ATM Machine Business: Everything You Need to Know

The idea of starting an ATM machine business appeals to many business owners seeking extra revenue streams and improved customer convenience. ATMs not only provide access to cash but also drive additional spending within the business. With steady surcharge revenue and increased foot traffic, an ATM can be one of the most practical investments a local business can make.

At Boston North Company, the focus is on providing New England businesses with tailored ATM solutions that combine reliable equipment, expert support, and industry knowledge. Understanding the ins and outs of the ATM industry is the first step toward making a smart investment.

Key Takeaways

- An ATM machine business can generate reliable passive income through surcharge fees and added in-store spending.

- The most profitable placements are high traffic areas like convenience stores, gas stations, and retail locations.

- Business owners can either buy an ATM outright or partner with an ATM company for shared revenue.

- Success depends on choosing the right type of machine, optimizing ATM processing, and working with trusted ATM operators.

- Boston North Company provides installation, servicing, and support for businesses across New England.

How the ATM Machine Business Works

At its core, the ATM industry is built on convenience and access. Customers use ATM machines for quick cash withdrawals, balance checks, and sometimes even check deposits. For business owners, each transaction produces surcharge revenue, typically through a fee added on top of the withdrawal.

The average surcharge in the U.S. is between $2.50 and $3.50, according to the ATM Industry Association. Business owners or independent ATM deployers (IADs) can keep a portion—or in some cases, up to 100%—of that fee depending on the ownership model.

Revenue adds up quickly, especially in high-traffic areas such as convenience stores, bars, gas stations, and retail shops. In fact, industry data suggests that up to 30% of the money withdrawn from an ATM is spent in-store, boosting both direct and indirect revenue.

ATM processing ensures transactions are securely routed between the cardholder’s bank, the ATM operator, and the business. Reliable receipt paper, strong connectivity, and 24/7 support keep machines running smoothly.

For a deeper dive into how these systems function, read our article: How Do ATM Machines Work and Why Businesses Should Care?

Why Business Owners Invest in ATM Machines

Adding an ATM machine is not just about offering a service—it’s about creating a passive income stream. Every time a customer uses the ATM, the surcharge fee generates revenue. Unlike other investments, an ATM requires minimal ongoing labor, making it a reliable way for businesses to increase profitability.

For business owners, the benefits include:

- Increased foot traffic: Customers are more likely to stop in if they know they can access cash.

- Higher sales volume: Studies show that a significant percentage of withdrawn cash is spent at the same location.

- Reduced reliance on credit cards: More cash in circulation helps cut down on credit card transaction fees.

- Customer convenience: ATMs create a better experience, encouraging repeat visits.

Investing in an ATM also positions businesses competitively. In areas where cash is still widely used, customers may choose a location with an ATM over one without.

For more insights into profitability, see Why Invest in ATM Machines for Your Business? This guide explores how an ATM becomes both a financial tool and a service upgrade, particularly in convenience stores and other volume locations where traffic is steady.

With expert placement and reliable support, ATMs remain one of the simplest yet most effective ways to increase both direct income and indirect customer spending.

Choosing the Right Type of Machine

Not all ATMs are the same, and selecting the right type of machine depends on location, customer base, and business goals. Boston North Company offers a wide selection of models from trusted brands like Genmega, Hyosung, and Hantle.

- Freestanding Units: Ideal for convenience stores, restaurants, or high-traffic retail areas. They require minimal installation and provide excellent visibility.

- Through-the-Wall ATMs: Perfect for outdoor access, letting customers withdraw cash at any time without entering the business. Common in gas stations and transportation hubs.

- Wall-Mount Machines: Compact and space-saving, these are effective for smaller businesses that want ATM access without sacrificing floor space.

Each option differs in cost, size, and capacity. For example, freestanding units are affordable and quick to set up, while through-the-wall ATMs involve higher installation costs but can hold more cash and handle larger transaction volumes.

To better understand the financial side, see How Much Does an ATM Machine Cost? This resource breaks down initial investments, ongoing expenses like receipt paper, and potential returns.

Choosing the right model ensures the ATM not only fits the space but also maximizes both customer satisfaction and revenue potential.

Finding Good Locations for ATMs

Location is everything in the ATM industry. An ATM in a low-traffic spot may generate minimal income, while the same machine placed in a high traffic area can quickly pay for itself.

The best locations for ATMs include:

- Convenience stores and gas stations – Frequent stops make them ideal for cash access.

- Nightlife venues – Bars, clubs, and entertainment spots often see high demand for cash.

- Retail centers – Malls, grocery stores, and busy shopping districts draw consistent traffic.

- Transportation hubs – Train stations and bus depots cater to travelers who need fast access to cash.

When evaluating a volume location, factors such as foot traffic, nearby banking access, and average spending habits matter. ATMs in these locations often generate higher surcharge revenue and provide greater long-term profitability.

To explore placement strategies and real-world results, see How Much Money Do ATM Machines Hold? This helps business owners plan for both usage levels and cash stocking requirements.

The key is balancing convenience for customers with profitability for ATM operators—a balance Boston North Company helps achieve with expert site assessments and tailored solutions.

Ownership Models: Buy an ATM or Partner with an ATM Company

When starting an ATM machine business, business owners typically choose between two main models:

- Buy an ATM outright: The business purchases the machine, manages cash loading, and keeps up to 100% of the surcharge fees. While this requires upfront investment, it offers the highest return.

- Partner with an ATM company: The provider handles installation, servicing, and ATM processing, while sharing surcharge revenue with the business. This reduces operational responsibilities but also lowers earnings.

Independent ATM deployers often manage fleets of ATMs across multiple sites, leveraging surcharge revenue across high-performing volume locations. For single-site businesses, owning a machine outright may be the more profitable long-term option, while partnerships can minimize upfront costs.

For a step-by-step breakdown of ownership and partnership models, visit How to Buy an ATM Machine with Boston North Company. This guide explains purchase programs, ATM processing, and ongoing support.

Either way, working with an experienced ATM company ensures smooth operation, reliable service, and access to the latest industry technology.

The Role of ATM Processing and Support

ATM processing is the backbone of any successful ATM business. Every transaction involves secure communication between the machine, the cardholder’s bank, and the ATM operator. Without reliable processing, transactions fail, leading to poor customer experiences and lost revenue.

Boston North Company provides 24/7 support, monitoring, and supply services (like receipt paper) to ensure ATMs remain fully operational. Downtime can cost significant surcharge revenue, particularly in high-traffic areas.

Partnering with a trusted provider like Boston North Company guarantees not only reliable uptime but also the security and compliance required by the modern ATM industry.

Build Your ATM Machine Business with Boston North Company

An ATM machine business offers one of the simplest and most effective ways for business owners to generate passive income, increase customer convenience, and enhance profitability. From good locations like convenience stores to ownership models that maximize surcharge revenue, the potential is substantial.

With Boston North Company’s expertise in installation, processing, and support, businesses across New England can access tailored ATM solutions that work. Whether looking to buy an ATM or partner with an experienced ATM company, the opportunities in the ATM industry remain strong.

Contact Boston North Company today to explore ATM options and start earning.

Frequently Asked Questions (FAQs)

How profitable is an ATM machine business?

Profitability depends on location and usage. In high traffic areas, a single ATM can generate hundreds of dollars in monthly surcharge revenue.

Do you need a lot of capital to start an ATM business?

Not always. Options range from purchasing outright to partnering with an ATM company, which lowers upfront costs.

What are the best locations for ATMs?

Convenience stores, gas stations, retail centers, and nightlife venues are among the top-performing good locations.

Who handles ATM processing?

ATM operators or partner companies manage transaction processing, compliance, and uptime.

Can ATMs accept credit cards for cash withdrawals?

Yes, though customers may face higher fees and interest when using a credit card instead of a debit card.

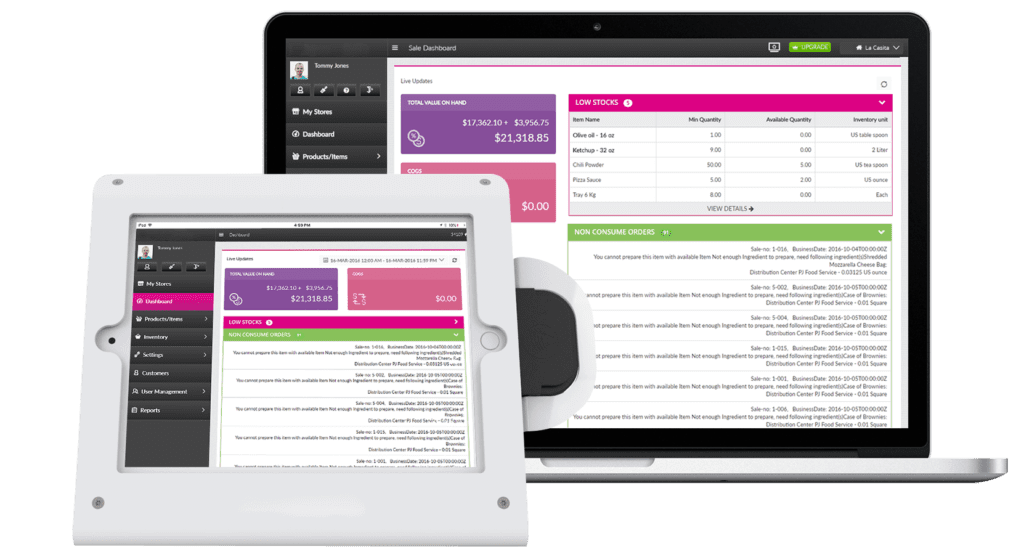

Tracking and managing inventory has never been easier with this fully integrated application. Set alerts for when inventory is low, reminding you to replenish items. LexgiaPOS Inventory also allows you to define minimum stock levels for any and all products, prompting the system to create automated shopping lists with every item that must be replenished. Check for the most popular items and plan restocking accordingly.

Tracking and managing inventory has never been easier with this fully integrated application. Set alerts for when inventory is low, reminding you to replenish items. LexgiaPOS Inventory also allows you to define minimum stock levels for any and all products, prompting the system to create automated shopping lists with every item that must be replenished. Check for the most popular items and plan restocking accordingly.

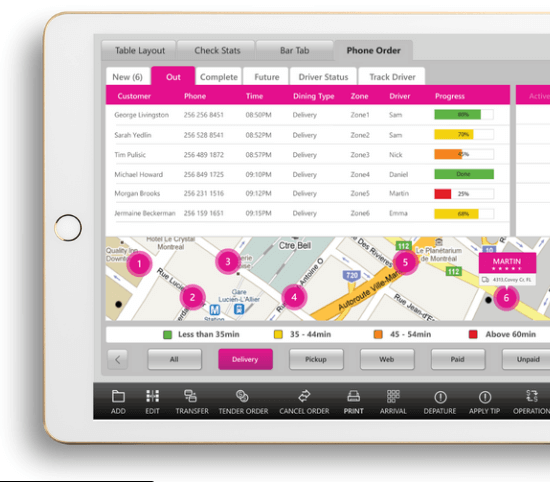

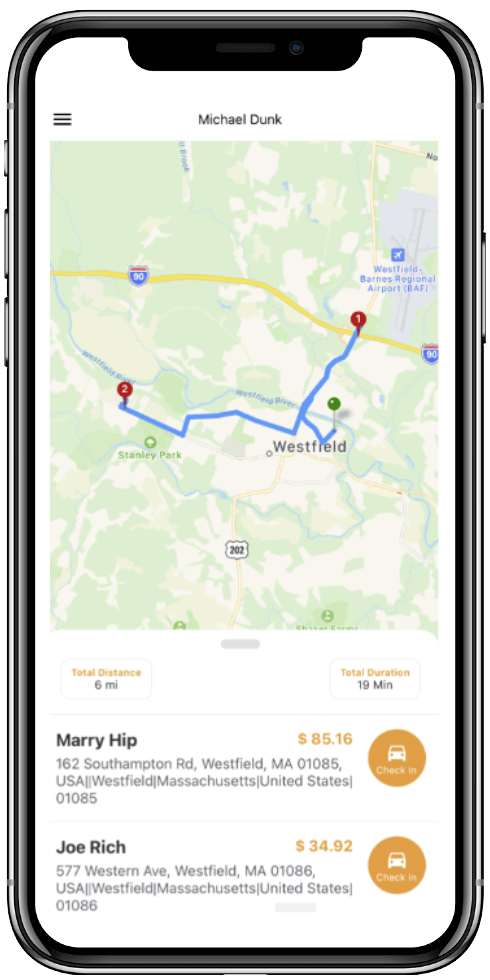

Delivery service is a valuable asset for any business, as it conveniences customers and creates another avenue for profit. LexgiaPOS Driver is a fully integrated application developed for restaurants as well as their drivers to foster a seamless delivery process.

Delivery service is a valuable asset for any business, as it conveniences customers and creates another avenue for profit. LexgiaPOS Driver is a fully integrated application developed for restaurants as well as their drivers to foster a seamless delivery process. Quickly and easily assign drivers to certain deliveries or delivery routes within the system, speeding up the process. They can be informed anywhere at any time with SMS alerts, allowing for route changes and quick turnaround time. The system provides real-time driver status and allows you to collect data to measure driver performance.

Quickly and easily assign drivers to certain deliveries or delivery routes within the system, speeding up the process. They can be informed anywhere at any time with SMS alerts, allowing for route changes and quick turnaround time. The system provides real-time driver status and allows you to collect data to measure driver performance.

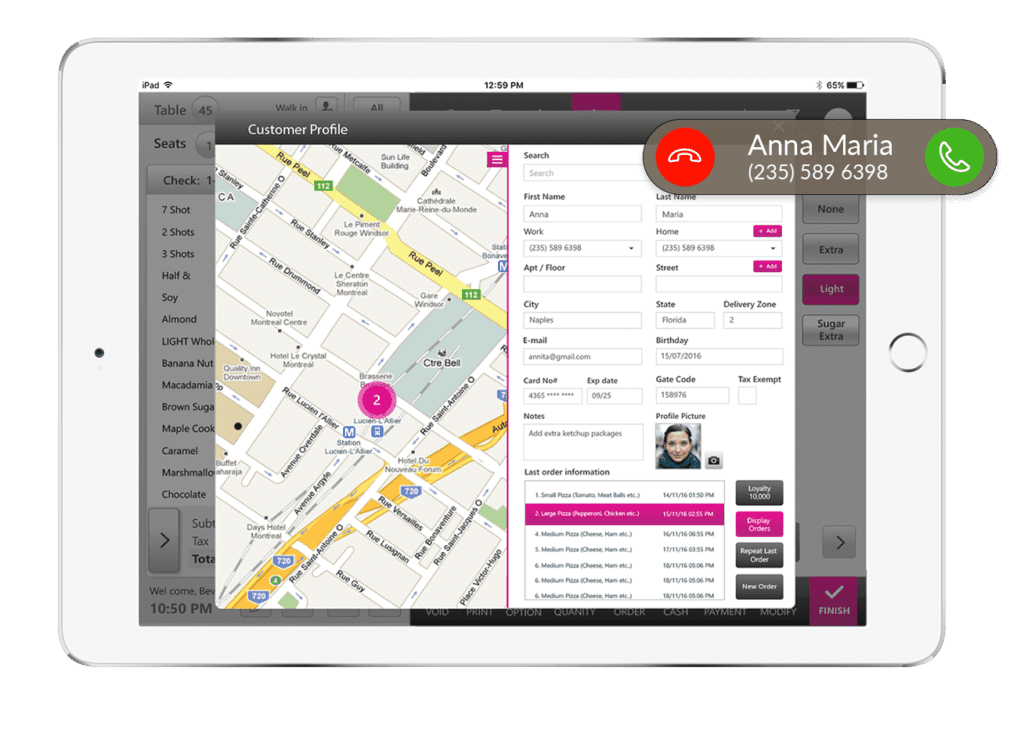

LexgiaPOS's S customer loyalty application allows businesses to create customized loyalty programs based on the best interests of both their consumers and the business itself. Loyalty rewards can be based on a variety of factors, including enrollment, customer visits, a fixed spent amount, specific menu items, and menu category.

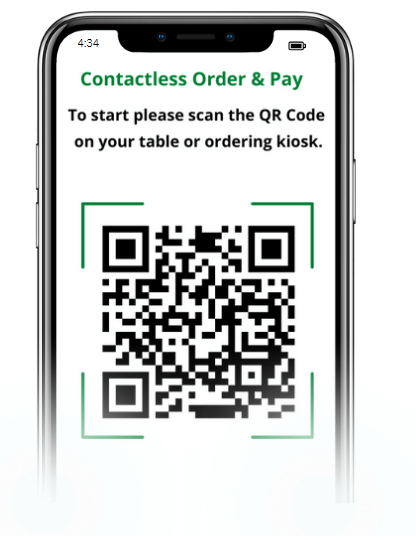

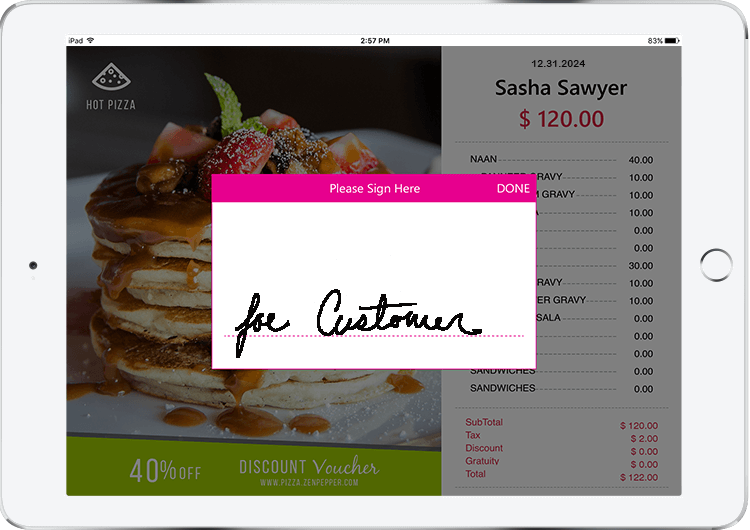

LexgiaPOS's S customer loyalty application allows businesses to create customized loyalty programs based on the best interests of both their consumers and the business itself. Loyalty rewards can be based on a variety of factors, including enrollment, customer visits, a fixed spent amount, specific menu items, and menu category. LexgiaPOS CDS is a customer facing display that they are able to interact with during checkout. The easy and fast technology provides high levels of service and convenience for customers, allowing for less delay at checkout and increased consumer satisfaction. Equipped with a tip processing feature and required digital signature, the system provides quick service that is both enjoyable and more secure. The application can also prompt customers to opt-in to your loyalty program if you choose, driving more signups.

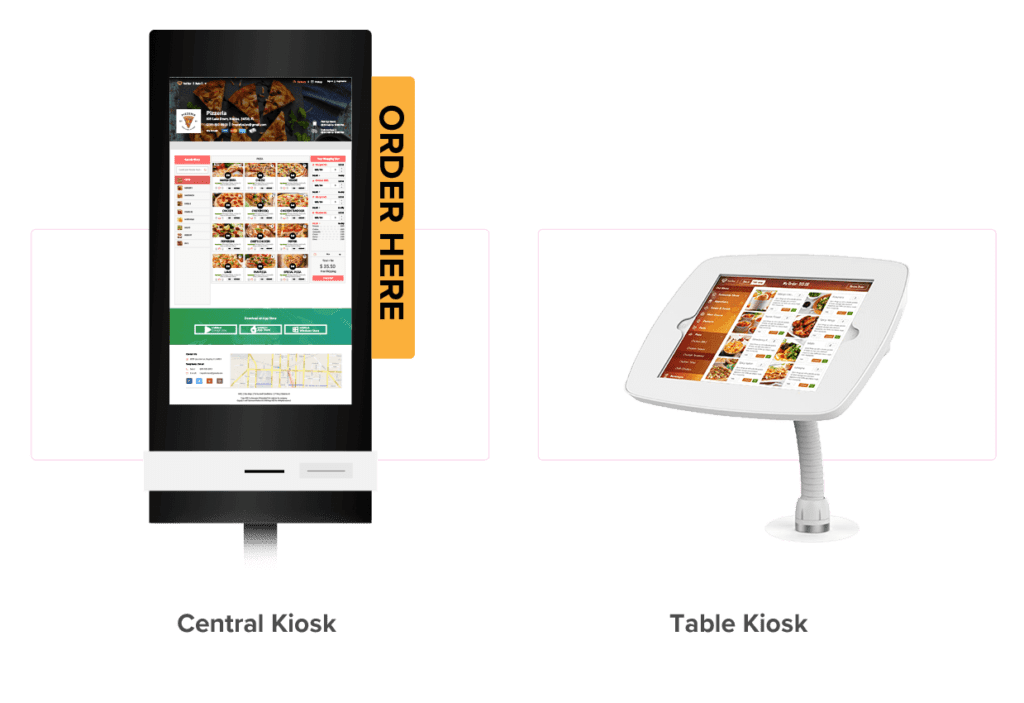

LexgiaPOS CDS is a customer facing display that they are able to interact with during checkout. The easy and fast technology provides high levels of service and convenience for customers, allowing for less delay at checkout and increased consumer satisfaction. Equipped with a tip processing feature and required digital signature, the system provides quick service that is both enjoyable and more secure. The application can also prompt customers to opt-in to your loyalty program if you choose, driving more signups. Self-order kiosk checkouts allow for customers to fully engage with the order and checkout processes independently, creating a more convenient customer experience while simultaneously lifting pressure from the front-of-house staff. LexgiaPOS Kiosk quickens the process of making and dispatching orders by communicating directly to a second display system located in the kitchen. The application eliminates extra steps by enabling direct communication from your consumers’ fingertips to the eyes of the kitchen staff.

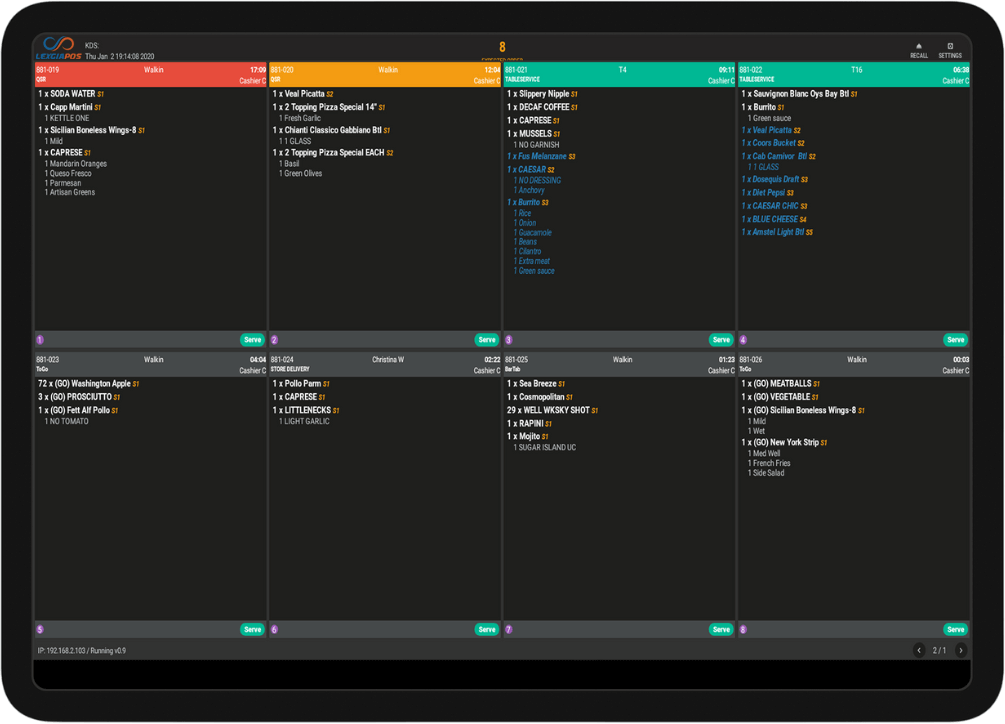

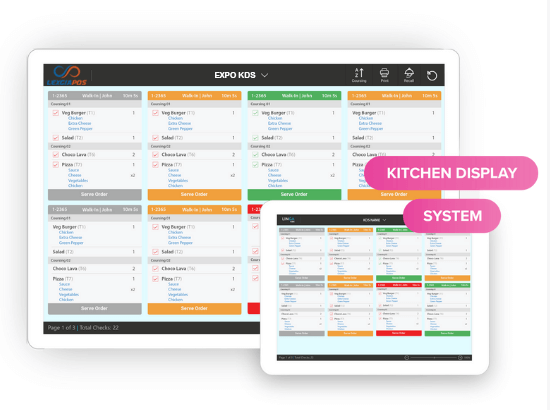

Self-order kiosk checkouts allow for customers to fully engage with the order and checkout processes independently, creating a more convenient customer experience while simultaneously lifting pressure from the front-of-house staff. LexgiaPOS Kiosk quickens the process of making and dispatching orders by communicating directly to a second display system located in the kitchen. The application eliminates extra steps by enabling direct communication from your consumers’ fingertips to the eyes of the kitchen staff. LexgiaPOS KDS is a system specifically designed for catering to needs inside the kitchen. Always in direct communication with the front-of-house display, both systems can stay connected even without internet, allowing for no interruptions to the flow of your workday.

LexgiaPOS KDS is a system specifically designed for catering to needs inside the kitchen. Always in direct communication with the front-of-house display, both systems can stay connected even without internet, allowing for no interruptions to the flow of your workday. If your restaurant serves pizza, LexgiaPOS KDS allows your customers to customize a pie down to the slice and make their topping choices as elaborate as desired. Customers can also receive SMS text alerts directly from the kitchen so that they are notified as soon as their order has been completed. The kitchen display system allows for optimal efficiency and a significant reduction of error and waiting time.

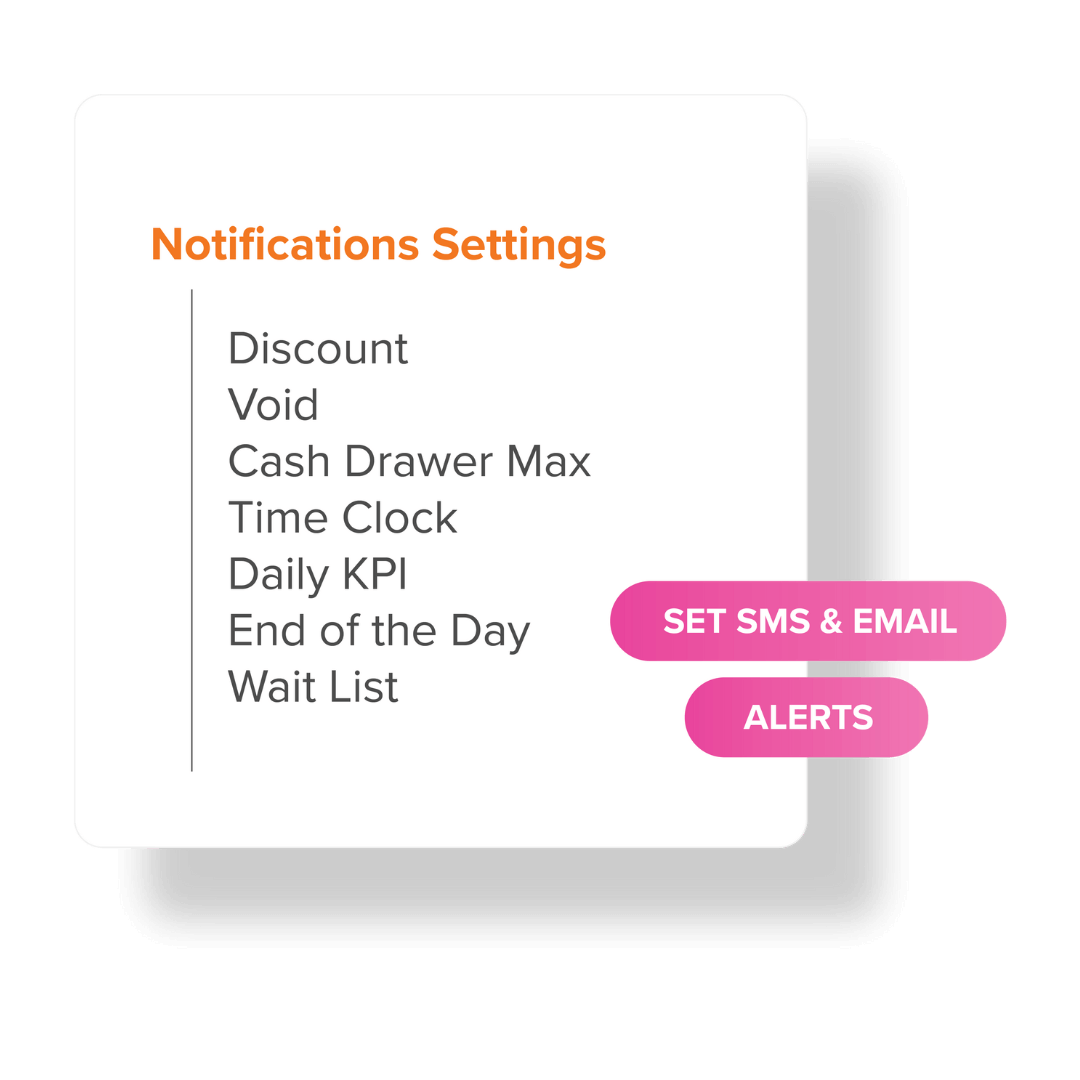

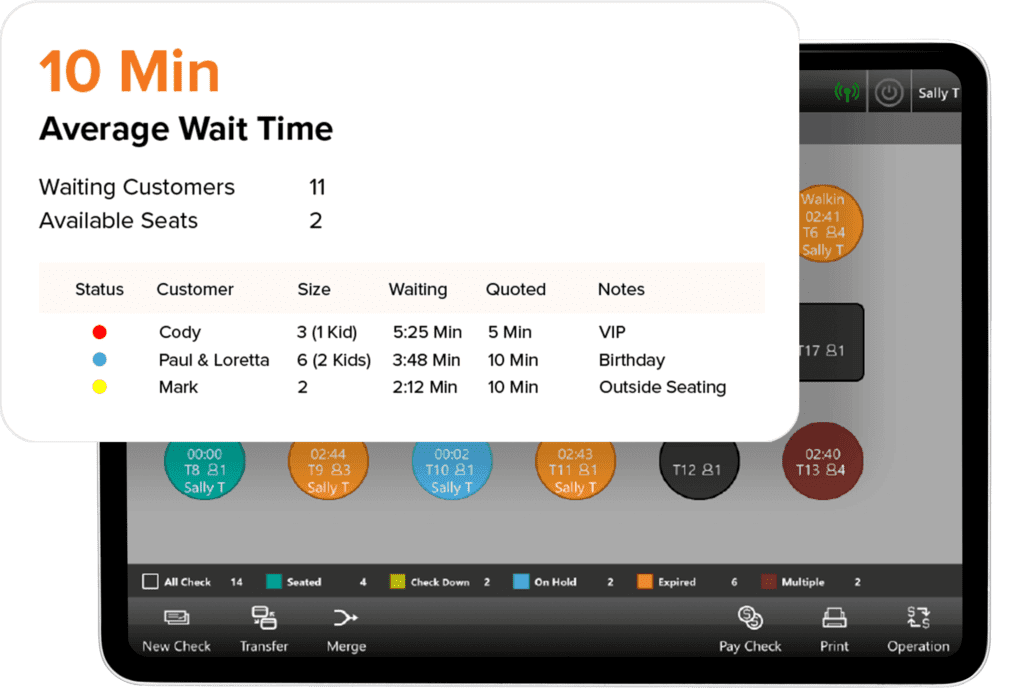

If your restaurant serves pizza, LexgiaPOS KDS allows your customers to customize a pie down to the slice and make their topping choices as elaborate as desired. Customers can also receive SMS text alerts directly from the kitchen so that they are notified as soon as their order has been completed. The kitchen display system allows for optimal efficiency and a significant reduction of error and waiting time. Excessive wait times can lead to customer dissatisfaction, lack of repeat business, and loss of sales. LexgiaPOS Waitlist is a fully integrated application within the operating system that tracks and manages your business’s bookings and guests to ensure minimal wait time and maximal communication with your customers. Equipped with a wait time calculator and synced with the statuses of your tables, the application remains constantly updated and can keep your customers in the loop as well by sending SMS text alerts regarding the status of their wait.

Excessive wait times can lead to customer dissatisfaction, lack of repeat business, and loss of sales. LexgiaPOS Waitlist is a fully integrated application within the operating system that tracks and manages your business’s bookings and guests to ensure minimal wait time and maximal communication with your customers. Equipped with a wait time calculator and synced with the statuses of your tables, the application remains constantly updated and can keep your customers in the loop as well by sending SMS text alerts regarding the status of their wait.