The Hidden Cost of “Too-Good-to-Be-True” POS Deals: What Leaving a Low-Cost System Can Really Cost Your Business

When Leaving a POS System Comes at a Steep Price

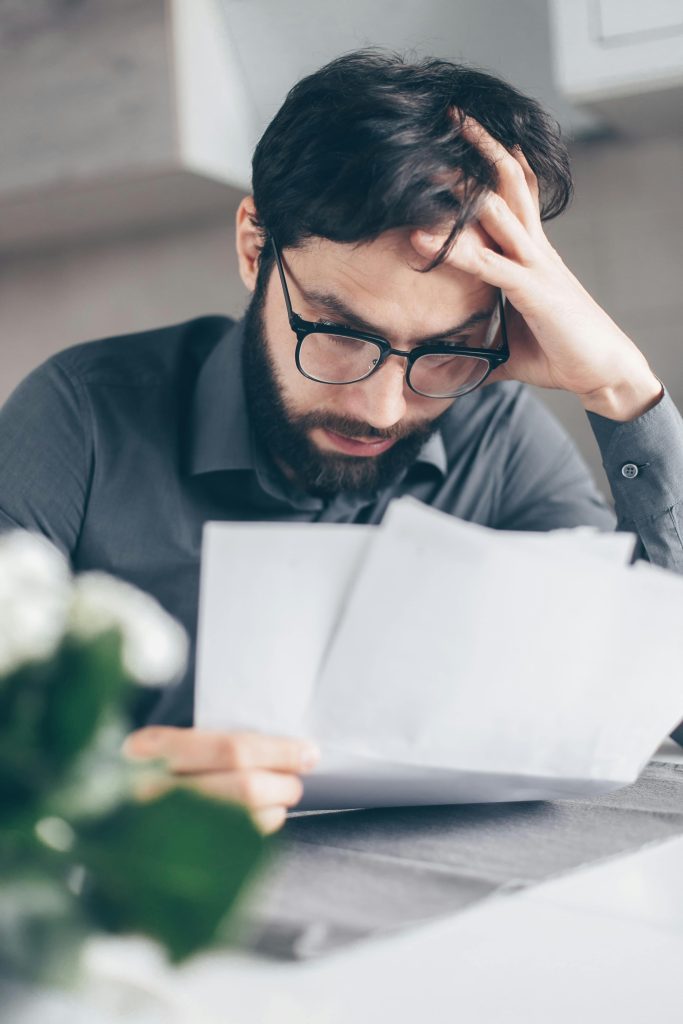

For many restaurant and retail owners, switching point of sale systems feels like a routine business decision. Technology evolves, needs change, and operators look for better tools to support growth. What many do not realize is that exiting a POS agreement can sometimes come with unexpected and overwhelming financial consequences.

At the center of the issue are contract structures that include early termination provisions often referred to as liquidated damages. While these clauses are legal and disclosed somewhere in the agreement, they are frequently misunderstood or underestimated at the time of signing. In some cases, the cost to leave is not simply a flat cancellation fee or a few remaining monthly payments. Instead, the termination amount may be calculated based on projected future revenue over the remainder of the contract term.

For a small or mid-sized business, this kind of calculation can result in a termination bill that reaches tens of thousands of dollars. That figure can easily exceed annual profit margins, turning what should be a strategic upgrade into a financially damaging event.

How Merchants Get Caught Off Guard

Many POS agreements are presented with attractive incentives up front. These can include free hardware, reduced processing rates, marketing credits, or cash bonuses for switching providers. While these offers can be helpful, they often come with long-term commitments ranging from three to five years. The termination language may be buried deep in the contract or explained in technical terms that do not clearly convey the real-world financial risk.

Compounding the problem, some contracts allow pricing structures, fees, or policies to change during the agreement. When service levels decline or costs rise, merchants may want to leave, only to discover that doing so triggers penalties far beyond what they expected.

Why This Matters for Small Businesses

Unlike large chains, independent operators rarely have legal teams reviewing every clause of a technology agreement. Cash flow is tight, margins are thin, and a sudden five-figure termination bill can derail payroll, expansion plans, or even day-to-day operations.

There is also a psychological toll. Business owners may feel trapped in systems that no longer serve them, continuing to pay for technology they dislike simply because leaving feels impossible. Over time, this erodes trust in vendors and creates hesitation around adopting new tools that could otherwise improve efficiency.

What Operators Can Do Differently

The takeaway is not that all POS contracts are predatory or that incentives are inherently bad. Rather, it is a reminder that technology decisions are also legal and financial decisions.

Before signing any agreement, operators should:

- Ask explicitly how early termination fees are calculated

- Request examples using real revenue numbers

- Clarify whether rates or fees can change during the contract term

- Understand who owns their data and how it may be used

- Avoid relying solely on verbal assurances

Transparency upfront can prevent major issues down the road.

A Call for Clarity in the Industry

As POS systems become more central to operations, from payments to customer data to reporting, the contracts behind them matter more than ever. Clear language, fair exit terms, and honest explanations benefit both vendors and merchants. When expectations are aligned from the start, partnerships last longer and trust remains intact.

For business owners, the lesson is simple but critical. Before switching systems, look beyond the incentives and ask what it truly costs to leave.

Tracking and managing inventory has never been easier with this fully integrated application. Set alerts for when inventory is low, reminding you to replenish items. LexgiaPOS Inventory also allows you to define minimum stock levels for any and all products, prompting the system to create automated shopping lists with every item that must be replenished. Check for the most popular items and plan restocking accordingly.

Tracking and managing inventory has never been easier with this fully integrated application. Set alerts for when inventory is low, reminding you to replenish items. LexgiaPOS Inventory also allows you to define minimum stock levels for any and all products, prompting the system to create automated shopping lists with every item that must be replenished. Check for the most popular items and plan restocking accordingly.

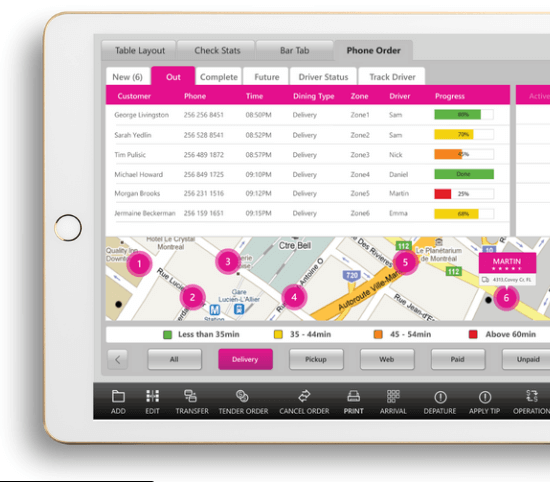

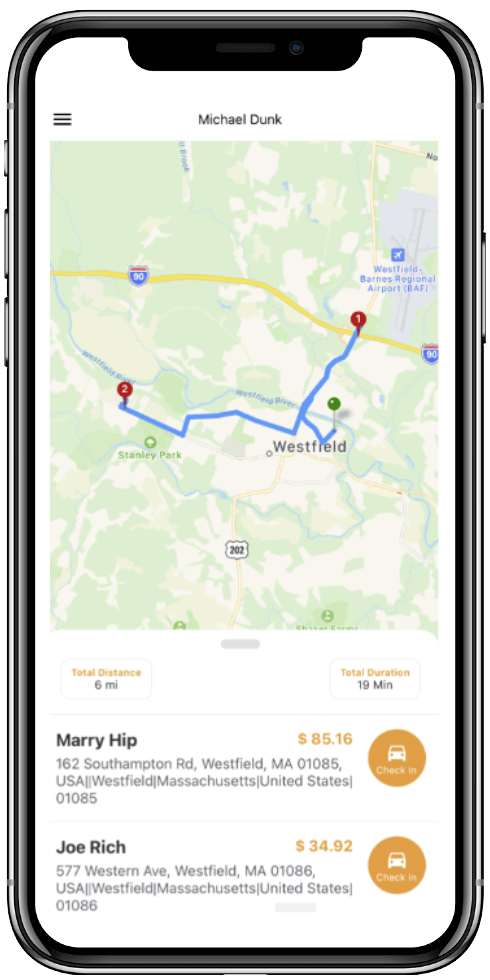

Delivery service is a valuable asset for any business, as it conveniences customers and creates another avenue for profit. LexgiaPOS Driver is a fully integrated application developed for restaurants as well as their drivers to foster a seamless delivery process.

Delivery service is a valuable asset for any business, as it conveniences customers and creates another avenue for profit. LexgiaPOS Driver is a fully integrated application developed for restaurants as well as their drivers to foster a seamless delivery process. Quickly and easily assign drivers to certain deliveries or delivery routes within the system, speeding up the process. They can be informed anywhere at any time with SMS alerts, allowing for route changes and quick turnaround time. The system provides real-time driver status and allows you to collect data to measure driver performance.

Quickly and easily assign drivers to certain deliveries or delivery routes within the system, speeding up the process. They can be informed anywhere at any time with SMS alerts, allowing for route changes and quick turnaround time. The system provides real-time driver status and allows you to collect data to measure driver performance.

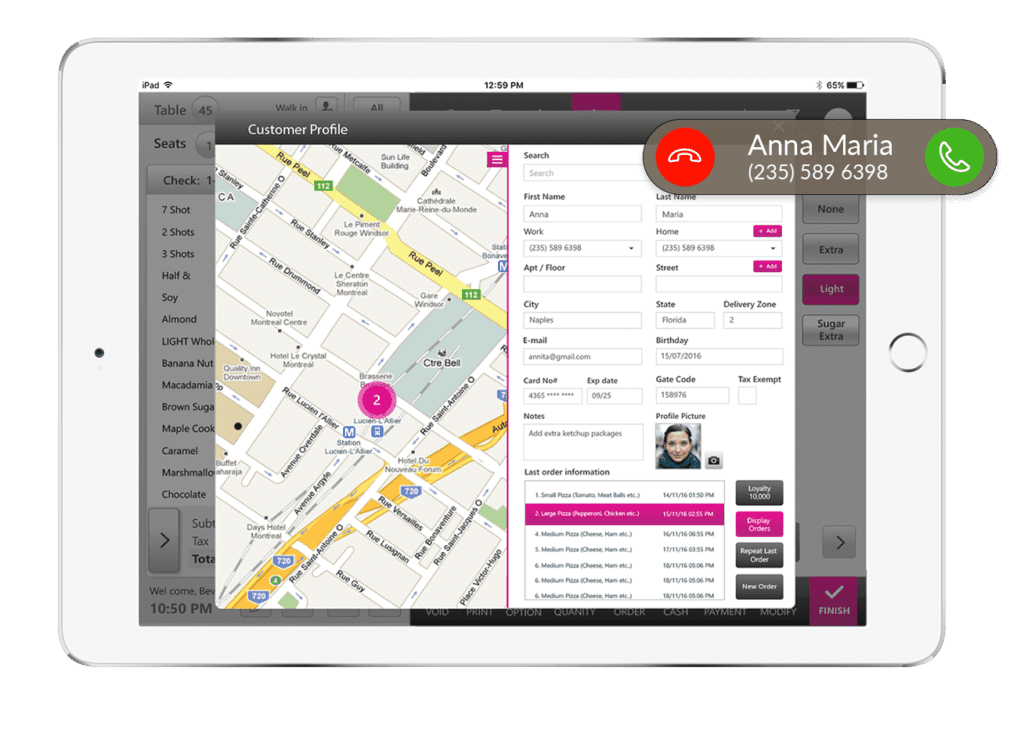

LexgiaPOS's S customer loyalty application allows businesses to create customized loyalty programs based on the best interests of both their consumers and the business itself. Loyalty rewards can be based on a variety of factors, including enrollment, customer visits, a fixed spent amount, specific menu items, and menu category.

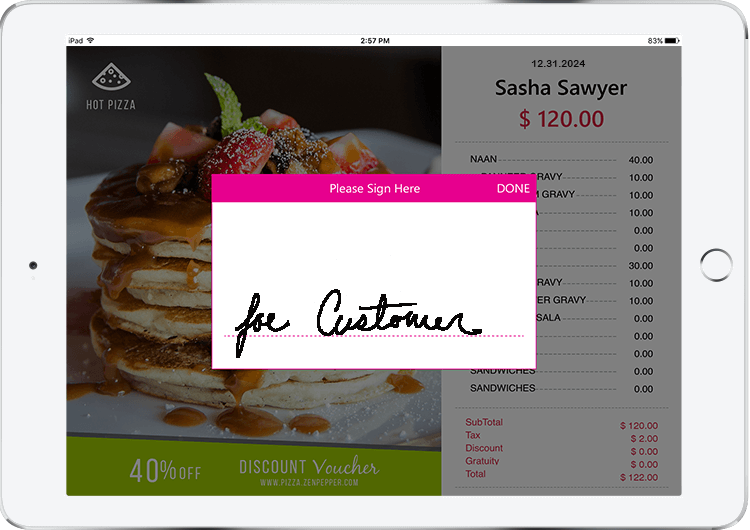

LexgiaPOS's S customer loyalty application allows businesses to create customized loyalty programs based on the best interests of both their consumers and the business itself. Loyalty rewards can be based on a variety of factors, including enrollment, customer visits, a fixed spent amount, specific menu items, and menu category. LexgiaPOS CDS is a customer facing display that they are able to interact with during checkout. The easy and fast technology provides high levels of service and convenience for customers, allowing for less delay at checkout and increased consumer satisfaction. Equipped with a tip processing feature and required digital signature, the system provides quick service that is both enjoyable and more secure. The application can also prompt customers to opt-in to your loyalty program if you choose, driving more signups.

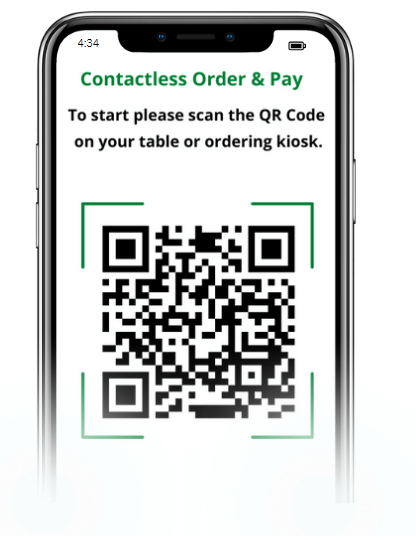

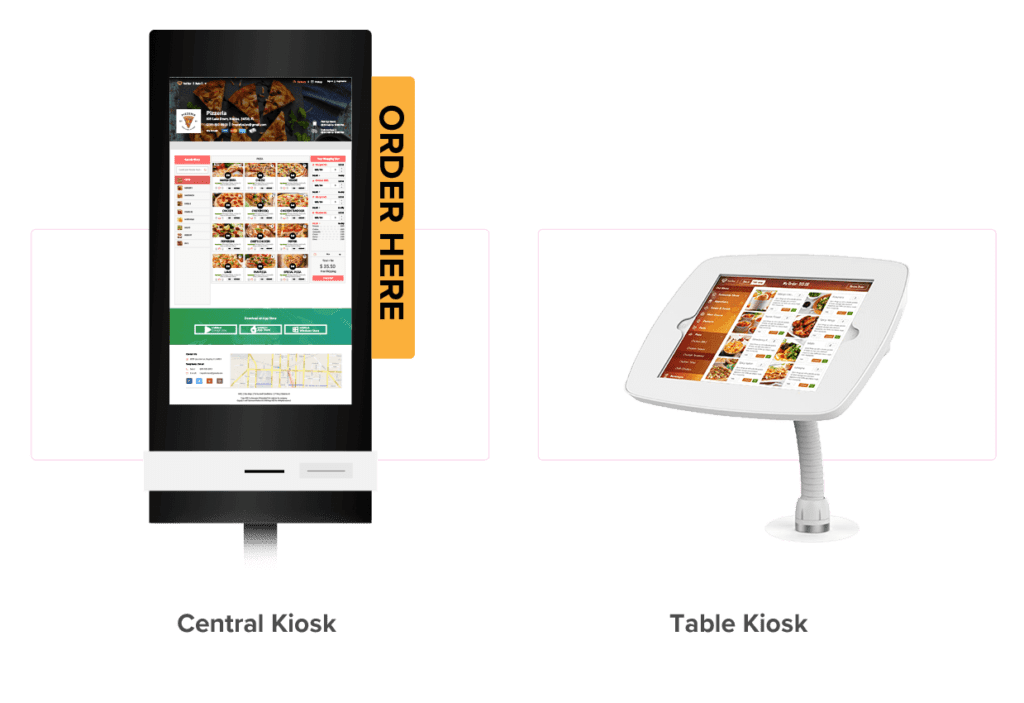

LexgiaPOS CDS is a customer facing display that they are able to interact with during checkout. The easy and fast technology provides high levels of service and convenience for customers, allowing for less delay at checkout and increased consumer satisfaction. Equipped with a tip processing feature and required digital signature, the system provides quick service that is both enjoyable and more secure. The application can also prompt customers to opt-in to your loyalty program if you choose, driving more signups. Self-order kiosk checkouts allow for customers to fully engage with the order and checkout processes independently, creating a more convenient customer experience while simultaneously lifting pressure from the front-of-house staff. LexgiaPOS Kiosk quickens the process of making and dispatching orders by communicating directly to a second display system located in the kitchen. The application eliminates extra steps by enabling direct communication from your consumers’ fingertips to the eyes of the kitchen staff.

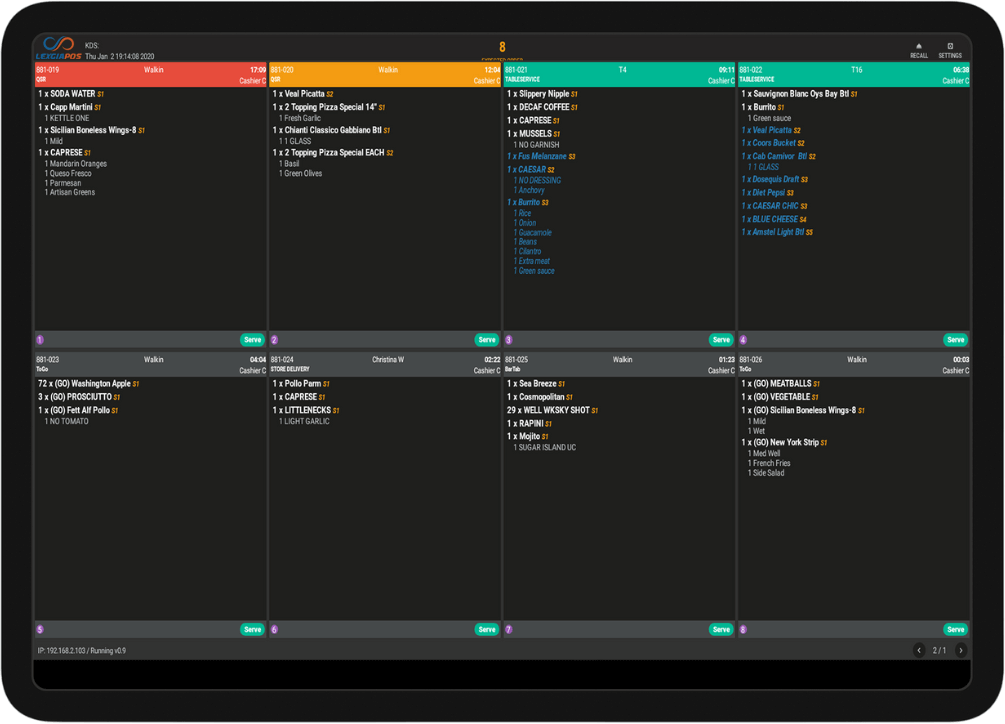

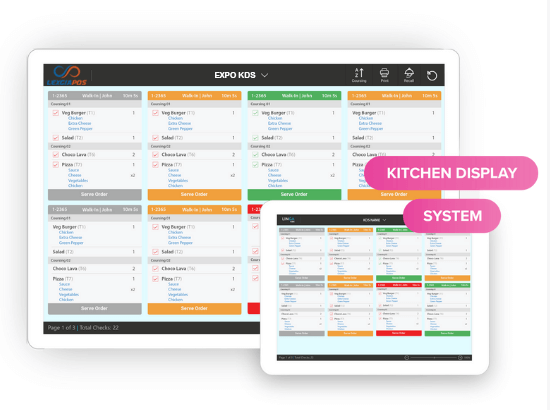

Self-order kiosk checkouts allow for customers to fully engage with the order and checkout processes independently, creating a more convenient customer experience while simultaneously lifting pressure from the front-of-house staff. LexgiaPOS Kiosk quickens the process of making and dispatching orders by communicating directly to a second display system located in the kitchen. The application eliminates extra steps by enabling direct communication from your consumers’ fingertips to the eyes of the kitchen staff. LexgiaPOS KDS is a system specifically designed for catering to needs inside the kitchen. Always in direct communication with the front-of-house display, both systems can stay connected even without internet, allowing for no interruptions to the flow of your workday.

LexgiaPOS KDS is a system specifically designed for catering to needs inside the kitchen. Always in direct communication with the front-of-house display, both systems can stay connected even without internet, allowing for no interruptions to the flow of your workday. If your restaurant serves pizza, LexgiaPOS KDS allows your customers to customize a pie down to the slice and make their topping choices as elaborate as desired. Customers can also receive SMS text alerts directly from the kitchen so that they are notified as soon as their order has been completed. The kitchen display system allows for optimal efficiency and a significant reduction of error and waiting time.

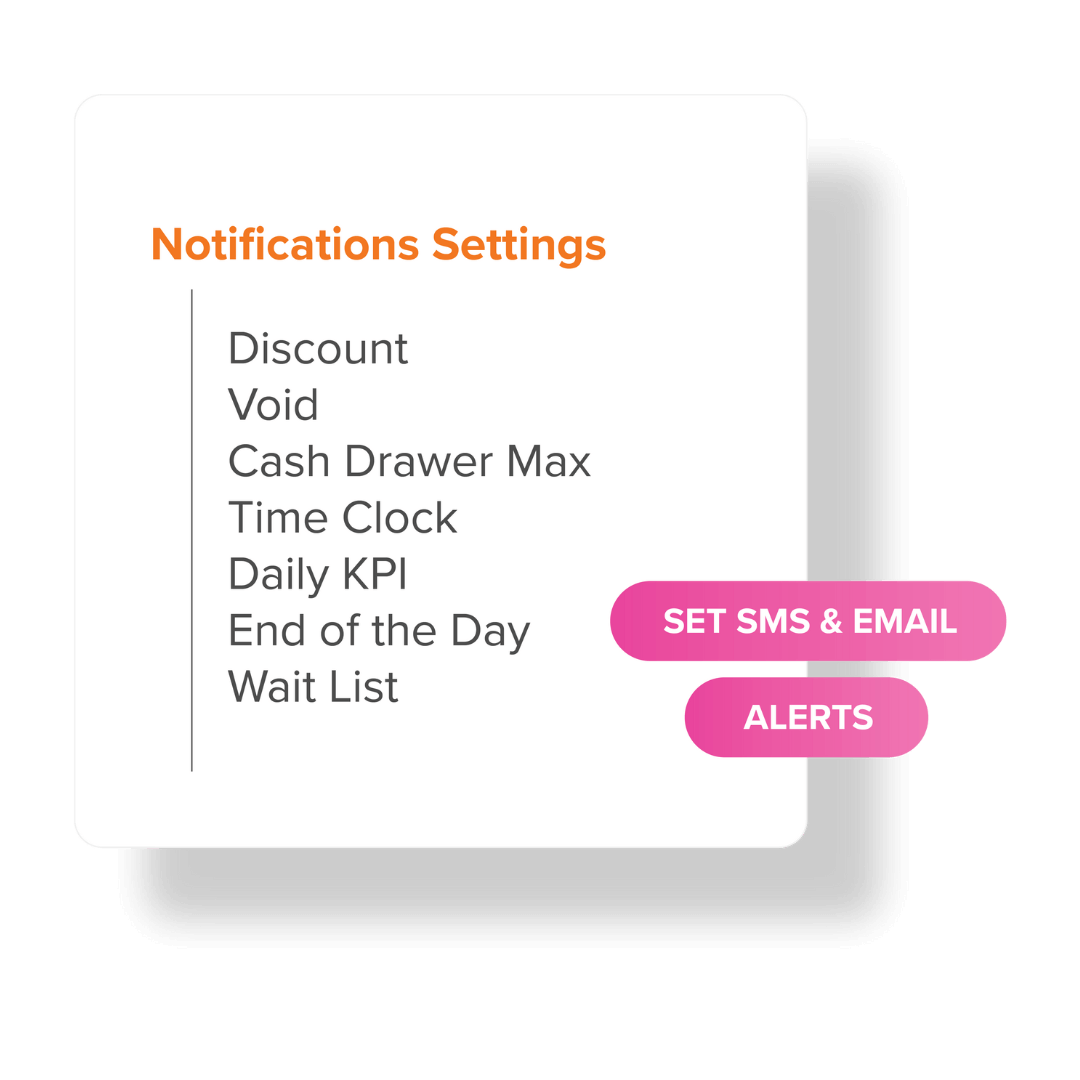

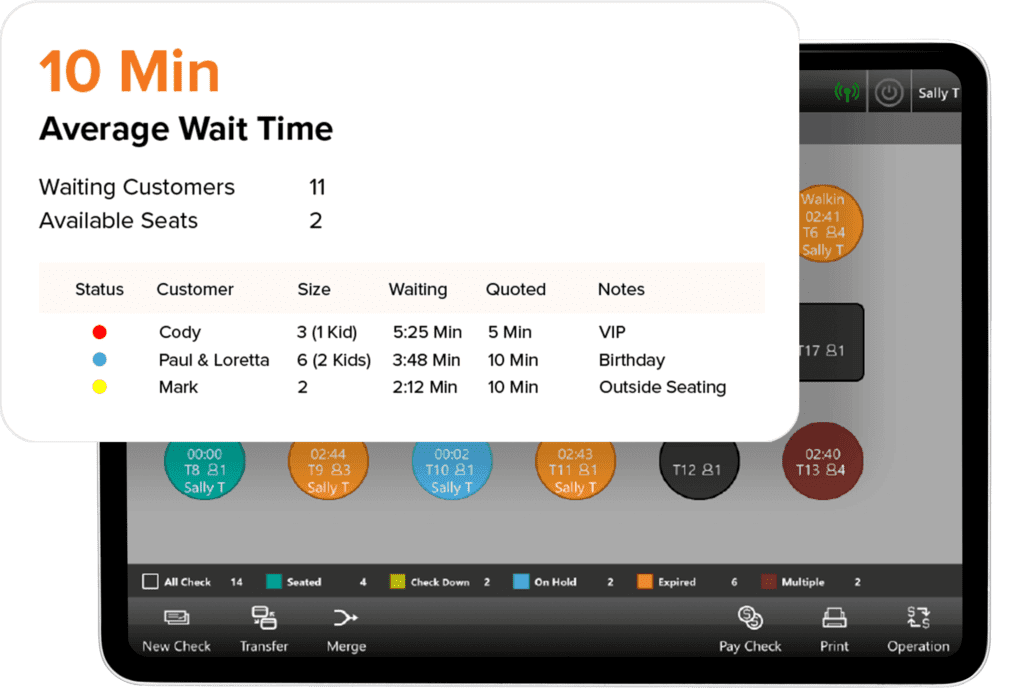

If your restaurant serves pizza, LexgiaPOS KDS allows your customers to customize a pie down to the slice and make their topping choices as elaborate as desired. Customers can also receive SMS text alerts directly from the kitchen so that they are notified as soon as their order has been completed. The kitchen display system allows for optimal efficiency and a significant reduction of error and waiting time. Excessive wait times can lead to customer dissatisfaction, lack of repeat business, and loss of sales. LexgiaPOS Waitlist is a fully integrated application within the operating system that tracks and manages your business’s bookings and guests to ensure minimal wait time and maximal communication with your customers. Equipped with a wait time calculator and synced with the statuses of your tables, the application remains constantly updated and can keep your customers in the loop as well by sending SMS text alerts regarding the status of their wait.

Excessive wait times can lead to customer dissatisfaction, lack of repeat business, and loss of sales. LexgiaPOS Waitlist is a fully integrated application within the operating system that tracks and manages your business’s bookings and guests to ensure minimal wait time and maximal communication with your customers. Equipped with a wait time calculator and synced with the statuses of your tables, the application remains constantly updated and can keep your customers in the loop as well by sending SMS text alerts regarding the status of their wait.