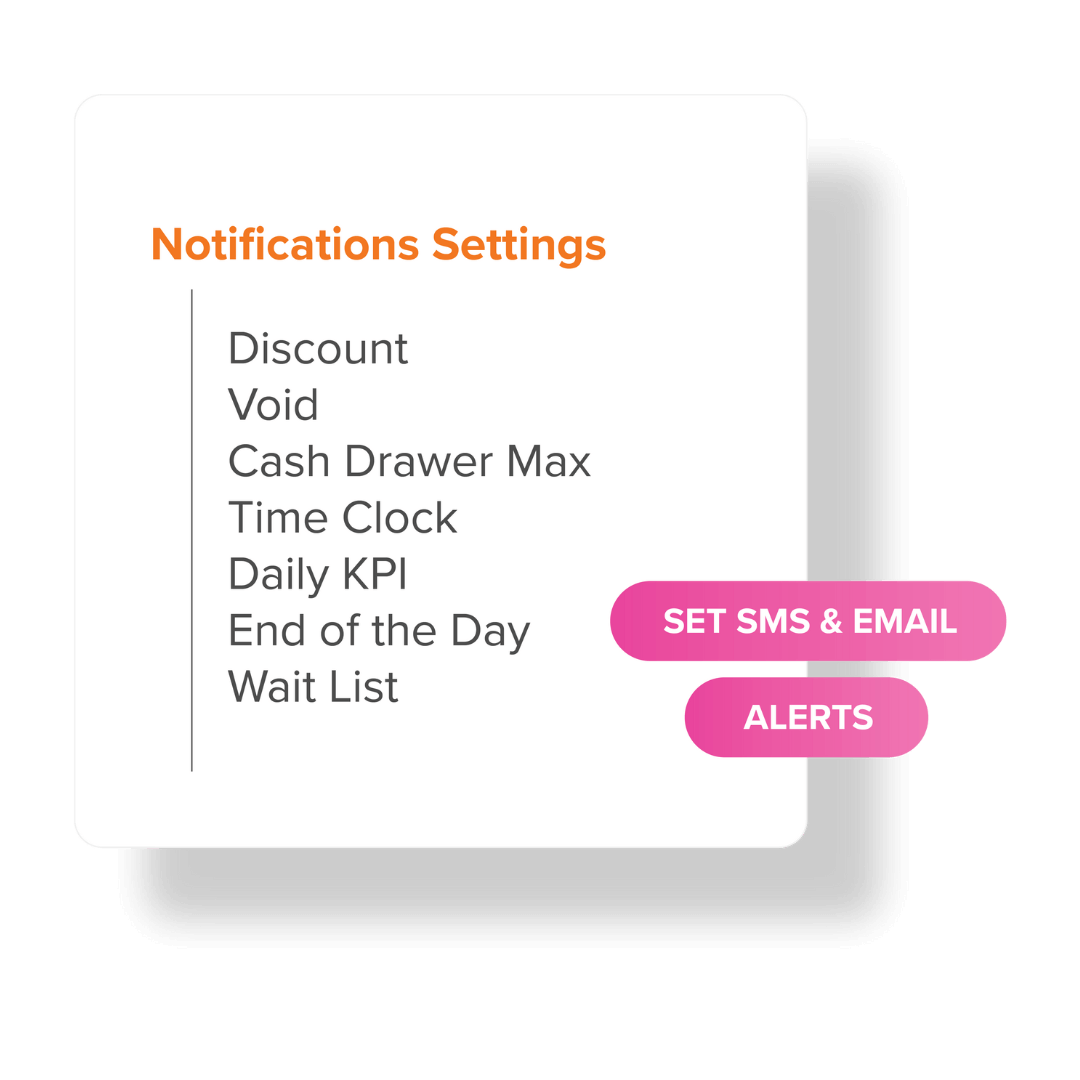

Excessive wait times can lead to customer dissatisfaction, lack of repeat business, and loss of sales. LexgiaPOS Waitlist is a fully integrated application within the operating system that tracks and manages your business’s bookings and guests to ensure minimal wait time and maximal communication with your customers. Equipped with a wait time calculator and synced with the statuses of your tables, the application remains constantly updated and can keep your customers in the loop as well by sending SMS text alerts regarding the status of their wait.